- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Cash flow means the flow of money in and money out. Cash inflow means money you earn and cash outflow means money you spend. Positive cash flow occurs when the money you receive is greater than the expenses. This means that there is still a cash surplus or positive cash balance at the end of the month that can be invested. Negative cash flow occurs when you spend more than you receive. As a result, the financial condition of the business or personal has a poor level of solvency. Monthly cash flow can fluctuate greatly, especially if the company is just starting out, the business is in transition, or a household that doesn't have a steady source of income and expenses that are difficult to budget for.

Step

Part 1 of 3: Calculating Monthly Cash Flow for the Company

Step 1. Prepare a table for compiling a cash flow statement

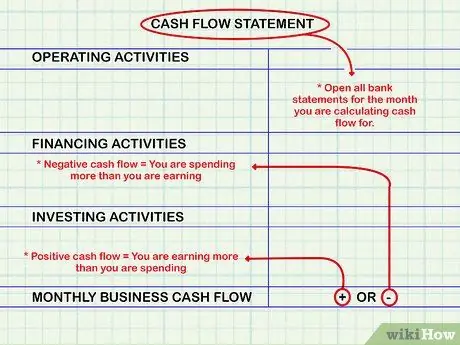

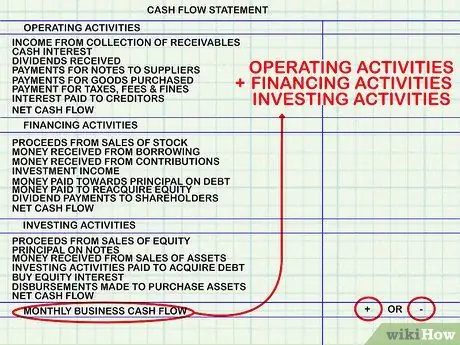

Make a table consisting of several columns with the headings “Operating Activities”, “Financial Activities”, and “Investing Activities”. Prepare a bank transaction report for one month according to the cash flow period you want to report. The purpose of preparing a cash flow statement is to find out whether the company has a positive or negative cash balance at the end of the month.

- Negative cash flow means that the company spends more money than it receives.

- Positive cash flow means the company receives more money than it spends. In order to invest, companies must manage their finances well so that cash flow is always positive in a certain amount and can be used to develop the business.

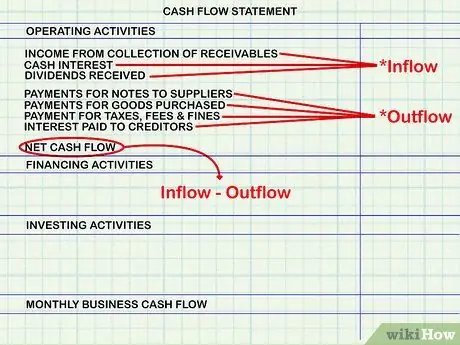

Step 2. Compute the net cash flow from operating activities

Sum up the receipts or incoming money from daily operations, delivery of goods, or sales of services to customers. Also record the incoming money received from customers, interest on deposits, and payments for investment development results.

- Next, count the money out. Cash issued to fund operating activities includes cash payments for the purchase of merchandise, payment of debts to suppliers, payment of employee salaries, taxes, honoraria, fines, and interest on loans to creditors.

- Finally, subtract the money in by the money out. Write the result of subtraction in the column “Operational Activity”. If the number is negative, put a “-“or use another sign that is easy to understand.

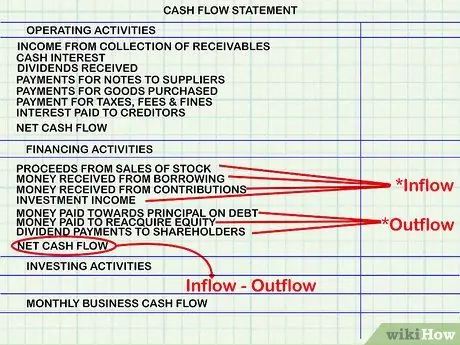

Step 3. Calculate the net cash flow from financial activities

Add up receipts funded by loans or equity, including cash inflows from the sale of stocks, bonds, and other securities. Also add money received from shareholder capital deposits, bank loans, and investment profits or income.

- After that, total the money out to finance financial activities including payment of principal debt, repurchased shares, and distribution of dividends to shareholders.

- Subtract incoming money from outgoing money and write the number in the “Financial Activity” column.

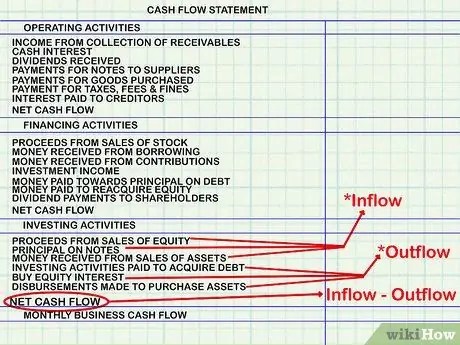

Step 4. Calculate the net cash flow from investing activities

This step is done to calculate how much cash comes from investments, for example from buying shares or bonds of other companies. Sum up the money coming in from receipts of receivables, sales of company shares or bonds, sales of assets or property, for example: sales of factories and machinery.

- Sum the money out due to investment activities which include payment of debt, interest on loans, and repayment of the purchase of assets or property, for example: payments for the purchase of plant and machinery.

- Subtract incoming money from outgoing money and write the number in the “Investing Activity” column.

Step 5. Add up the three columns in the cash flow statement

Add up the numbers listed in the “Operating Activities”, “Financial Activities”, and “Investing Activities” columns. The final result you get is the company's cash flow for one month. If the number is positive, the company has positive cash flow, which means that the company's revenues are greater than expenses. If the number is negative, the company spent more money than it received during the month reported.

Part 2 of 3: Calculating Monthly Cash Flow for Individuals

Step 1. Prepare a statement of your bank account transactions for a given month

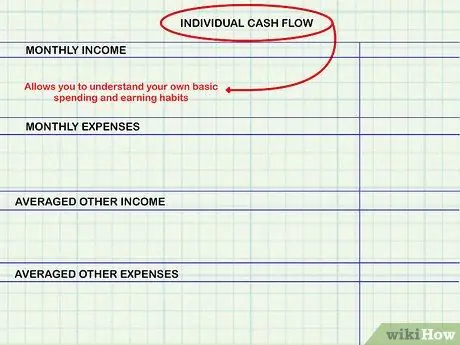

For company management, monthly cash flow reports are needed to evaluate business performance and make decisions. However, a cash flow statement can be used to monitor an individual's financial activity to find out the amount of income and patterns of spending money. Potential investors usually need a cash flow statement to determine how much money can be invested.

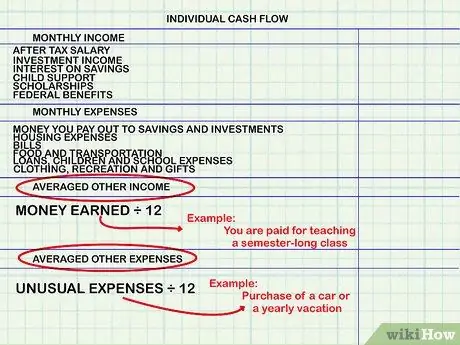

Create a 4-column table with the headings: “Regular Income”, “Regular Expenditure”, “Average Non-routine Income”, and “Average Non-routine Expenditure”

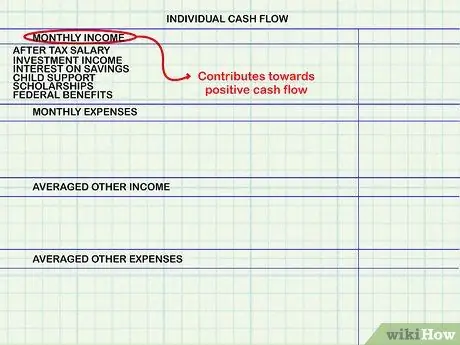

Step 2. Calculate the amount of monthly income

Add up the money you receive for one month. Revenue can come from salary after tax, investment income, interest on savings, and allowances, for example: child support, scholarships, or other benefits. Growing revenue is one of the reasons you have positive cash flow. Other non-routine income should be recorded in a separate column.

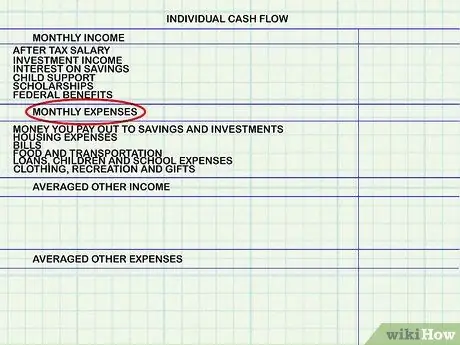

Step 3. Calculate the amount of monthly expenses

Add up the money you set aside each month to save and invest. The next step is to add up the expenses related to housing, for example: rent, mortgage, or property taxes. After that, add up the cost of living for one month, for example: electricity, gasoline, internet/telephone/cable TV fees, mobile phone credit, water, cleaning, and other bills.

- Calculate the amount of expenses for buying food, daily necessities, and eating at restaurants. If you eat at restaurants more than 2 times a week, record these expenses separately.

- Continue to add up transportation costs, for example: fuel purchases, public transport tickets, and taxi costs.

- Add up loan payments, insurance premiums, and health care.

- If you have children, figure out how much to pay for babysitters, tuition, extracurricular fees, and tuition fees.

- If you are still in school, add up your expenses to buy school supplies.

- Finally, add up your expenses for buying clothes, gifts, and recreation, for example: movie tickets, weekend getaways, and doing hobby activities.

- The relatively large non-routine costs should be recorded in the “Other Non-routine Expenditures” column.

Step 4. Compute the average cash flow from non-routine transactions

Read your bank account to calculate the amount of non-routine income where the money is received all at once for several months or cannot be ascertained. For example: if your salary as a teacher is paid all at once at the end of the semester, you will receive a large amount of money in a given month.

- Add up the non-routine income for the past year, divide by 12 and then write down the result of the division in the “Average Non-routine Income” column.

- Add up non-routine expenses for one year, for example: buying a car for a child who has just graduated or a year-end vacation to visit relatives. After dividing by 12, write the result of the division in the “Average Non-routine Expenditure” column.

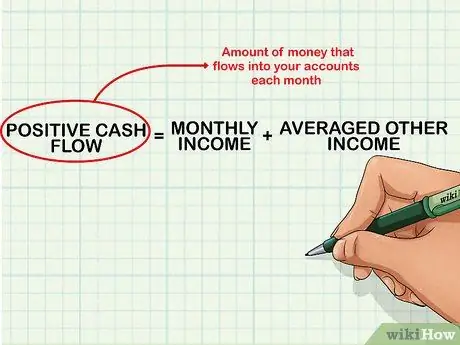

Step 5. Calculate the amount of cash inflows

Add up your regular income and average non-routine income to find out how much cash inflows you have, which is the amount of money you receive each month. To be sure, check if the amount received in the bank account is close to that amount.

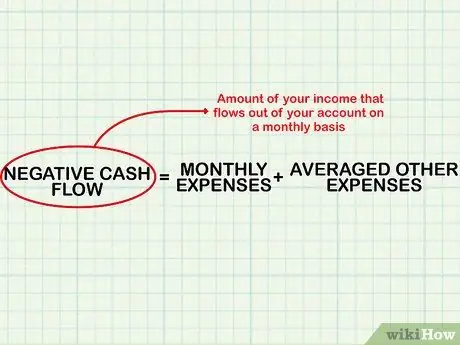

Step 6. Calculate the magnitude of the cash outflow

Add up all the money you use to pay for routine and non-routine needs to find out the amount of cash outflow or the money you spend each month.

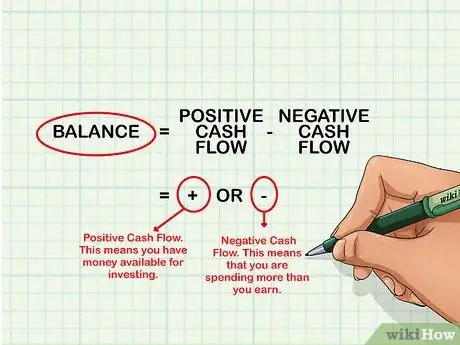

Step 7. Subtract cash inflows by cash outflows

You have positive cash flow if the balance is positive. This means that you have money that can be partially or fully invested.

You have negative cash flow if the balance is negative. This means that you are spending more than you are earning. So, start reducing expenses by making savings

Part 3 of 3: Managing Cash Flow

Step 1. Monitor cash flow

If you own a company, try to manage cash flow by recording all receipt transactions. Deposit cash every day, send billing receipts to customers according to the due date, and do billing on time so that customers are not in arrears. Give discounts to customers who pay cash.

- Ensure that all financial transactions are carried out based on supporting documents. Use numbered receipts and issue sequentially numbered checks as supporting evidence for bookkeeping.

- Carefully record all cash disbursements to monitor individual cash flows. Keep all receipts or purchase receipts and check bank accounts regularly.

Step 2. Prepare funds for unexpected expenses

Set aside money to anticipate emergencies or take advantage of opportunities for business expansion. Prepare funds for raising salaries, paying debts, and non-routine purchases in large quantities. Reserve money every month so that you are ready to fund any unforeseen needs because the amount can be very large.

- If most of the cash surplus has already been invested, determine how to partially divest in case of an emergency.

- Get a bank credit facility so you can borrow money if you have trouble.

Step 3. Manage expenses as well as possible to pay for daily living expenses

Check payment transactions every month whether you spend money on things that are not useful or excessive. When income declines, review policies that govern spending money, for example to pay rent, cost of capital, and pay employees. Put off unnecessary renovation plans and expensive equipment purchases until cash flow improves. Reduce unproductive working hours. Streamline the company by firing unproductive employees.

- If you have to pay rent, negotiate with the landlord so you can afford the rent.

- Cost efficiency also needs to be applied in daily life, for example by cooking your own food so you don't have to eat at restaurants. Arrange a food menu for one week and then buy the groceries you need on the weekend. Cook 2-3 of your favorite menus in large portions and finish off the remaining food.

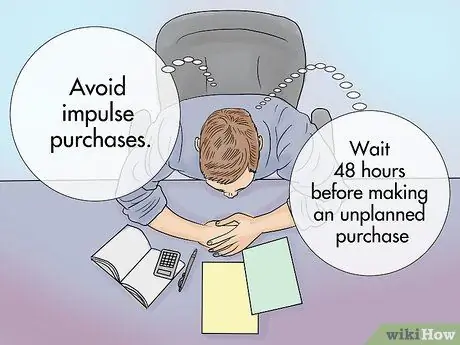

- Don't spend money impulsively. This applies to managing individual and corporate cash flows. Make sure first the stock of items that are still available and how much you need. Postpone unplanned purchases for up to 48 hours and control the impulse to buy things that weren't budgeted for.

Tips

- Although difficult, cash flow statements can be manipulated to look better, for example by delaying payments or debt repayments, selling securities (eg notes, stocks, bonds, and securities), or reverse journalizing costs that have been charged in previous periods.

- Learn how to make a cash flow statement by searching the internet for guides or reading a company's cash flow statement. Many companies publish financial statements, especially to attract potential investors who want to buy shares.