- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

A financial report is a document that contains information about the financial condition of a company or organization in the form of a Balance Sheet, Income Statement, and Cash Flow Statement. Financial statements are typically reviewed and analyzed by business managers, boards of directors, investors, financial analysts, and government officials. This report should be prepared and disseminated in a timely manner with accurate and clear information. Although the process of preparing financial statements may seem very complicated, learning the accounting procedures that need to be known to prepare these reports is not too difficult.

Step

Part 1 of 4: Preparing Financial Statements

Step 1. Determine the period on which the financial statements are prepared

Before starting to make reports, you must determine the period for which the financial statements will be prepared. Financial reports are usually prepared quarterly and annually, although there are also some companies that prepare monthly financial reports.

- So that you can determine the period that must be reported, study the documents that form the basis for the formation of your organization/company, for example the articles of association, by-laws, or the deed of establishment of the organization/company. These documents usually describe when financial statements should be prepared.

- Ask your company's leadership how often each report is prepared.

- If you are the head of your own organization, consider when you need financial reports the most and set this date as the date for preparing the financial statements.

Step 2. Review your general ledger

Next, you must ensure that all financial transaction records in the general ledger are updated and properly recorded. Financial reports will be of no use to readers unless the data is recorded properly by the bookkeeping department.

- For example, make sure all accounts payable and receivables have been recorded, verify that the bank reconciliation is complete, and ensure that all stock purchase transactions and product sales have been recorded.

- You should also consider any liabilities that may not have been recorded at the date of preparation of the financial statements. For example, has the company used unbilled services? Are there any outstanding and unpaid employee salaries? These are accrued liabilities and must be recorded in the financial statements.

Step 3. Gather incomplete information

If you have checked the general ledger and there is still incomplete information, go through the related documents you need to ensure that the financial statements are complete and correct.

Part 2 of 4: Preparing a Balance Sheet

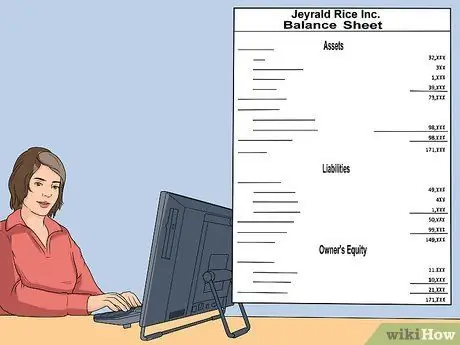

Step 1. Prepare the page for the Balance Sheet

The Balance Sheet report presents data on the company's assets (what it owns), liabilities (what becomes debt), and capital accounts such as share capital and additional paid-in capital on a certain date. Write “Balance Sheet Report” as the title on the first page of your financial statements, followed by the name of the organization and the date of reporting the Balance Sheet.

Balance Sheet accounts will be reported on certain dates of the year. For example, a Balance Sheet may be prepared as of December 31 in a given year

Step 2. Determine the proper format for your Balance Sheet

The balance sheet generally lists assets on the left, liabilities and capital on the right. As an alternative, there is a Balance Sheet which lists the assets above and liabilities/capital at the bottom.

Step 3. List all the assets of your company

Put the title “Assets” at the top of the Balance Sheet followed by the various assets owned by the company.

- Start with current assets such as cash and other accounts that can be converted into cash within one year after the balance sheet reporting date. Write the title “Total Current Assets” on the bottom line of the current assets statement.

- Next, list all the non-current assets of your company. Non-current assets are defined as assets that are not in the form of cash and cannot be converted into cash in the near future. For example, property, equipment, and securities receivable are non-current assets. Write the title “Total Fixed Assets” on the bottom line of the fixed assets statement.

- Finally, add up current assets and non-current assets and write “Total Assets” as the title on this line.

Step 4. Write down your company obligations

The next section in the Balance Sheet is liabilities and equity. The title you should write in the Balance Sheet for this section is “Liability and Equity”.

- Start by listing your short-term obligations. Short-term liabilities are obligations that will mature within one year and usually consist of trade payables, accrued debts, the portion of mortgage debt that will soon mature, and other debts. Write “Amount of Short-Term Liabilities” at the bottom.

- Next, write down long-term obligations. Long-term liabilities are obligations that have not been repaid within one year, such as long-term debt and securities payable. Write “Amount of Long-Term Liabilities” at the bottom.

- Add up your short-term and long-term liabilities and put the heading “Amount of Liabilities” at the bottom of the liability accounts.

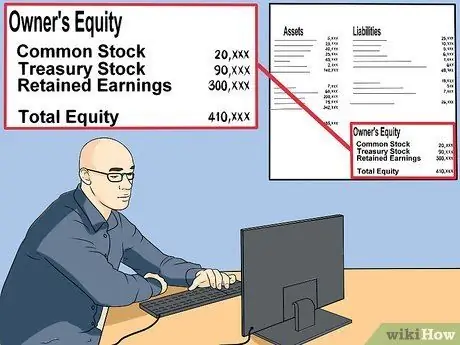

Step 5. List all sources of capital

The capital portion in the Balance Sheet is under liabilities which shows the amount of money the company will have if all assets are sold and liabilities are paid off.

Now, write down all the capital accounts such as share capital, repurchased share capital, and retained earnings/(losses). After all the capital accounts are listed, add them up and give the title “Amount of Capital” at the bottom of the capital accounts

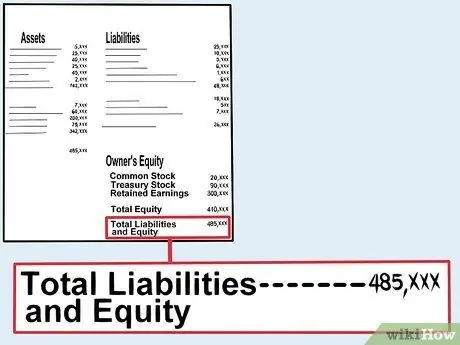

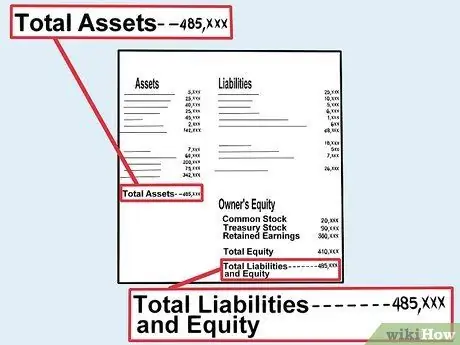

Step 6. Add up liabilities and equity

Combine "Amount of Liabilities" and "Amount of Capital" then give the title "Amount of Liabilities and Capital" at the bottom line of the Balance Sheet.

Step 7. Check the amount

The “Total Assets” and “Total Liabilities and Equity” calculations that you just did should produce the same numbers in the Balance Sheet. If these two numbers are the same, the Balance Sheet is complete and you can start preparing the Income Statement.

- Shareholders' capital must be equal to the total assets of the company minus the total liabilities. As explained earlier, the result of this reduction is the amount of money that is still there if all the company's assets are sold and all liabilities are paid off. So, liabilities plus capital must equal assets.

- If your Balance Sheet is out of balance, check your calculations again. There may be accounts that you haven't counted or are in the wrong category. Double-check each column and make sure all accounts are recorded in the proper groups. It is possible that you have not counted a valuable asset or an important liability.

Part 3 of 4: Preparing an Income Statement

Step 1. Prepare the page for the Income Statement

The Income Statement will report the amount of money generated and issued by the company during a certain period. Write “Profit and Loss Statement” as the title of your financial statement followed by the name of the organization and the period to be reported.

- For example, the Income Statement is usually prepared for the period January 1 to December 31 in a given year.

- Be aware that financial statements may be prepared for a quarterly or monthly period, whereas your financial statements may be prepared for a full year period. Financial statements are easier to understand if they are prepared over the same period, but there is no need for this.

Step 2. List all sources of revenue

List the various sources of your company's receipts and the amount of money received.

- Make sure you report each type of receipt separately and also calculate if there is a sales discount or reserve for returning goods, for example: "Sales IDR 10,000,000, 00" and "Service Receipts IDR 5,000,000, 00"

- Group the sources of revenue in a way that is beneficial to the company. Acceptance groups can be formed by geographic area, management team, or specific product.

- When all sources of revenue have been recorded, add them up and include them in your report as “Amount of Receipts”.

Step 3. Report the cost of goods sold

Cost of goods sold is the total cost incurred to prepare merchandise, produce products to be sold, or provide services during the reporting period.

- To calculate cost of goods sold, you must add up the costs of direct materials, direct labor, manufacturing costs, transportation costs, and shipping costs.

- Subtract the cost of goods sold from the total revenue and then title “Gross Profit” for the result of this reduction.

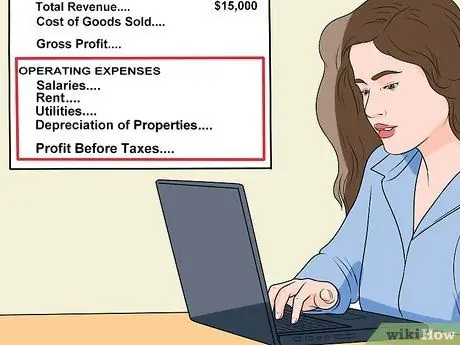

Step 4. Record operating costs

Operating costs are all the costs required to run your business. These costs include general and administrative expenses such as salaries, rental fees, utility costs, and depreciation of assets. In addition, advertising costs, research and development costs are also included in operating costs. You should report these costs separately so that the reader of the report can get an idea of how the company's money is being used.

Subtract these costs from gross profit and then title “Profit Before Tax” for the result of this deduction

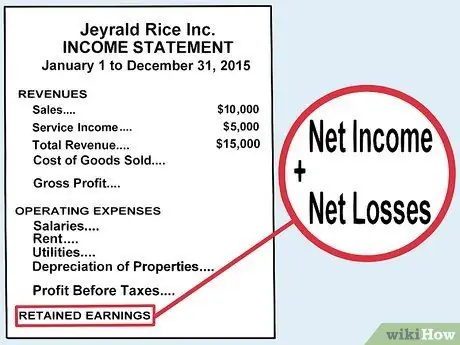

Step 5. Enter the amount of retained earnings/loss

"Retained Profit/Loss" is the sum of all net income and net loss since the organization/company was founded.

Add up the retained earnings balance at the beginning of the year with the net profit/loss earned during the current period to calculate the retained earnings balance at the end of the reported period

Part 4 of 4: Preparing a Cash Flow Statement

Step 1. Prepare the page for the Cash Flow Statement

This report presents the sources and disbursements of cash by the company. Write “Statement of Cash Flows” as the title of your financial statement followed by the name of the company and the period to be reported.

Similar to the Income Statement, the Cash Flow Statement is also prepared for a certain period of time, for example January 1 to December 31 in a certain year

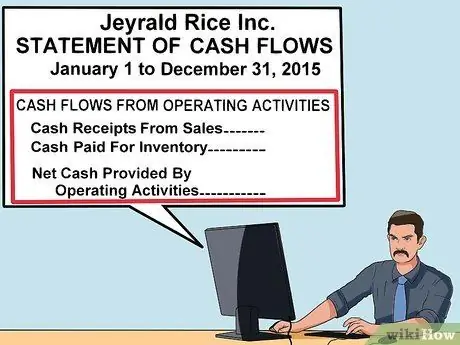

Step 2. Prepare a section that lists the company's operations

The Cash Flow Statement begins with a section you should title “Cash Flows from Operating Activities.” This section relates to the Income Statement that you just prepared.

Write down all the operations of your company. This activity includes the receipt of money from sales and money spent to purchase inventory. Calculate the difference between these two activities and then title it “Net Cash from Operating Activities.”

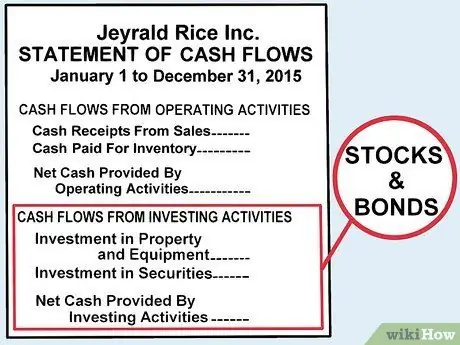

Step 3. Prepare a section for recording investment activities

Write the title “Cash Flow from Investing Activities” for this section. This investment record is related to the Balance Sheet that you have just prepared.

- This section deals with cash paid or received from investments in property and equipment, or investments in securities such as stocks and bonds.

- Write the title “Net Cash from Investing Activities” for the results of this calculation.

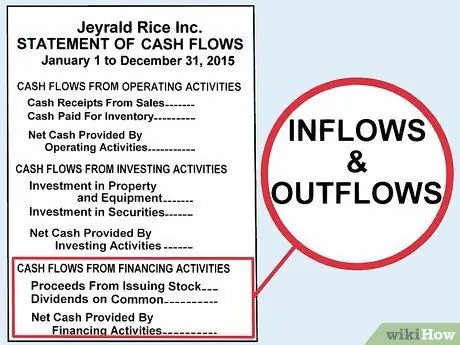

Step 4. Record all financing activities

This is the last section that you should give the title “Cash Flows from Financing Activities” which relates to the Amount of Capital in the Balance Sheet.

This section should report cash inflows and outflows from securities and debt transactions conducted by the company. Give the title “Net Cash from Financing Activities” for the results of this calculation

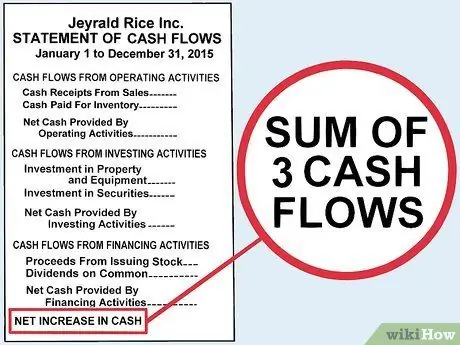

Step 5. Add up all the numbers from each section

Add up the three groups of calculations that you have done earlier and include them in this Statement of Cash Flows with the title "Increase or Decrease in Cash" during the reporting period.

You can add up this cash increase or decrease with the cash balance at the beginning of the reporting period. The results of the calculation of these two numbers must be the same as the cash balance listed in the Balance Sheet

Step 6. Also include any important notes or explanations

In the financial statements there is usually a section called “Notes to Financial Statements” which contains important information about the company. Provide additional information about the company's financial condition that is most helpful in the “Notes” section and then incorporate this information into your report.

- These records may contain information about the company's history, long-term plans, or information about industry developments. This is an opportunity you can use to explain to investors what your report means and what things need attention. This report will help potential investors see the condition of the company from your point of view.

- This note can also provide an explanation of the accounting practices and procedures applied by the company as well as an explanation of important matters in the Balance Sheet.

- This section is also often used to discuss in detail the condition of the company related to the tax situation, pension plans, and stock offerings.

Tips

- Use the Statement of Financial Accounting Standards (PSAK) as a reference when looking for the information you need to prepare financial statements. PSAK is a professional accounting and financial standard for all business and industrial activities applicable in Indonesia.

- Provide a clear title for each section in the Balance Sheet and Income Statement. The information you provide must be understandable to readers of financial statements who do not understand the specifics of your company's activities.

- If you have difficulty preparing financial statements, look for financial reports from other companies operating in the same industry as your company. You may be able to gain useful insight into the format of your report. You can study financial report formats online or through the United States Securities and Exchange Commission's website.