- Author Jason Gerald [email protected].

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Beta is the volatility, or risk, of a particular stock relative to the volatility of the entire stock market. Beta is an indicator of how risky a particular stock is and is used to evaluate its expected rate of return. Beta is one of the basics that stock analysts consider when selecting stocks for their portfolios, along with price-to-earnings ratio, shareholder equity, debt-to-equity ratio, and other factors.

Step

Part 1 of 4: Calculating Beta Using Simple Equations

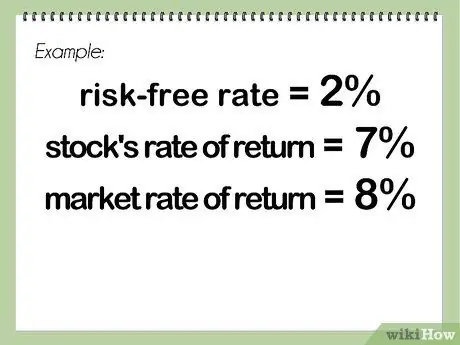

Step 1. Find the level of the risk-free ratio

This is the rate of return investors expect on investments whose money is not risky. This figure is usually expressed as a percentage.

Step 2. Determine the level of each representative index

These figures are also expressed as a percentage. Usually, the rate of return is for several months.

One or both of these values may be negative, meaning that the investment in the stock or market (index) as a whole suffered a loss against the investment during the period. If only 1 of the 2 levels is negative, the beta will be negative

Step 3. Subtract the risk-free rate from the stock's rate of return

If the stock's rate of return is 7 percent and the risk-free rate is 2 percent, the difference will be 5 percent.

Step 4. Subtract the risk-free ratio from the market (or index) rate of return

If the market price or return index is 8 percent and the risk-free rate is again 2 percent, the difference will be 6 percent.

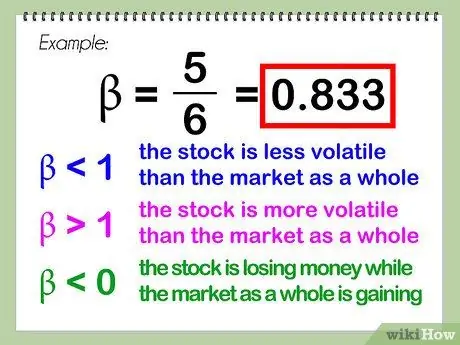

Step 5. Divide the difference in the stock's rate of return minus the risk-free rate by the market (or index), the rate of return minus the risk-free rate

This is a beta version, which is usually expressed as a decimal value. In the example above, beta would be 5 divided by 6, or 0.833.

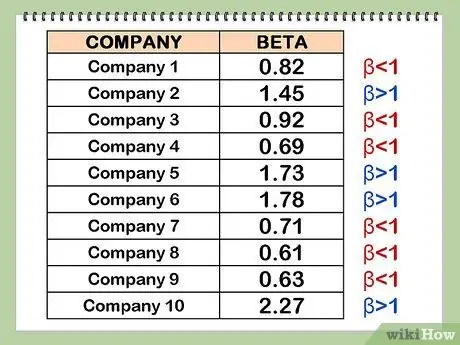

- The beta of the market itself, or the index it represents, is 1.0, because the market is being compared against itself and the number zero divided by itself equals 1. A beta of less than 1 means the stock is less volatile than the market as a whole, while a beta of greater than 1 means the stock is more stable than the market as a whole. The beta value can be less than zero, which means the stock is losing money while the market as a whole is gaining money or the stock is gaining temporary money and the market as a whole is losing money.

- When looking for beta, although it is not required, it is usual to use a representative index of the market in which the stock is trading. For internationally traded stocks, the MSCI EAFE (representing Europe, Australasia and the East) is a suitable representative index.

Part 2 of 4: Using Beta to Determine the Exchange Rate of Return

Step 1. Find the level of the risk-free ratio

This is the same value as described above "Calculating Beta for a stock." For this section, we will use the same value of the 2 percent example, as used above.

Step 2. Determine the market rate of return or a representative index

In this example, we will use the same number 8 percent, as used above.

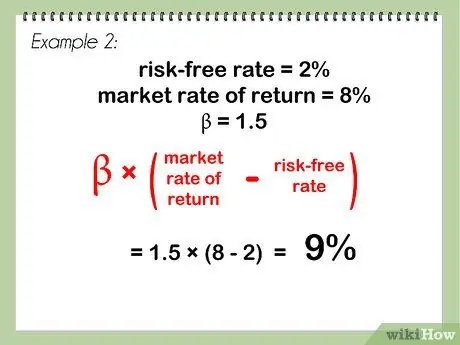

Step 3. Multiply the beta value by the difference between the market rate of return and the risk-free rate

For example, we'll use a beta value of 1.5. Using 2 percent for the risk-free rate and 8 percent for the market rate of return, this works out to 8-2, or 6 percent. Multiplied by a beta of 1.5, yields 9 percent.

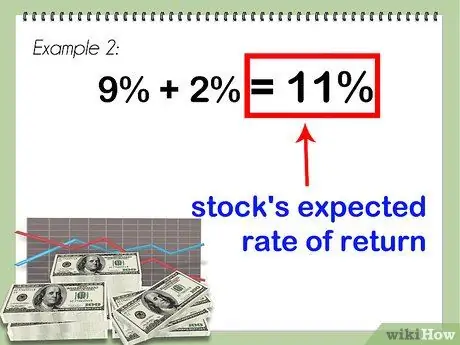

Step 4. Add the result with the risk-free rate

It yields 11 percent, which is the stock's expected rate of return.

The higher the beta value for the stock, the higher the expected rate of return. However, this higher rate of return is coupled with increased risk, so it is necessary to look at other fundamental stocks before considering whether they should be part of an investor's portfolio

Part 3 of 4: Using Excel Charts to Determine Beta

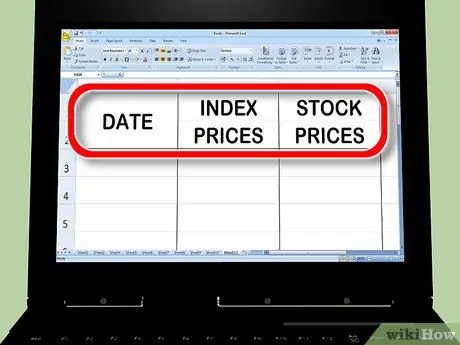

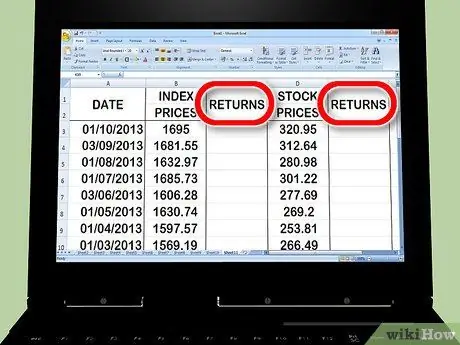

Step 1. Create three price columns in Excel

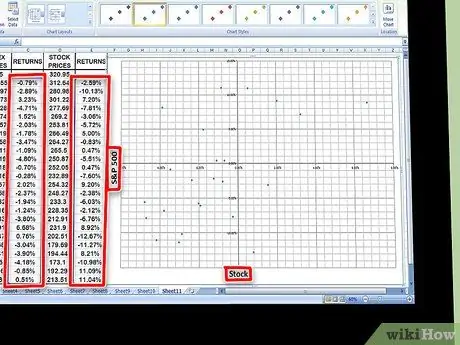

The first column is the date. In the second column, put the index price; this is the "overall market" you will compare betas to. In the third column, put the representative stock price for which you are trying to calculate the beta.

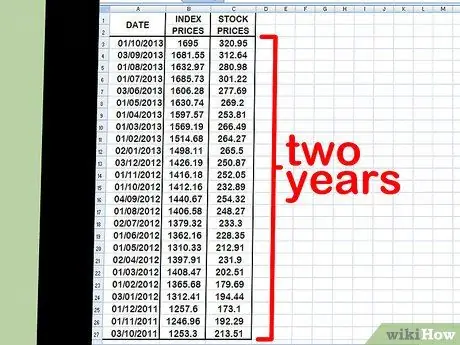

Step 2. Place your data points into a spreadsheet

Try starting at one month intervals. Choose a date - for example, at the beginning or end of the month - and enter the appropriate value for the stock market index (try using the S&P 500) and then the representative stock for that day. Try picking the last 15 or 30 dates, perhaps extending a year or two into the past. Pay attention to the index price and representative stock price for that date.

The longer the timeframe you choose, the more accurate your beta calculation will be. Beta changes as you monitor both stocks and indices for a long time

Step 3. Create two columns back to the right of the price column

One column will return the index; the second column is stock. You will use Excel formulas to redefine what you will learn in the following steps.

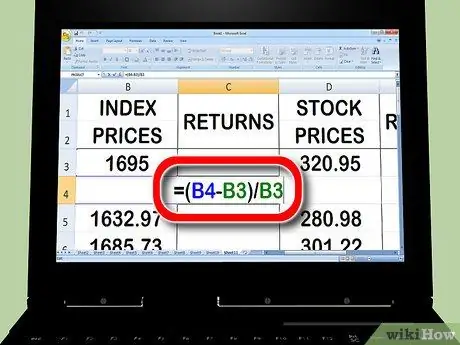

Step 4. Start calculating back for the stock market index

In the second cell of the index column type =. With your cursor, click the second cell in the index column, type -, then click on the first cell in the index column. Next, type /, then click on the first cell in the index column again. press Return or Enter.

- When you recalculate Over Time, you enter nothing in the first cell; leave it blank. You need at least two data points to recalculate, which is why you'll start at the second cell of the index column.

- What you do is subtract the new value from the old value, and then divide the result by the old value. This is so that you know what the percent loss or gain was for the period.

- Your equation in the return column might look like this: =(B3-B2)/B2

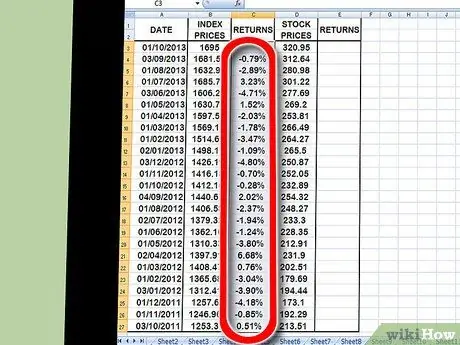

Step 5. Use the copy function to repeat this process for all data points in the index price column

Do this by clicking the small square at the bottom right of the index cell, then dragging it down to the bottommost data point. What you do is ask Excel to replicate the same formula used for each different data point.

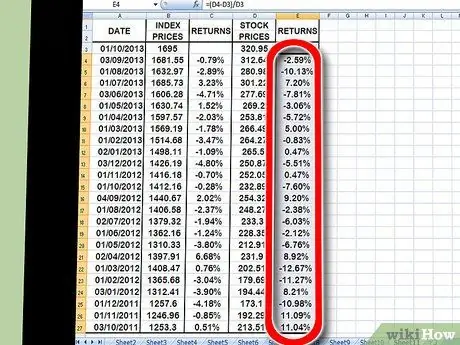

Step 6. Repeat the exact same process to recalculate, this time for individual stocks, not indices

When you're done, you have two columns, formatted as percent, that list the returns for each stock index and individual stocks.

Step 7. Plot the data into a table

Highlight all the data in the two return columns and hit the Chart icon in Excel. Select the scatter graph from the list of options. Title the X axis as the index you are using (eg S&P 500) and the Y axis as the stock you are using.

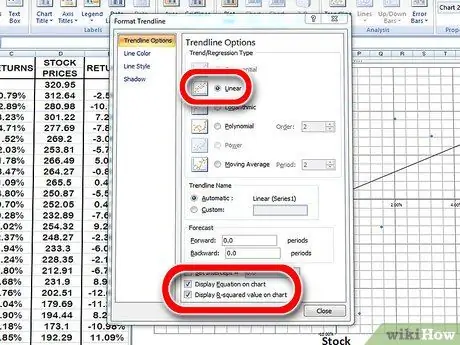

Step 8. Add a trendline to your scatter chart

You can also do this by selecting a trendline layout in newer versions of Excel, or specifying it manually by clicking on Chart → add Trendline. Be sure to display the equation in the table. 2 values.

- Make sure you choose a linear trendline not a polynomial or an average.

- Showing the equations in the table, will depend on what version of Excel you have. Newer versions of Excel will let the equation chart by clicking Chart Quick Layout.

- In this version of Excel, point to Chart; Add Trendline; options. Then check both boxes next to "Display Equation on Chart".

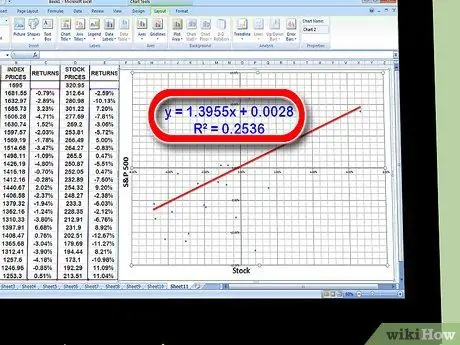

Step 9. Find the coefficient for the value "x" in the trendline equation

Your trendline equation will be written in the form "y = x + a". The coefficient of x value is beta.

Part 4 of 4: Understanding Beta

Step 1. How to interpret beta

Beta is the risk to the stock market as a whole, with the investor assuming ownership of a particular stock. That's why you need to compare the rate of return of a single stock against the return of the index - the benchmark index. The index risk remains at 1. A “low” beta of 1 means that the stock is less risky than the index being compared. A “high” beta of 1 means the stock is riskier than the index to which it is being compared.

- Take this example. Let's say that the beta of Gino Germ is calculated at 0.5. Compared to the S&P 500, the benchmark Gino is comparing is "half" as risky. If the S&P moves below 10%, Gino's share price will likely only fall 5%.

- As another example, imagine that Frank's Funeral service has a beta of 1.5 compared to the S&P. If the S&P falls 10%, expect Frank's stock price to fall "more" than the S&P, or about 15%.

Step 2. Risk is also associated with returns

High risk, high reward; low risk, low reward. A stock with a low beta won't lose as much as the S&P when it falls, but it won't gain as much as the S&P when it posts gains either. On the other hand, a stock with a beta over 1 will lose more than the S&P when it falls, but will also gain more than the S&P when it posts.

For example, Vermeer Venom Extraction has a beta of 0.5. When the stock market jumps 30%, Vermeer only makes 15% profit. But when the warehouse stock market is 30%, Vermeer only gets 15% warehouse stock

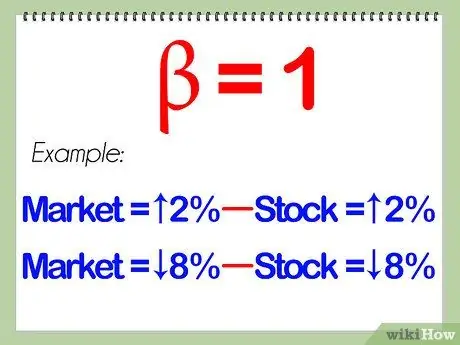

Step 3. Know that stocks with beta 1 will move in line with the market

If you do a beta calculation and know the stock, you analyze when it has beta 1, there will be no more or less risk than the index used as the benchmark. The market is up 2%, your stock is up 2%; the market is down 8%, your stock is down 8%.

Step 4. Include both high and low beta stocks in your portfolio for diversification

If it's a good mix of highs and lows, betas will help you analyze if the stock market value is dropping drastically. Of course, because low-beta stocks generally underperform the overall stock market over a given period, a good mix of betas also means you won't experience a stock price being particularly high.

Step 5. Recognize that, like most financial prediction tools, betas may not fully predict the future

Beta actually measures the past volatility of a stock. Generally projects are volatility into the future, but not always accurate. Beta can change drastically from one year to the next. Using a stock's historical beta may not always be an accurate way to predict current volatility.

Suggestion

- Note that the classical covariance theory may not apply because of the financial time series Heavy tail”. In fact, the standard deviation and mean for the underlying distribution may not exist! So maybe a modification using quartile and median spreads instead of the mean and standard deviation could work.

- Beta analyzes the volatility of a stock over a certain period of time, regardless of whether the market is on an upswing or down. Like other stock fundamentals, analyzing past performance is no guarantee of how the stock will perform in the future.