- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

If you're just starting out with a credit card, you'll need to sign the back of the card before using it. Sign the card after activation online or by phone. Use a marker pen, and sign like you would any other document. Don't leave the back of the card blank and don't write “see ID” instead of signing it.

Step

Part 1 of 2: Signing Credit Card Clearly

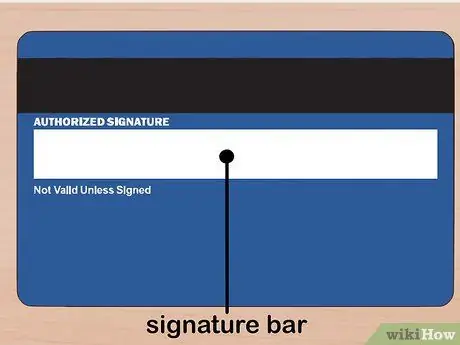

Step 1. Find the signature field

This column is located on the back of the card. Turn the credit card over so you can see the reverse side, and look for a light gray or white column.

Some cards may have an adhesive sticker covering the signature field. If your card has one, remove the sticker before signing

Step 2. Sign using a marker pen

Because it's made of plastic, the back of a credit card won't absorb ink as easily as paper. Marker pens or Sharpie pens can leave a permanent signature and are not at risk of spilling ink on the back of the card.

- Some people prefer to sign the back of the card with a pointed marker. This type of marker is also less likely to spill ink on other parts of the card.

- Do not use unusual ink colors, such as red or green.

- Also, don't sign with a ballpoint pen. Ballpoint pens can scratch cards and leave only a faint mark on the plastic.

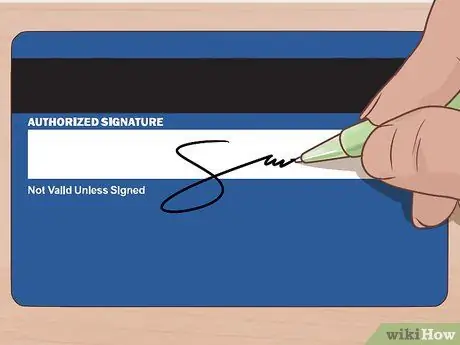

Step 3. Sign as you normally would

Consistency and clarity are key when signing the back of a credit card. The signature on the credit card must look the same as your signature on any other document.

- It doesn't matter if your signature looks sloppy or hard to read, as long as it looks the same no matter where you put it.

- If the salesperson suspects credit card fraud, the first step to take is to compare the signature on the back of the credit card with the one on the receipt.

Step 4. Let the ink dry

Don't keep a credit card immediately after signing the back. If you put your credit card in your wallet too quickly, the ink will run off and your signature will appear blurry.

Depending on the type of ink used, the signature can take up to 30 minutes to dry

Part 2 of 2: Avoiding Common Mistakes

Step 1. Don't write "View KTP"

You may have been told to protect yourself from credit card fraud by writing “View KTP” or “Check KTP” instead of signing it. The idea behind it is that if someone steals your credit card, they can't use it without holding your ID. However, most merchants are prohibited from accepting cards that do not have the user's signature.

- Look at the small note on the back of the credit card. The note may contain a statement that resembles: “Invalid without an authorized signature”.

- In addition, the salesperson will generally swipe a credit card without even looking at the back to confirm the signature.

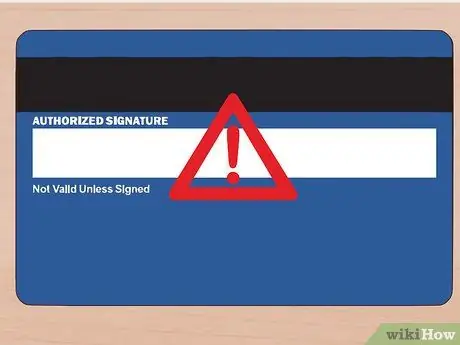

Step 2. Do not leave the signature field blank

Technically, you are legally required to sign a credit card before use to validate the card. Some sales clerks may refuse to swipe a credit card if they see the back unsigned.

- With the increasing prevalence of chip reader technology and standalone credit card readers (eg at gas stations), many sales clerks don't have the opportunity to see your credit card.

- Emptying the back of a credit card will not increase its security at all. Thieves can use it easily, either with or without your signature.

Step 3. Make sure that your credit card has fraud protection

If you're concerned about the possibility of a thief using a signed credit card to make a purchase, the best way to protect yourself is to make sure it has fraud protection. Contact the credit card issuer's customer service department and ask if your account has fraud protection.