- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

Receipt is a written statement made as evidence of receipt of cash or payment by other means. When conducting business transactions or sales, sellers and buyers usually make receipts for each other's interests, for example for bookkeeping or documentation. Receipt is a document that proves the existence of a mutual agreement between the seller and the buyer as the basis for recording the receipt or disbursement of money.

Step

Part 1 of 2: Creating Receipts

Step 1. Prepare a receipt form that provides a carbon sheet as a copy

If you want to generate receipts manually, prepare a carbonized receipt form. That way, you only need to write once and instantly get two receipts, one for you and one for the party making the payment.

Carbon receipts are usually printed in a certain format as proof of sales and receipt of money, for example: a sheet in the form of a form that has the company name printed and a few words or only a few lines are printed to be filled with correct and clear information

Step 2. Use a black ballpoint pen

Writing receipts in black ink is required to ensure the validity of receipts. Do not write receipts with pencils or light colored ink because receipts serve as proof of bookkeeping for the long term.

Receipts that are generated manually must be filled in in large and clear writing so that they are easy to read. If you're using a carbonized receipt, you'll need to press as you write so that it appears on the second or third sheet as a copy

Step 3. Use a company stamp or printed receipt that has the company name on it

To make a legally valid receipt, you must affix the company stamp on the top or bottom of the receipt according to applicable law. In addition, you may use printed receipts that already have the company name and logo on it. This proves to the buyer that the product being traded comes from your business or company and this document will be a reference at a later date if needed.

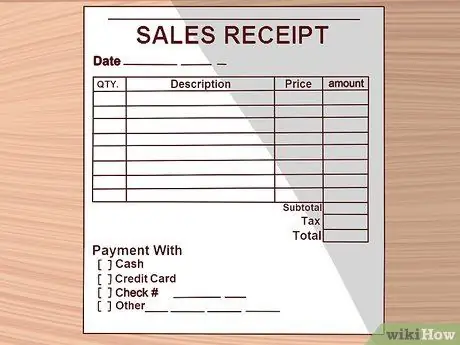

Step 4. Include all required information in the receipt

When generating receipts manually or using forms that can be downloaded from a computer program, you must include the following:

- Detailed seller data.

- Detailed buyer data.

- Transaction date.

- Detailed product data.

- Amount of money.

- Payment method.

- Signature of seller and buyer.

Step 5. Include all the required information when creating a rental receipt

Rent receipts are required by tenants who pay cash or use checks to record cash disbursements. Receipts are also required by the lessor as proof that the rental fee has been received and complies with the law that requires the lessor to provide a receipt to the lessee. Receipts made as proof of receipt of rental payments must include the following:

- The amount of rent paid.

- Payment date.

- Tenant's full name.

- The full name of the lessor.

- Full address of the property for rent.

- Paid rental period.

- Method of payment of rent (cash, cheque, etc.)

- Signatures of the lessor and lessee.

Step 6. Download the online (online) receipt form for free

If you want to use printed receipts for your business or company, take advantage of receipt forms that can be downloaded for free via the internet. After the receipt form is printed, put the company stamp on it so that it is ready to be used for daily transactions.

Part 2 of 2: Knowing the Purpose and Reasons for Receipts

Step 1. Know the purpose of the receipt

Receipts are an important document for recording income and are needed when reporting taxes. Keep all payment receipts because these documents usually have to be attached as proof of expenses in the tax report. As a businessman, you are obliged to provide a receipt to the buyer when receiving payment. After the buyer makes a payment, the seller usually provides a receipt for the payment.

After paying for goods or services that are relatively expensive, making a receipt is considered an obligation for both the buyer and the seller. This document must be prepared in anticipation of a violation of the law during the sale and purchase transaction because both parties can use the receipt as evidence in court

Step 2. Learn the four types of receipts that are commonly used

Theoretically, receipts can be made for all payment transactions, for example: rent payments, hairdressing services, or garden design fees. In general, receipts are divided into four groups and one of them you may see when making a purchase or sale transaction.

- Purchase receipt. After paying, the seller will make a payment receipt by including the receipt number, transaction date, and the amount of money received. If the payment is made in cash, there must be the word “cash” on the receipt. If payment is made by check or giro, the receipt must include the check number or demand deposit number. If payment is made by credit card, it must include the name of the credit card issuing company (example: Mastercard, Visa, American Express) and the last four digits of the credit card number.

- Treatment receipt. This document is issued for payment for health services, for example for doctor services, purchasing drugs, or using surgical instruments. The receipt must include the patient's name, diagnosis code, doctor's name, name of medicine or medical device paid for, date of treatment, hours of consultation, and amount of payment.

- Selling Note. In most cases, you will receive a sales receipt when you shop. As an entrepreneur, you must provide a sales receipt after entering data on the items sold. This document is proof of sale and it must include the amount of payment, date of sale, name and price of the goods, name of the person who processed the sales transaction and received the payment.

- Rent payment receipt. This receipt is issued by the owner of the leased property as proof of receipt of payment from the tenant. The payment receipt must include the name of the lessor, the name of the tenant, the address of the property being leased, the billing period, the amount of the rental fee, the start and end date of the lease agreement.

- The perpetrators of buying or selling transactions via the internet will receive or provide electronic receipts. The information contained in the electronic receipt is the same as the information in other payment receipts and serves as proof of purchase in the network (online).

Step 3. Know the important things about buyers and sellers that must be included in the receipt

This article focuses on creating payment receipts between buyers and sellers. The party selling the goods or services must include the following information on the receipt:

- Detailed seller data. Include the name of the person or company who made the sale, address, telephone number, and email address at the top of the receipt. Also include the name of the store manager or company owner.

- Detailed buyer data. Include the full name of the buyer or party who made the purchase transaction.

- Transaction date. Include the date, month, and year of the transaction because this information is needed to report taxes.

- Detailed product data. Write a short description to explain the goods or services being sold, for example: product name, quantity, product number, and other information to identify the product. This data will be useful if you need to find information about products that have already been sold.

- Prices of goods/services. Include the price of goods/services in detail starting from the selling price, taxes, packing or shipping costs, discounts, or rebates in the context of promotional programs. Sales transactions will be more valid and specific if item prices are written in detail.

- Payment method. Include how the buyer made the payment, for example: in cash, by check, credit card, or debit card.

- Signature of seller and buyer. After the receipt has been made or printed and the buyer makes the payment, put the “Paid” stamp (if it has been paid off) at the bottom of the receipt and then signed by the seller. You may sign a receipt for the buyer as documentation.

Things Needed

- Paper or blank receipt

- Ballpoint

- Detailed information about purchase transactions