- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Dealing with auditors may be very inconvenient because the auditee has many difficult tasks. It may seem unfair, but the reality is that the auditor's job is no less. The difference is, the auditor has a lot of pre-employment research and the auditee is given many tasks during the audit process. Auditor is a very good career, although the process is the same, the work is always changing so that every day there is always something new and different. Of course, you must know how to audit before becoming an auditor. However, once the basics are learned, auditing is a fairly simple and rewarding job.

Step

Part 1 of 4: Planning the Audit

Step 1. Make sure you are eligible for the audit

All auditors are required to be objective in their assessment. Thus, the auditor must be completely independent from the company. This means that the auditor must not have any relationship with the company outside of the audit, including:

- Has no interest in the company (does not own audited company shares or bonds).

- Not employed by the company in any other capacity.

- Rotated regularly throughout the audit process to obtain a fresh opinion on the material being assessed.

Step 2. Assess the size of the audit

Before entering the audit process, the auditor or audit team must analyze and assess the scope of work to be carried out. This includes estimating how many team members are used and the length of work. In addition, an assessment of all special or work-intensive investigations should be carried out during the audit. All of these scope assessments will help the auditor build a team (if needed) and provide a timeframe for the company being audited.

Step 3. Find possible errors

Prior to commencing the audit, the auditor should use experience and knowledge of the industry to predict areas in which the company's financial information will be misstated. This requires in-depth knowledge of the company's current operating environment. Of course, this assessment is very subjective. Therefore, the auditor must rely on his own judgment.

Step 4. Develop an audit strategy

Once the preliminary assessment has been made, you will need to plan for the audit. Prepare all kinds of actions that need to be done, including areas that may have a lot of importance. Delegate each team member to each task, if possible. Then, create a timeline for each action that needs to be completed. Be aware that this timeline may change significantly during the audit process due to new information.

Part 2 of 4: Carrying out the Audit

Step 1. Provide notification letter

You need to allow sufficient time for the company being audited to prepare all of its company information. Indicate the period of the audit (eg fiscal year), and a list of documents that need to be prepared for the audit, including:

- Bank statements for the year audited.

- Bank account reconciliation report. This is where bank statements will be compared to cash receipts and payment slips.

- Check register for the period being audited.

- Canceled checks.

- A list of transactions recorded in a general journal (either manually or by an online system that tracks company transactions, including revenues and profits).

- Requests for checks and return forms, including receipts and receipts for all expenses.

- Deposit receipt.

- Annual budget and monthly treasurer reports.

Step 2. Prove that all issued checks are properly signed, recorded and posted to the correct accounts

It's better if it can be proven. However, as an external auditor, this is beyond your scope. You just need to make sure each transaction is posted to the appropriate account.

For example, there may be two different Accounts Payable, one for raw materials, and one for office supplies

Step 3. Make sure all deposits are posted correctly

That is, the deposit is entered into the appropriate account and line on the general ledger. At the most basic level, this account is accounts receivable, but it can be further devoted to specific accounts receivable, depending on the complexity of the company.

For example, income from product sales will be included in accounts receivable, while dividends will be included in retained earnings

Part 3 of 4: Auditing Financial Reports and Reports

Step 1. Review all financial statements

Review the statement of financial position and income statement for the period audited. Make sure all transactions are properly calculated and recorded in the general ledger. All unusual deposits or withdrawals should be recorded and verified. Check if all the accounts are reconciled every month.

- Unusual deposits can be large or come from a business unit located overseas. Unusual withdrawals include moving large amounts of money to one person or business unit over a long period of time.

- Reconciliation means comparing two different reports or documents. For example, cash and investments are compared on bank statements and brokerage firms. In addition, accounts receivable and accounts payable must be compared against customer receipts and payments. For inventories, physical counts and valuations are carried out over a period of at least a year to ensure that the accounts in the general ledger are accurate.

- For reconciliation, the auditor does not need to examine all transactions individually. Taking a statistical sample of the total of all transactions (i.e. analyzing a small number and then assigning a percentage error to the entire transaction) can give similar results in a short period of time.

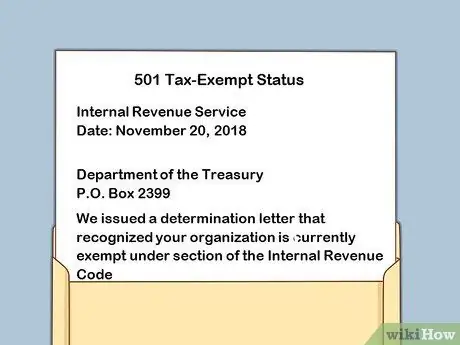

Step 2. Ensure company compliance with country laws and regulations

If you are auditing a for-profit company, prove the company's tax-exempt status and the validity of filling out the form. Make sure the company complies with all requirements and fills out all forms proving that the company gets tax exemption from the state.

Step 3. Review all treasurer reports

Make sure all reports are recorded and the figures from the reports to the general ledger are exactly the same. Check to see that the annual treasurer's report has been prepared and submitted.

Part 4 of 4: Completing Audits and Making Opinions

Step 1. Complete the financial audit working papers

This paper is a summary of all activities in the period being audited (usually annually, but sometimes quarterly). Among them:

- Cash balance at the beginning of the period

- All receipts in the audited period

- All payments in the audited period

- Cash at the end of the period

Step 2. Suggest improvements to the internal control department

Make sure you take note of any discrepancies. If prompted, rate the company's performance against budgets or other metrics.

For example, you might want to suggest that it takes two people to sign all checks, not just one. There may be documents that should still be kept for tax purposes but are discarded at the end of the year. Notify that originals should be kept, not copies. Describe the period of time all emails should be kept, usually 7 years

Step 3. Determine your audit opinion

At the conclusion of the audit, the auditor must provide an opinion. This document states whether the financial information provided by the company is error free and properly reported in accordance with the Statement of Financial Accounting Standards (PSAK). Whether or not the company's financial statements meet the criteria depends on the auditor's judgment. If the financial statements are reported correctly and are free of errors, the auditor provides an unqualified opinion, an unqualified opinion with an explanatory paragraph, or an unqualified opinion. Otherwise, the auditor gives an adverse opinion or disclaims an opinion. This opinion is also used if the auditor feels unable to continue the audit (for any reason).

Step 4. Submit the audit result document that you have signed

This is a statement that you have completed the audit and report that all financial statements are accurate or problematic if there are any discrepancies. If you encounter problems, such as missing checks (without explanation) or miscalculations, please disclose them all in this report. It is helpful to include all the information that you feel can correct the problem or prevent a reoccurrence for the next audit period.