- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Creating a good budget is the first step to managing finances and living a quality life. You can live a calm and stress-free life if you have a budget because you can pay off debt and save. However, managing finances using a budget does not mean that you have to reduce expenses. A budget helps you allocate money to pay for necessities that should be prioritized before having fun. By recording the receipts and expenditures of money every month, you can manage your finances well and fulfill your wishes according to deadlines.

Step

Method 1 of 3: Budgeting

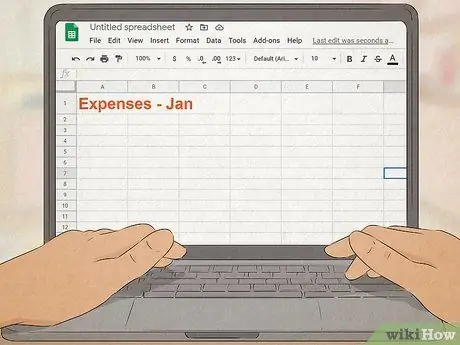

Step 1. Create a budget using a computer program or application

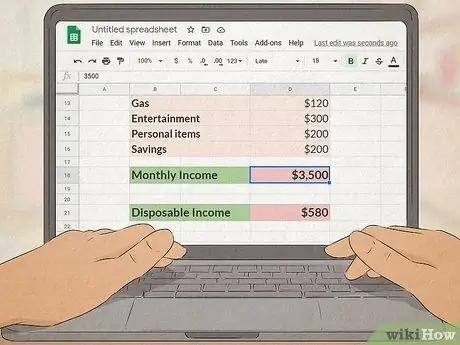

Use Google Sheets or Excel to create a budget. This step helps you record every transaction of expenses and receipts for 1 year so you can immediately determine the expenses that need to be reduced.

List the names of the 12 months as the headings of each column on the top row of the spreadsheet

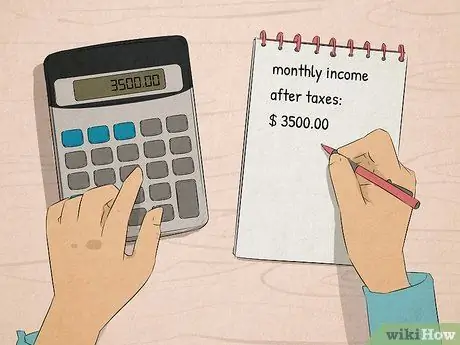

Step 2. Calculate your monthly after-tax income

Net income, i.e. money available for daily use, is monthly income after deducting income tax. If you receive a fixed monthly salary, the net income is the same each month and the figure is listed on the payslip. If you receive a salary based on hours worked, your net income usually varies each month, but you can calculate the average using your last 3-4 months' payslips.

If you are a freelancer or self-employed, the income you receive may not be tax deductible. Allocate 20% of income to pay annual taxes

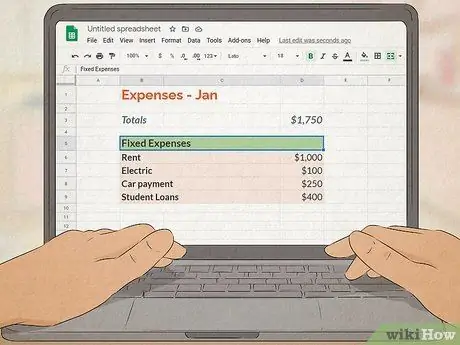

Step 3. Record all fixed costs

Fixed costs are costs that must be paid every month and the amount is the same, for example the cost of renting a house, utility costs, bank loan installments, or vehicle installments. Put the label "Fixed Costs" in the leftmost column of the spreadsheet, then write the amount of money that must be spent in the box below the column heading. For example:

- House rent: IDR 1,000,000

- Electricity: IDR 300,000

- Water: IDR 200,000

- Car installment: IDR 2,000,000

- Bank loan installment: IDR 2,000,000

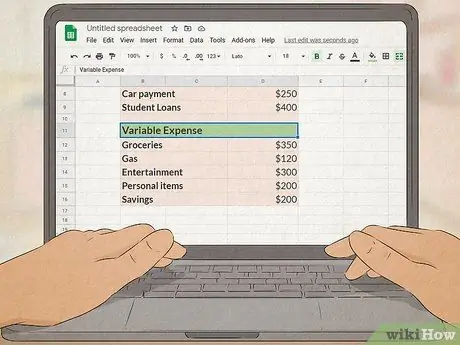

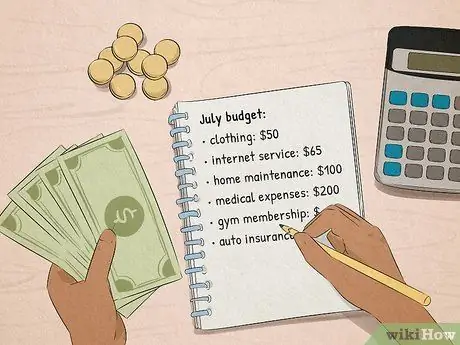

Step 4. Record all variable costs

Variable costs are costs that can change every month. If you want to save, variable costs are the easiest expenses to reduce. Put the label "Variable Costs" under "Fixed Costs", then write the amount of money that must be spent in each box below the fixed cost numbers. For example, variable costs for March:

- Food: IDR 2,000,000

- Gasoline: IDR 500,000

- Recreation: IDR 500,000

- Personal needs (hair care, cosmetics, clothes, etc.): IDR 1,000,000

- Vacation: IDR 200,000

- Savings: IDR 300,000

Step 5. Compare expenses with net income

To create a monthly budget, add up the fixed costs and variable costs for the same month. Then, subtract net income by those costs. The figure obtained is income that can be used to fund other needs or a surplus at the end of the month. If the number is negative, it means you have no money at the end of the month. There is a possibility, the money used to pay monthly needs is greater than the monthly net income.

For example: monthly fee = IDR 5,500,000 (fixed cost) + IDR 4,500,000 (variable cost) = IDR 10,000,000/month. Surplus = IDR 15,000,000 - IDR 10,000,000 = IDR 5,000,000

Method 2 of 3: Using a Budget

Step 1. Prioritize paying all monthly expenses

Before you allocate funds for savings or realize certain plans, make sure you are able to pay off the costs that must be paid every month. For that, allocate funds from net income every month to pay off bills so that you still have housing and food.

- Don't save if you have unpaid bills!

- Try to pay off all monthly expenses and still have a surplus so you can save.

Step 2. Allocate surplus to realize a specific plan

After knowing the money available at the end of the month, use the funds to achieve the things you want, for example saving, paying off debt, or setting up funds for your children's education. Decide what you want to achieve using the available money so that you can develop a plan.

- For example, allocate a surplus to pay off debt and save every month.

- You may use the surplus for unexpected expenses or making investments, such as buying stocks or gold.

- Allocate 20% of net income to save or fulfill certain desires.

Step 3. Change your lifestyle if you have a deficit

After calculating the balance of funds at the end of the month and the number is negative, you should change your habits of using money. Reduce expenses to pay for secondary or tertiary needs, such as buying clothes, recreation, or eating at restaurants.

- If you can't reduce your current monthly expenses, that's okay. Do not feel guilty! You need to eat, pay bills, and buy clothes to live a good life.

- Determine expenses that can be reduced. You may decide right away that you want to reduce your recreation costs by 50%, but consider the impact if you refuse every time your friends invite you to have fun.

- Prepare funds of approximately 30% of net income to pay for what you want, but not primary needs.

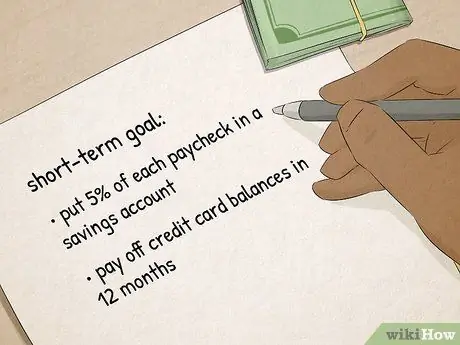

Step 4. Define short-term goals to be achieved in 1 year

Once you know the amount of income and expenses each month, determine how to allocate funds to achieve certain goals. Short-term goals are specific and realistic targets that can be achieved in 12 months. For example:

- Allocate 5% of net income for savings.

- Pay off credit card debt in 12 months.

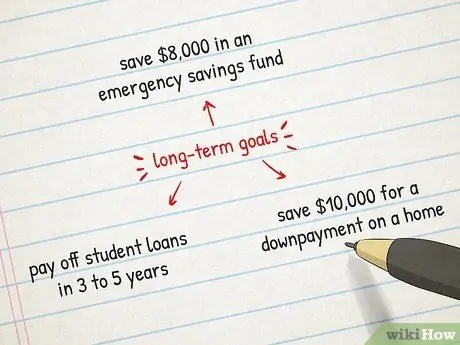

Step 5. Define long-term goals that you want to achieve in a few years

Long-term goals are targets that can be achieved within a minimum of 1 year. Make sure you set specific and realistic goals for planning for the future. For example:

- Save IDR 100,000,000 to set up an emergency fund.

- Pay off debt in 3-5 years.

- Saved IDR 200,000,000 to pay the down payment for the purchase of a house.

Step 6. Record the money that is issued each time you make a payment

The best way to monitor financial management is to record every money spent. Choose the easiest way to take notes, whether you're using a notebook, a note-taking app on your phone, or a spreadsheet on your computer. That way, you can monitor every expense transaction and determine the use of money that can be saved.

When recording the money used, write down the information in detail so you don't forget, for example, "A watch for Mother's birthday is IDR 500,000."

Step 7. Reduce expenses by buying economical items

If you realize that you are going into a deficit, establish habits that can be changed, but not drastically change your daily life. For example, make it a habit to shop for groceries at the market, instead of buying them at the mall. Drink brewed coffee yourself, rather than from a coffee shop. Do this consistently because small changes make a big impact over time!

Other examples: bring lunch from home, instead of buying it at the cafeteria; get used to exercising in the park, instead of at the gym; start subscribing to online newspapers, instead of buying printed newspapers; read a book in the library, instead of buying a new book

Method 3 of 3: Using a Budget Consistently

Step 1. Review the budget each month

Make sure you update your budget regularly because receipts and expenses usually change every month. Get in the habit of keeping track of every time you spend and save, then adjust your spending plan if needed.

- At the beginning of each month, review last month's budget to find out how it was realized. This step helps you make budget adjustments for the current month and the following months.

- Your budget is impacted if you get a raise or pay off debt.

Step 2. Use tools that make budget implementation easier

Excel program is very useful, but less effective for monitoring all data independently. If you need a more practical tool, use a website or app to enter new data. That way, you can use a budget template and set an alarm on your website reminding you to upload new data.

Use the Mint, YNAB, Quicken, AceMoney, or BudgetPlus apps to create a budget

Step 3. Give yourself a gift once in a while, but don't be extravagant

You have to manage the money, not the other way around. Don't let yourself be enslaved by budget or money. So, you can treat yourself once a month without compromising your budget.

While considering the budget, decide which gifts are worth buying. This month, you may be able to afford a new pair of shoes. Next month, maybe you want to enjoy a latte or buy a new laptop

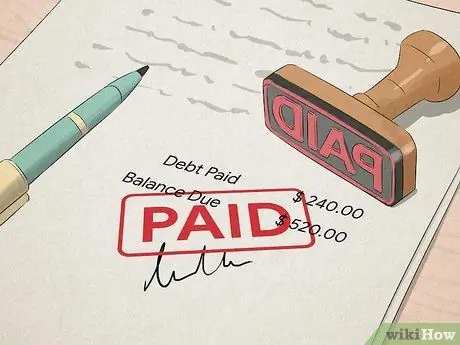

Step 4. Pay off debt installments every month

If you use a credit card or borrow money from the bank, make sure you pay the credit card according to the minimum bill to avoid high interest costs. If you can't pay off your bills, prioritize paying off the debt until it's paid off by a reasonable deadline.

Try allocating more money to pay your monthly bills if you're having trouble doing this. In addition to delaying debt repayment, you have to pay high interest costs if you pay debt according to the bill at least every month

Step 5. Prepare funds to anticipate emergencies by saving

Funding needs during an emergency is impossible to plan and can mess with your budget if you're not prepared. Set aside money every month just in case your car breaks down, you need treatment, or you get laid off so you can stay out of trouble.

- Make preparations from now on to anticipate the unexpected. Don't let yourself be unprepared in case of an emergency.

- If you experience an emergency, contact your credit card company and crediting bank to apply for a deferral of payment and the waiver of a penalty for several months.

- As a guide, you should have savings to pay for the necessities of life for 6 months. For example, if you have to spend IDR 10,000,000 every month, prepare IDR 60,000,000 for emergencies.