- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

Maintaining the health of your personal finances may be a challenging, strenuous and sometimes discouraging process, but for most people it is indispensable. Spending in excess of income is the main cause of a person being in debt, and if you are not careful in managing your expenses, you will have a hard time meeting your basic needs. Fortunately, keeping track of your personal finances isn't difficult, but it does take time and discipline. Try one of the two methods below to better manage your finances.

Step

Method 1 of 2: Manually Recording Personal Finance

Step 1. Create a system

The most important part of monitoring your personal finances is consistency. No matter what system you use to record transactions, you should be able to easily monitor them again. Make sure you include important information such as date, amount of expense or income, and expense category in each journal. Make sure your logging is consistent. For example, you can record transactions as soon as they occur, or even once a week.

Expense categories are an easy way to see where your biggest expenses are. These categories include housing expenses, utilities (eg electricity and water), household expenses, food expenses, health expenses, pets, personal expenses, and entertainment. The types of categories are of course different for everyone and you can customize the specifications as you wish. For example, maybe you only want to list expenses that are important or desirable. The most important thing is that the categorization is carried out consistently for each transaction

Step 2. Save the notebook

The easiest way to keep track of your personal finances is to write down each transaction in a notebook. That way, you can find out where every penny you have is coming or going. At the end of a period (eg weekly or monthly), you can move the information in the book to your computer as a backup.

You can structure this book in a number of ways. To keep things simple, you may want to use books for expenses only. Or, you can use a book to record income and expenses to see the balance of personal finances. Some people just use an expense book, and combine it with credit and debit card loads at the end of each month

Step 3. Save the checkbook

It may seem old-fashioned, but recording transactions in a checkbook is still a simple and reliable way of tracking personal finances. Recording is done simply by writing down the amount and description of the transaction (including the category of the transaction), and adding or subtracting the amount from your account balance. For more information, see Checking the Balance of the Savings Book

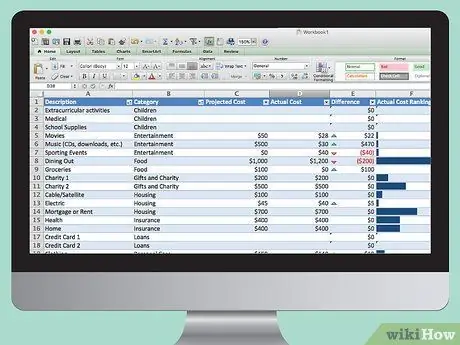

Step 4. Use worksheets on the computer

Using a computer programmable worksheet, such as Microsoft Excel, you can clearly organize your expenses and even create graphs to better understand your expenses. There are many ways to take notes with worksheets, but it's best to start by creating a personal budget. Budgeting is done in each period (usually monthly) and includes information such as the amount, category, and date of each transaction

To create a personal budget, start by ranking your fixed costs each month (such as rent, electricity and water) as priority, then move on to the expenses that are expected to occur during the month. You can subtract or add other expenses as needed during the current period

Step 5. Perform financial analysis at the end of each period

No matter how you record your personal finances, you need a way to aggregate and analyze your expenses at the end of each period. This is done to see where your money is coming and going and whether adjustments need to be made for the next period.

- Start by calculating the total cost and compare it to the total revenue for the month. If your stake is larger than the stake, of course you should identify the source of the overspending and adjust for the following month.

- You can add up all your expenses by category to find where the biggest expenses go. Total up costs in the same category and then compare them with each other or with your total expenses. Or, you can divide the total costs in each category by the overall total expenses to see the percentage of expenses by category. Thus, the costs with the largest percentage are the costs with the most expenses.

- You can also use this information to create a budget for the following month.

Method 2 of 2: Using a Personal Finance App

Step 1. Choose the appropriate application

There is a wide selection of personal finance apps available for both mobile devices and internet browsers that can monitor, tabulate, and analyze your expenses. The app also offers a full range of features, from being just a budgeting tool to displaying all your assets at once. In choosing, determine your financial goals and commitment in using this application.

-

You may be able to choose a comprehensive app that pulls all financial information from bank accounts, pensions, and other sources. the app can also sometimes track bills and remind you when they're due. The best apps to choose from include::

- Mint

- Personal Capital

- Pocket Expenses

-

Or, you can use a fairly simple application to record expenses and income. This app is also linked to a bank, but offers a simpler interface and limited options than comprehensive apps. Good examples include:

- Money Level

- BillGuard

-

Finally, if you want to use an app to monitor your finances, but are hesitant to provide sensitive information (such as passwords or bank account numbers), there are several apps that serve as journal keeping and financial analysis tools. For example:

- Mvelopes

- You Need a Budget

Step 2. Enter your information into the application

If the selected app requires bank information, enter it and wait for it to sync with your bank account. Or, enter your own transaction information when spending money and your app will do the rest. The app will also guide you through this process.

Step 3. Study the analysis the app performs

At regular intervals, the app will provide an analysis of your spending habits. Be sure to read these reports and adjust your habits if necessary. Some apps provide guidance on how to save money in certain areas.

Tips

- This article is primarily about keeping track of your expenses and income. For more information on managing your finances and saving money, see How to Check your Savings Book Balance and How to Save.

- Try to reduce the use of cash, because it is more difficult to track than debit or credit card loads.