- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

You definitely don't like it when your wallet is empty when you really need money. You must spend your money wisely, regardless of the amount; The goal is to make savings. Follow these tips to reduce expenses in the main section and take a safer overall approach to shopping.

Step

Method 1 of 4: Basic Expenses

Step 1. Create a budget

Record expenses and income so that you have an accurate picture of your financial situation. Keep receipts or write down each purchase in a notebook. Review your bills each month and add those costs to your budget.

- Organize purchases by category (food, clothing, entertainment, etc.). The category with the highest monthly amount (or the very high monthly amount you think) is a great goal for saving money.

- After you've recorded your purchases for a while, set a monthly (or weekly) limit for each category. Make sure your total budget for the period is less than your income, if possible, have enough money left for savings.

Step 2. Plan purchases in advance

Making decisions in a moment of urgency can increase expenses. Write down what you should buy when you are calm and at home.

- Take an early trip before going on a real shopping trip. Pay attention to the prices of several alternative products in one or more stores. Go home buying nothing, and decide which products to buy on the "real" shopping trip. The more focused you are and the less time you spend in the store, the less money you will spend.

- If you are motivated to treat every purchase as an important decision, you will make better decisions.

- Don't accept free samples or try products just for fun. This can convince you to make a decision now rather than weighing it up first, even if you don't plan to buy one.

Step 3. Avoid the urge to buy

Planning a purchase in advance is a good thing, and buying something on the spur of the moment is a bad idea. Follow the steps below to avoid making shopping decisions for the wrong reasons:

- Don't browse shops or shop for fun. If you buy something because you enjoy shopping, you will spend too much money on things you don't need.

- Don't make a buying decision when your judgment is being compromised. Alcohol, other drugs, or lack of sleep can make you make poor decisions. Even shopping when you're hungry or listening to loud music can be a bad idea if you don't stick to your shopping list.

Step 4. Shop alone

Kids, friends who love to shop, or even friends you respect can cost you some extra cash.

Don't listen to the shopkeeper's advice. If you want your question answered, politely listen to their response but ignore their advice on the purchase decision. If they just stay with you, leave the store and come back later to make a decision

Step 5. Pay in full and in cash

There are two reasons why credit and debit cards will increase spending: You have more money available to spend than usual, and because the money doesn't appear to change hands you don't think it's a "real" purchase. Similarly, running a tab bar or using a delayed payment plan will make it harder for you to realize when you've actually spent a lot of money.

Don't carry more cash than you need. You can't spend extra money that you don't carry. Similarly, withdrawing money from an ATM once a week is better than filling up your wallet every time the money runs out

Step 6. Don't be fooled by product marketing

Outside influence is a big factor influencing where your money will go. Know and be aware of the reasons you are interested in a product.

- Don't buy anything because of advertising. Television advertising and product packaging, respond to advertising with skepticism. Ads are designed to encourage you to spend money and will not provide an accurate picture of your choice.

- Don't buy something just because it's discounted. Coupons and laundry are just right for the products you're planning to buy; but buying something you don't need just because it's a 50% off offer isn't going to save you any money.

- Be aware of the price trick. The "$1.99" price is actually "$2". Consider the price of a product for its benefits and not because it offers a "greater price" than other options. (By creating a "overpriced" value, a product can trick you into paying more for extras you don't need).

Step 7. Wait for the laundry period and discounts

If you know you're going to need a certain product but not right now, wait for it to offer a discount or look for a coupon for it.

- Only use coupons or take advantage of discounts on products you want really need, or buy it before the discount is available. The lure of lower prices is an easy way to get customers to buy something they don't need.

- Buy products that are only useful at certain times when they are not needed. Winter coats, for example, will be cheap during hot weather.

Step 8. Do your research

Before making an expensive purchase, search the internet or read consumer reports to find out how to get the best product for the least amount of money. Look for products that last within your budget and best meet your needs.

Step 9. Calculate all costs

You may have to pay more than the product price listed. Read all printed descriptions and calculate the total price of the product before buying it.

- Don't be fooled by lower monthly installments. Calculate the total price you will pay (monthly installments x number of months until fully paid) to find out which option is the cheapest.

- If you take out a loan, calculate how much interest you have to pay.

Step 10. Give yourself an occasional cheap product

This may sound paradoxical (doesn't this mean buying something you don't need?) but in reality, it's easier to maintain a spending goal if you gift yourself the occasional gift. If you buy a product you don't need out of the blue, you can "go crazy" and end up spending a lot more money than you need to.

- Set aside a very limited amount of money in your budget for this gift. Your main goal is to give small gifts to keep your spirits up and prevent major waste in the future.

- If this method of gifting is expensive, look for a less expensive alternative. Take a bubble bath at home instead of going to the spa, or borrow a movie from a movie rental instead of going to the cinema.

Method 2 of 4: Spending On Clothes

Step 1. Buy what you really need

Take a look at your closet and remember what you already have. Sell or gift clothes that you don't wear or don't fit so that your buying plans are more mature.

Cleaning the closet is not a reason to buy a replacement. The goal is to know what kind of clothes you have enough and what clothes you need more

Step 2. Know when to buy branded products

Do not buy the most expensive socks because they will stretch quickly. Buy a pair of higher quality, more durable shoes, as they can save you money in the long run.

- Remember that price does not guarantee quality. Look for the brand that lasts the most, and the most expensive product doesn't necessarily mean the best.

- Similarly, wait until the product you need is discounted, if possible. And remember not to use laundry excuses to buy things you don't need.

Step 3. Shop at thrift stores

Some used clothing stores have very high quality products. At the very least, you can buy the basics at very low prices.

Thrift stores in wealthy neighborhoods usually have high-quality products

Step 4. If the product you're looking for isn't available at a secondhand store, buy an inexpensive, generic brand

Designer logos do not denote higher quality.

Method 3 of 4: Food and Drink Expenditure

Step 1. Make a weekly menu and shopping list

Once you've budgeted your money for food, write down the foods you'll definitely eat and the ingredients you'll need to buy to make them.

This not only prevents you from buying other products, but also prevents you from spending money on food that you don't need. If the food you buy often does not run out, reduce the portion of the food you plan to eat

Step 2. Learn how to save money on food

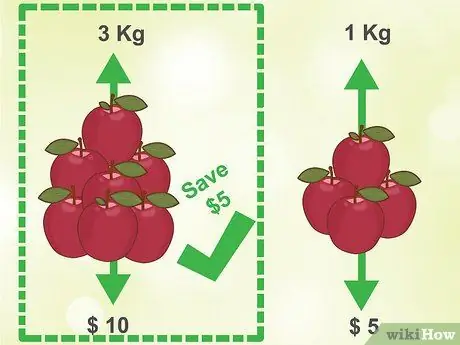

There are many ways to save money when shopping, from buying food in bulk to knowing when a product will be cheaper.

Step 3. Reduce the intensity of eating in restaurants

Eating out is much more expensive than cooking your own food, and shouldn't be done by anyone looking to save money.

- Bring lunch from home if you are working or studying.

- Bring a water bottle from home instead of buying bottled water.

- Similarly, if you always drink coffee, prepare your coffee from home.

Method 4 of 4: Save Wisely

Step 1. Save money

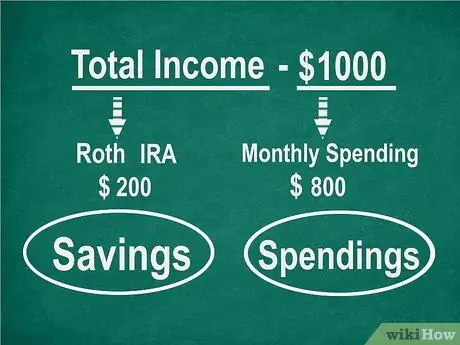

Make wise shopping decisions along with frugal steps. By saving as much as possible, you can create a savings or investment for other accumulated results. The more money you save each month, the better your overall financial health will be. Isn't this a goal to spend money wisely? Here are some savings ideas you can consider:

- Establish an emergency fund.

- Starting a Roth IRA or 401(k) (a type of retirement investment).

- Avoid unnecessary costs.

- Plan your meals for the week

Step 2. Break expensive habits

Compulsive habits like smoking, drinking, or gambling will easily drain your savings. Breaking this habit is good for your wallet as well as your health.

Step 3. Don't buy what you don't need

If you are unsure about a particular purchase, ask yourself. If your answers are not all "yes", this is a strong sign that you are not spending money.

- Will you use this product regularly? Make sure you finish off all the milk before it goes stale, or make sure you have enough summer clothes to wear several times until the last summer is over.

- Are you lacking something for the same purpose? Be aware of special products whose functions can be replaced by basic products that you already have. You don't need special kitchen utensils, or special workout clothes if pants and a t-shirt can work too.

- Does this product make your life better? It's a tricky question, but you should avoid purchases that encourage "bad habits" or cause you to neglect important parts of your life.

- Will you miss this product if you don't buy it?

- Does this product make you happy?

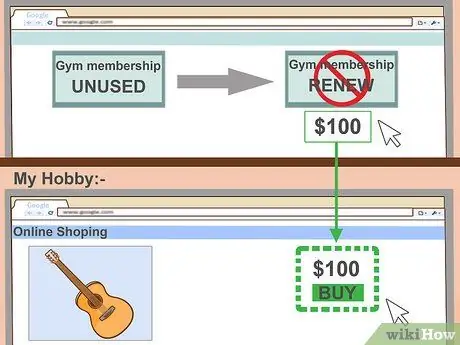

Step 4. Cut back on your hobbies

If you have a sports membership but don't use it, don't renew. Your passion for collecting Just a moment? Sell the collection. Spend your money and energy only in areas that excite you.

Tips

- Saving steps will be much easier if all household members are committed.

- Shop around regularly for utilities and insurance. Many services (telephone, internet, cable or satellite, insurance, etc.) offer better deals for new customers. If you keep switching services, you can create better savings plans. (In Western countries, some phone companies will pay an early cancellation fee for your old phone contract if you switch to them.)

- When comparing two cars, calculate how much fuel you would have to spend if you bought a less efficient (low MPG) car model.

- Avoid clothes with dry-clean. Check shirt markings before buying. You don't want to have to spend money on dry-cleaning services over and over again.