- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

If you're planning to buy something but don't remember if you have enough balance on your credit card, there are various ways to get this information and put your mind at ease. The best way to check your credit card balance really depends on two things: how much information you are looking for and the sources of information and connection lines available. Not knowing the remaining balance on your credit card can be confusing but with one of the following methods, you can find out quickly and easily.

Step

Method 1 of 3: Checking Balance Online

Step 1. Use the internet if you can

If you have internet access, the best option is to get your credit card balance information online. Most credit card issuers provide online banking or bill payment services that allow you not only to check your balance, but also to transfer credit balances or pay credit card bills online. This can be done using a computer or smartphone.

Step 2. Visit the website of your credit card issuing bank or open the app on your smartphone

If you have a computer, you can simply visit the bank's website. The website address is usually listed on the back of your credit card. If you have a smartphone, download your credit card issuer's app, if available. Otherwise, you will have to use a web browser on your phone.

Step 3. Create an online account if you don't already have one

If you've never signed up for online banking with your credit card issuer, be prepared to provide your identifying information, such as your full credit card number, date of birth, and billing address.

- You will need to create a username and password for your new online account. Create usernames and passwords that you'll remember without having to write them down somewhere, but which also can't be guessed by anyone else. It's a good idea to have different usernames and passwords for different online accounts, so don't use the same username and password as other online accounts.

- Many banking sites will ask you to link an account with your email address. To create an account, your credit card issuer will send you an email with a link to create your account.

Step 4. Log in to your account

To do so, you must enter your username and password, either on the computer or in the application. After successfully logging in, look for the link that says “balance” and click on that option. There, you can find everything you're looking for: real-time account balances, recent transactions, and any pending processing that might affect your available credit card balance.

- If you want to make an online transaction, you must also provide information about the bank account that will be used to pay for the credit card.

- Some online services also allow you to view your billing history, so you can compare your credit card balances each month.

Method 2 of 3: Calling the Bank to Ask for the Balance

Step 1. Find a phone that works

If you have access to a telephone and just want to get your credit card balance information, calling your credit card customer service is the best way to go.

- The benefit of calling is that you can speak directly to a customer service representative and get the information you need.

- The downside is that the waiting time to speak to a customer service representative may take a while.

- One more drawback is that if you ask something related to the calculation of a transaction that has been made, it may be difficult to pay attention to it if an explanation is given over the phone.

Step 2. Prepare the information you will need before calling

You will need some information. First, the customer service representative will ask for some detailed personal information to verify your identity. This includes your social security number, date of birth and answers to any secret questions you have created, such as your mother's maiden name.

Second, make sure the card you want to ask is near you. You may be asked to provide the card number you wish to inquire

Step 3. Call your bank's customer service number

The number you need to call is on the back of your card. Most customer service numbers will direct you to a system that will automatically notify you of your credit card balance, or give you the option of hearing your balance information before speaking with a customer service representative.

Step 4. Perform identity verification

If you talk to a customer service representative in person, he or she will ask you questions to verify your identity. If you are connected to an automated service, you must enter a security answer using the keypad on your phone.

Step 5. State that you want to know your credit card balance

An automated system will guide you through the steps to find out your balance. You may be asked to enter a number with the keypad on your phone to indicate the choice you made. If you talk to a customer service representative, he or she can tell you your balance and answer any other questions you may have.

- You may be directed through a number of menus to get your credit card balance information. In the first menu, you may be asked to dial a certain number to access the account you want to inquire. For example, if you want to check your business credit card, you have to press button 2. Then on the next menu, you will usually be asked what kind of information you want from the account. In this case, the answer is credit card balances.

- If for some reason you are unable to obtain credit card balance information through the automated system, a customer service representative will be able to provide you with the same information. Usually you can be redirected to talk to a representative by pressing the 0 button on the automatic menu.

Method 3 of 3: Checking Your Credit Card Bill

Step 1. Find out your credit card charges

If your goal is not to inquire about fraud or to dispute a transaction, perhaps questions about previous credit card usage or pending transaction processing are better to know from your physical monthly credit card bill.

Some people choose to view their credit card bill electronically. If you also choose this method, you will need to check your credit card account online or check the bill sent to your email address

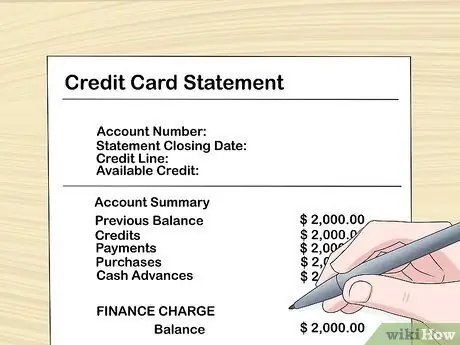

Step 2. Find the balance listed on your credit card bill

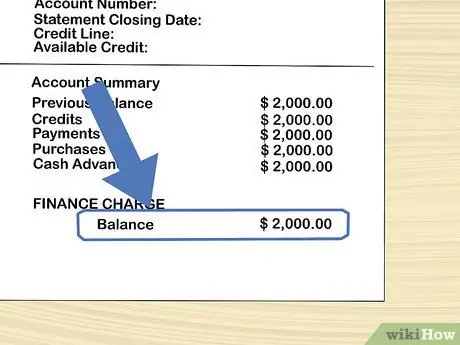

The balance is usually located in a prominent place and is marked on your bill.

- You can view the date the bill was printed, to estimate whether you have made additional purchases since the bill was printed.

- The advantage of checking credit card bills is that you can see additional information, such as your total credit limit and remaining balance for making purchases.

Step 3. Add any purchases you've made since the last billing date to the balance on your bill

The invoices you hold may not cover your most recent transactions.

- If you can't remember whether you've made another purchase, it might be a good idea to check your credit card balance using another method.

- The downside of checking bills is that because the distance between one bill and another is approximately one month, the information listed will not include any transactions made since the date of your last bill print.

- The invoice will also reveal a variety of other information, including purchase information, applicable interest rates, and available credits for cash withdrawals.

Warning

Keep in mind that whichever way you choose to access your credit card balance information, any recent purchases that have not been recorded in your account will not be included in the printed balance

Tips

- If you always record purchases by credit card between billing dates, you can use a checkbook-style notebook, so you don't have to bother checking the latest balance from your credit card.

- Keeping track of how much you owe is a surefire way to remind you of the importance of living within your income and to pay off debt as soon as possible.

- If your credit is so close to the maximum limit on your credit card that you need to check your current balance right before buying anything, your usage may have already exceeded 50 percent of the credit card usage limit. Although exact numbers vary, financial experts recommend keeping your credit balance below 30 to 50 percent of the credit limit on each card. Allowing your credit balance to rise beyond that number can result in your credit score dropping.

- Checking the balance of a prepaid credit card is usually very similar to checking the balance of a postpaid credit card. Look for a phone number or website where you can check the balance on the back of your credit card.