- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

If you usually make financial transactions electronically, you may find it difficult to monitor the amount of expenses. Fortunately, banks keep records of all your transactions, and all you need to do is check your account balance. The easiest way to monitor account balances is to use online banking via the bank's website or app. However, you can also check your balance through the nearest ATM or bank branch.

Step

Method 1 of 3: Using Online Banking

Step 1. Visit the bank's website using a computer or mobile phone

To find the site, type the name of the bank into the search bar of your internet browser. Then, click the site link to open the page.

Make sure the URL starts from https to make sure it's safe to access

Variation:

Download the bank's mobile app on your smartphone or tablet, if available. Look for the app in the App Store or Google Play Store. This makes it easier for you to check your balance at any time.

Step 2. Create an account using your account information, if you don't already have one

Click the link that says “create an account” or “register” (register). Then, fill in all the boxes to create an account. You will be asked to enter your account number, routing or sorting number, name, date of birth, and email address. In addition, you will be asked to create a username and password.

- If you don't see a link to create an account, select “log in” and look at “create an account” under the login box.

- If you already have an online bank account, skip this step and log in to your existing account.

- Some banks ask you to call or visit a bank branch office to start online banking.

Step 3. Log in to online banking with your username and password

Type the username and password into their respective boxes on the login screen. Then, answer security questions if asked.

- Make sure the “remember me” option is unchecked if you are not using a personal computer.

- Banking sites usually ask security questions if you are logging in for the first time or using an unknown computer.

Step 4. Click the account information option to check the balance

Look for a label that says "Account Information" (account summary) or "Balance Information" (checking account). Click this link to view the current account balance and transactions.

Browse the listed transactions to make sure nothing is missed

Warning:

Some debits may not appear immediately so that the balance amount listed is not accurate. For example, checks, automatic payments, and third-party payments may take some time to appear in your account.

Step 5. Log out of the account when you are done

Usually, the bank's site will force you to log out after a certain amount of time, usually 30 minutes. However, we recommend that you log out yourself so that no one can access your banking information. Click the “log out” button to end the online banking session.

Method 2 of 3: Using an ATM

Step 1. Look for an ATM directly or use a cell phone

Usually you can check your account balance at all ATMs, even those that your bank doesn't have. Look for ATMs at bank branches, retail stores, gas stations, and some supermarkets. At the bank, there should be an ATM that can be accessed 24 hours a day. In other locations, ATMs are usually in-store or ATM posts outside the store.

- If there is, you can use a lantatur ATM (drive-thru) so you don't have to get out of the car.

- It's better if you use an ATM in the room because the chances of being tampered with by thieves are smaller. However, outdoor ATMs are usually safe to use, so don't worry too much if this is your only option.

Tip:

If you use your bank's ATM, checking your balance should not incur a fee. However, you may be charged a fee if you use another bank's ATM.

Step 2. Insert the debit card into the ATM

Check the diagram on the machine to determine which side of the card needs to be inserted into the card slot. Leave the card in the machine, or withdraw it, depending on how the machine works.

Step 3. Type in the personal identification number (PIN) code

This is the 6-digit number that is received or specified when obtaining a debit card. Type in the PIN code using the keypad, then press enter.

If there are other people nearby, cover the keypad so that no one can see the number you entered

Step 4. Select the option to view bank balance

Most machines will show you all your banking options. Choose the one that says "balance". Then, select the type of receipt you want.

The balance can be displayed on the machine screen. However, some machines only show your balance via a receipt

Step 5. Take the receipt containing the account balance

You can get paper or email receipts, but the majority of ATM machines in Indonesia only provide paper receipts. This receipt lists your current account balance.

If the machine displays the balance on the screen, you are not given a receipt

Step 6. Log out the machine

Some machines will force you to log out automatically, but others will give you options. To make sure your information is safe, press the log out button or complete the transaction.

Make sure you also take the card from the machine, if you haven't already. If the card is held by the machine when you make a transaction, this card will be removed from the machine when you complete the transaction

Method 3 of 3: Visiting the Bank

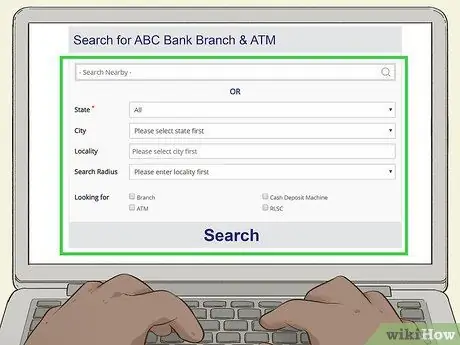

Step 1. Go to the bank branch office

Find the bank branch closest to you via the internet. Then, visit the bank to talk to the bank teller.

If you open the mobile map application, you should be able to find the nearest bank branch easily from your current location

Tip:

You may be able to call the bank to check the balance. However, usually the bank asks you to come in person so that your identity can be verified directly.

Step 2. Ask the bank teller to check your account balance

Usually you have to wait in line to talk to the teller. When it's your turn, go to the teller counter and ask to check your bank balance.

Usually, bank tellers are at a large long table on one side of the bank's interior room. If you are confused, ask the security guard or employee there

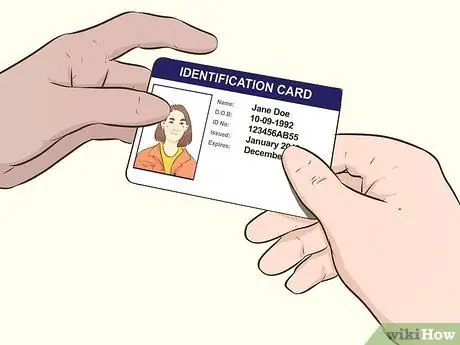

Step 3. Provide your account number or debit card and photo ID

The bank teller will ask for your identification information. Provide your account number or debit card so the teller can check your account. Then, provide a photo ID to prove that you really are the owner of the account.

Usually you can use any government-issued identification card. Tellers usually do this to protect your account from people pretending to be you

Step 4. Get a receipt containing your account balance from the teller

The teller can print the receipt for you, or just write it down on paper. Take this receipt before leaving.