- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

All banks require documentation in the form of a deposit slip with complete data for the process of depositing funds into your savings or check account. The process of filling out a deposit slip is almost the same as writing a check, in that you have to fill in certain fields in the deposit slip with certain information, such as the date, bank account number, amount and total deposit. This process may seem difficult, but it is actually very easy. With the instructions below, you will feel confident that you are following the correct procedure.

Step

Method 1 of 3: Collecting Your Basic Information

Step 1. Prepare your account information

You'll want to make sure that the money you deposit goes to the correct account. This is especially important if you have more than one account at the same bank. If you don't remember the account number, bring a checkbook with you. You will find the account number there.

- If making a deposit to a savings account, make sure that you have the account number. You can view them on online banking sites or view one of your most recent printouts of bank statements.

- Your check has several deposit slips printed with personal information (name, etc.). You can use either one or the bank will provide a blank slip if you don't have one.

Step 2. Bring your ID card or letter

Better to bring a photo ID with you when you go to the bank. You may not need it to make a deposit. However, it's best if you take it with you in case something goes wrong. Watching is always better.

- Make sure that you know the form of identity your bank branch accepts. You should be able to find this information by calling the bank and asking or viewing the information on the bank's website.

- Usually, you need a driver's license (SIM), passport, identity card (KTP), or student ID card.

Step 3. Prepare your cash and checks

Make sure that you have all the types of money you want to deposit. If you have cash, make sure you've counted it and then recalculated to make sure you know the exact amount you're going to deposit.

If you deposit a check, you must sign it. On the back of the check, there is a special place for your signature. Under the signature, you can write “For deposits only”. That way, if you lose the check on your way to the bank, no one can cash it

Step 4. Know the bank's operating hours

Many banks offer different working hours. Drive-through service operating hours are often different from lobbying times. In addition, many banks have ATMs 24 hours in the front room. Know all operating hours and days when the bank is open.

- Decide in advance if you want to use a drive through service, through a bank cashier, or using an ATM.

- If this is your first time filling out a deposit slip, it is better to use the lobby. There will be many people who can help if you need it.

Method 2 of 3: Filling in the Deposit Slip

Step 1. Use a pen

When filling out a deposit slip, using a pen instead of a pencil is a smart move. Thus, no one can change the information you have written down. The cashier can also more easily read the numbers written in dark ink.

Don't worry if you make a mistake. Just tear up the deposit slip and start writing on a new one

Step 2. Write clearly

There are several different things you should write down on the deposit slip. You want to make sure that bank employees can read everything easily. This will prevent mistakes in making your deposit. Use your best handwriting.

Write the exact date on the deposit slip. You want clear writing when you make this deposit

Step 3. Deposit a check or cash

On the deposit slip, there is a place to write down the amount of money you deposit. There will be a line for the amount of cash you want to keep in your account. There are several lines to write down the check you deposit.

Make sure to write down all the checks one by one. There are a few lines for you to write them down. If you run out of space, there are still a few rows on the back of the deposit slip

Step 4. Receive the money back

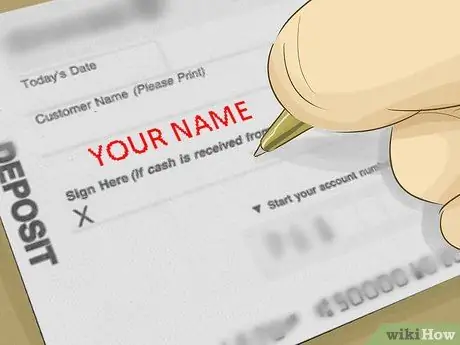

You can choose to deposit all the money in your check or your savings account. You can also receive part of the stated amount in cash. If you want to receive the money back, you must sign a deposit slip.

The place for your signature is clearly marked. It says “sign here for cash withdrawal” or something

Method 3 of 3: Tracking Your Financial Information

Step 1. Ask for a receipt

Once you've provided your cash, check, and deposit slip, you're done. But remember, it's important to keep track of all your financial transactions. This will help you figure out how much money you have in your account, and can help you make sure that the bank hasn't made any mistakes.

You should receive a printed receipt from the cashier or ATM. If you don't receive it, be sure to ask for it yourself

Step 2. Make your own notes

In addition to bank receipts, you should also keep records of all your financial transactions. This can help you understand how much money you are spending and saving. There are many online banking programs that you can use to track your finances. If you don't like technology, you can use a regular notebook or cash book.

Step 3. Check your account balance

You need to check and make sure that the deposit was actually added to your account. On the next business day, check your account balance to make sure that the amount recorded is correct. You can do this by using the online banking system or by calling your bank branch.

Tips

- Do not write your deposit slip with a pencil. Use a pen.

- Review your deposit slip to prevent errors from occurring. Bank cashiers usually notice if there are errors, but it's best to check your writing.

- Your bank may not always be able to agree on the amount of cash you want to receive when you make a deposit. Your bank policy and account status will determine the amount of cash you can receive when you make a deposit.