- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

In the past, depositing a check required you to go specifically to the bank, wait in line, and wait longer for the check to be completed. Many new and creative methods are available to deposit checks into your checking or deposit account quickly and safely. In some bank networks, it is even possible to deposit a check with a smartphone phone!

Step

Method 1 of 5: Depositing at the Bank

Step 1. Visit your bank

You will need to carry your check, valid ID, and your account number with you to make a deposit.

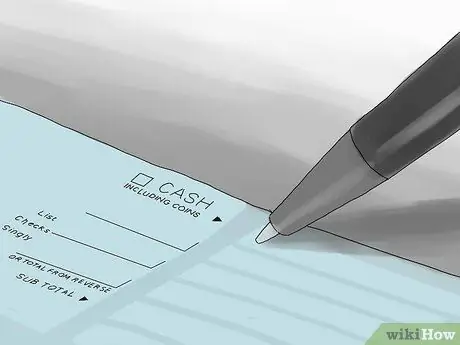

Step 2. Fill in the deposit sheet

These sheets should be readily available in your bank, usually in a pile on the desk with pens and other sheets. You can also request one from the teller, but the deposit process will be faster if you do this beforehand.

You will need to fill in your account number, check amount, how much (if any) you want in cash, deposit, check, and the total amount of the check

Step 3. Validate the check

First, look at the elements written on the front and back of the check to ensure the validity of the check. The following sections of the check are written and complete and legible, and true and precise: the name and address of the person or entity issuing the check, date of issue, your name, the amount of money given is written in numeric and alphabetical form.

Both hands are required for a check to be considered valid

Step 4. Ask the teller to deposit the check with your check or deposit account

The teller can deposit your check, tell you your current balance, and give you the cash you want to collect at that time. You should get a receipt or receipt from the deposit with your current balance.

Method 2 of 5: Depositing at an ATM

Step 1. Visit one of your bank's Automated Teller Machines (ATMs)

Make sure your checks are filled out clearly and legibly, and that you have authorized the checks beforehand. It is important that you choose your own bank ATM. While most cash machines and ATMs will issue money to anyone with a debit card who is willing to accept a deposit fee, other ATM deposit functions will only work for bank members specifically.

Credit union members who routinely do co-arranging in other locations will have to use the credit union's ATM, not co-arranging series

Step 2. Swipe your ATM card or debit card and enter the ATM with your Personal Identification Number (PIN)

If you do not have this information you will need to go to the bank and talk to the teller.

Step 3. From the menu, select "Deposit

A list of your checking and deposit accounts will appear after this. Select the account you want to deposit the check into. Next, you will get a choice between cash or check. Select a check.

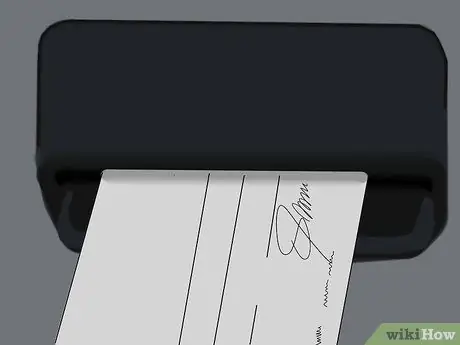

Step 4. Enter your check

There should be a slot to enter with instructions on directing the check (face up or down, etc.) written on the machine. Follow the instructions and enter your check. Next, the ATM will scan the check and will ask you to confirm the information on the "read" check. Check the information carefully to ensure the ATM has the correct amount, account number and other information.

Some Bank of America ATM kiosks allow you to enter up to ten checks at a time, but read the ATM's instructions before you try and enter more than one

Step 5. Complete another transaction if you wish

At this point, the ATM will give you your current balance and ask if you want to make another transaction. You can withdraw cash, print receipts, or deposit cash.

Method 3 of 5: Depositing to a Credit Union

Step 1. Visit a credit union

If you are a member of a local or federal credit union, you can deposit checks not only at any branch of your own union, but at any branch of any credit union.

Step 2. Do not fill in the deposit sheet

Get in line with a valid and endorsed check and tell the bank teller you want to deposit your check, but you are a member of another credit union. You will need to provide the teller with your check, a valid photo ID, your account number, your branch name, and possibly the address of your credit union central branch.

There are hundreds of credit unions, and some have similar names: "Teachers Credit Union" and "Federal Teacher Credit Union" are completely different, for example. Tellers may not be familiar with your specific credit union, so be sure to provide them with an address when they search your database

Step 3. Deposit the check into your checking or deposit account

This is also a good opportunity to withdraw cash without paying the fees that credit union users usually pay at ATMs.

Method 4 of 5: Depositing with the Mobile App

Step 1. Download the mobile deposit app

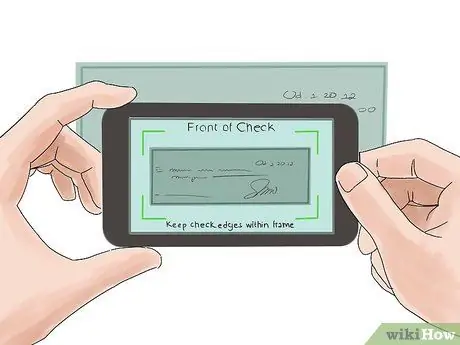

Check to see if your bank provides a mobile deposit application for your tablet or smartphone. Chase, Bank of America, and Citibank and other banks have developed applications for mobile devices that make depositing a check as simple as taking a picture. If available, download the application to your phone or mobile device.

Step 2. Open the app and select Deposit

You should be taken to a screen with options marked "Front of Checks" and "Back of Checks." Use this to take a photo of your backed check front and back, respectively.

Step 3. Select the account you want the check to be deposited into

Fill in the check amount using the app, and check to make sure all the information is correct on the confirmation screen. If so, click "Deposit Check."

You can choose to receive a confirmation email or message when the check is deposited

Method 5 of 5: Sending Checks by Mail

Step 1. Determine the designated route location in your area

If visiting your bank branch or registering for online banking is too difficult from your current location, you can send a complete check and deposit sheet by mail to the designated route location from your bank. You will need to check with your bank to determine where to send the check. Call the toll-free number on your bank card and talk to a representative to find out where to send the check.

Bank of America, for example, registers addresses in Phoenix, AZ for all members residing in AZ, CA, ID, IL, IN, MI, NM, NV, OR, TX, and WA, and addresses in Tampa, FL for members in countries other parts. If you send a check by overnight mail or by FedEx, the address changes. You will need to look online or talk to a representative on the phone to get your bank address and exact location

Step 2. Mail your check backed with a deposit sheet to a route location in your area

Make sure you have a supported and valid check and a deposit sheet from your bank filled in with your information. You may need other information, such as a photocopy of your ID, so it's a good idea to talk to a representative from your bank before mailing a check.

Step 3. Never send cash by mail

You can't deposit cash into your account this way, so make sure you only mail checks. There are usually fees associated with this type of transaction, so make sure you've exhausted all online and ATM options before you attempt to deposit a check by mail.