- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

All businesses, big or small, need to monitor all their transactions. There are many simple financial software systems for sale, but you still need to have a clear understanding of how accounting transactions work. You will enter all business transactions, such as receiving income or paying bills, into an accounting journal similar to a ledger. Here, you are required to collect various categories called accounts, and will record on a debit or credit (according to increase or decrease). Examples will be given later. Accounting software makers also follow this formula in creating their programs, but the process has been made easier for casual users.

Step

Part 1 of 3: Entering Transactions

Step 1. Collect all documents regarding business transactions

These documents typically include supplier receipts, utility bills (such as water and electricity), credit memos issued to customers, tax statements, checks issued, and payroll information. Check every invoice and payment received to be accurate and verified before recording the accounting journal. Make sure everything has been acknowledged by the supervisor or business owner before entering transactions into the system.

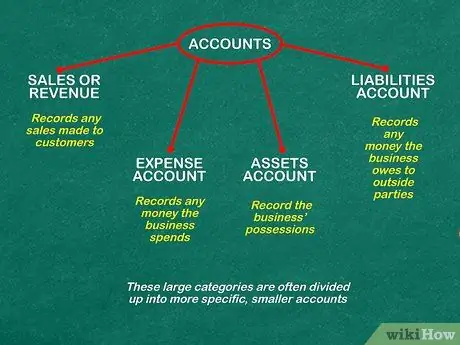

Step 2. Set up different accounts or categories for each type of transaction

Accounts that are recorded for example Cash, Inventory, Expenses, and so on. Think of these accounts as separate pages in a notebook or line of items listed in a personal budget. Set up the following account types:

- The sales, or revenue, account records all sales to customers.

- An expense account records all the money a business spends, for example to operate a business facility, make products, and sell products.

- In addition, businesses are also required to record their assets, such as cash, receivables (unpaid sales), and fixed assets such as buildings and equipment.

- A liability account records all money that the business borrows from external parties, such as bank loans, trade payables (eg to suppliers), and salaries payable (salaries that are already due to employees but have not been paid).

- These large categories are usually subdivided into smaller, specific accounts.

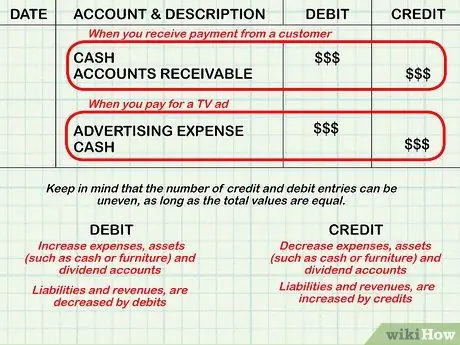

Step 3. Determine whether the account is debited or credited

It is important to remember that every transaction involves debit and credit accounts and the total number of debits and credits must be the same. For example, when you receive a payment from a customer, you would record Cash as debit and Accounts Receivable as credit. When you pay for advertising, you'll record Advertising Expense on a debit and Cash on a credit.

- Record any increases in expenses, assets (such as cash and equipment), and dividend accounts as debits and record decreases as credits. In other accounts, such as liabilities and revenues, increases are recorded as credits and decreases are recorded as debits. This accounting system has its own logic and start remembering while using your logic to determine the causes of "increase" and "decrease" in accounts.

- Keep in mind that the numbers that are journalized on debits and credits may not be the same, but the totals must be the same. For example, if a customer pays for a product partly with cash and partly by credit, two accounts are journalized on debit, namely Cash and Accounts Receivable. While the account that is journalized on credit is only one, namely Sales.

- All computer software systems will make recording accounting journals easy by entering all accounts in their correct places in the Journal.

- You may have to create a new account name in the journal if you have an extraordinary transaction such as a sale of stock or purchase of land.

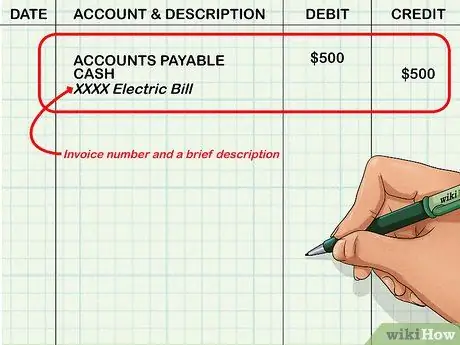

Step 4. Check all the accounting transactions entered in the journal at least twice

Each transaction will appear in its own category: for example, debit on one side of the journal, and the amount must equal the amount that appears on the credit side of the journal.

For example, you will record an electricity bill payment transaction by entering Accounts Payable on the debit side of Rp. 500,000 and Cash of Rp. 500,000 on the credit. be sure to include the receipt number and a brief description in the notes section

Step 5. Move the accounts in the journal to the general ledger periodically

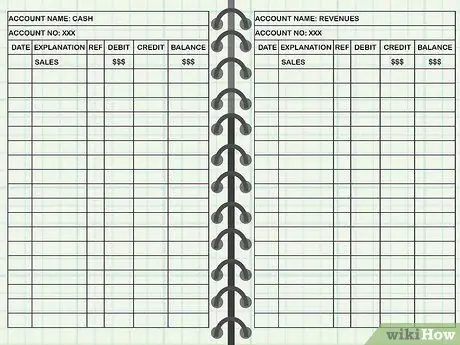

The general ledger is a collection of all your accounts. For example, there are pages for each category of cash, receivables, payables, expenses, and so on in your general ledger. Then, you'll be able to see the total amount for each account over a period of time.

- A general ledger records information by account, as opposed to a journal which records transactions. In other words, one transaction that is moved to the general ledger will be in at least two places (accounts) in the ledger.

- For example, cash receipts from customers on sales would be recorded in the journal as one transaction and recognized cash on debit and income on credit. when transferred to the general ledger, these entries are recorded in separate locations: cash and revenue accounts. That way, you can see how transactions affect each account individually.

- Records in the general ledger must be dated so that the source of the transaction can be identified. Some accountants also include a reference number, for example in the form of a serial number, so that transactions can be monitored back into the journal easily.

Part 2 of 3: Balancing Accounting Transactions

Step 1. Balance the general ledger before closing each time you enter an accounting transaction

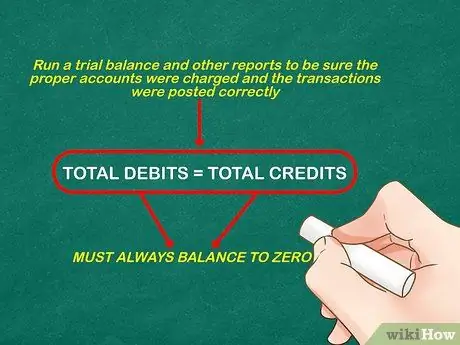

Prepare trial balances and other reports to ensure that the numbers and accounts recorded for each transaction are correct. No matter how many transactions are recorded, the total debits must equal the total credits.

If you take notes manually or with a computer program, all the numbers in the debits and credits will be added up, regardless of the category. The total amount of debits and credits must be the same

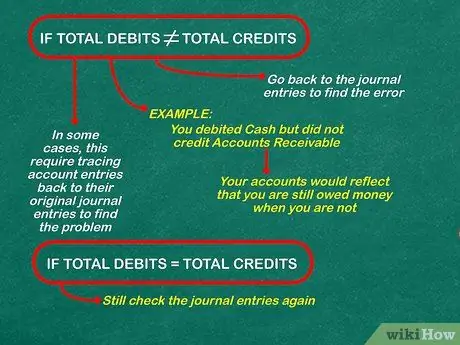

Step 2. Check for errors in the Trial Balance

If the debits do not equal the credits, you will have to find errors in your journal entries. In fact, errors can still occur even if the debit and credit amounts are the same, for example due to double recording or transactions entered into the wrong account.

- For example, when you receive a payment from a customer, you may have recorded Cash but forgot to record Accounts Receivable so the journal looks like the receivables are still unpaid. Thus, the amount on the debit will be different from the credit.

- In some cases, you may be required to trace the records to the initial entry in the journal to find errors. This is why the transaction date and/or reference number needs to be recorded in the journal so that tracing is easy.

Step 3. Run reports for income statement, balance sheet and capital change report

These financial reports can be done manually or with an accounting software system. It is from these reports that you get a complete picture of your business.

- For example, the income statement will subtract the income earned by the expenses incurred during a certain period of time, and from this report you know the company is making a profit or loss.

- The balance sheet displays all the assets and liabilities of the company. Company assets include cash, equipment, land, and accounts receivable. Liabilities include accounts payable and notes payable.

- If you have paid dividends (rewards) to shareholders in previous periods, you will also need a statement of changes in equity. This report shows the amount of profit generated (not net income) minus dividends paid. Retained earnings represent earnings that are reinvested into the company.

Part 3 of 3: Keeping Detailed Records of Accounting Transactions

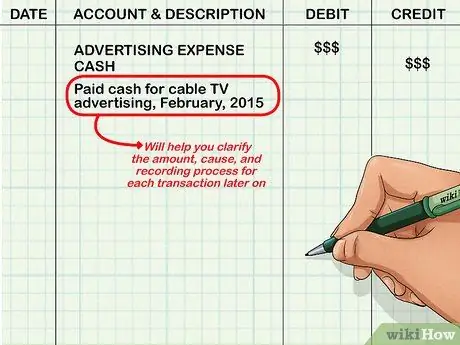

Step 1. Include a brief description of each transaction entered in the journal

For example, “cash television advertising payments, February, 2016.” Thus, the amount, cause, and process of recording each transaction will be clearer.

Step 2. Keep a backup of your transaction journal

Backups need to be made in case of errors or future questions. Documentation of all records can be filed by entering a number of records and the date of a journal into one package. Everyone should be able to search for journal entries in the general ledger and then access backup documentation easily

Step 3. Keep paper copies of all documentation for at least a year

This includes journal entries and ledgers, along with all invoices and other transaction documents. All these documents are required for audit and tax reasons.

Step 4. Keep documentation electronically for at least seven years

Scan your paper documents, back and forth, and store them in two electronic cases: one to keep at the office and another to use in an emergency. There is always the possibility that corporate taxes will be audited over the past few years so these documents need to be kept.

Tips

- Balance your journal every day. Monitor all errors and correct them immediately. This is so important that it becomes one of the first lessons for accounting students.

- Provide cross-training employees so that understanding of the accounting system and how to enter transactions can be known to more than one employee.