- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Accounting, the recording of the details of financial transactions, is a critical process necessary for the success of large and small businesses. Large companies generally have large accounting departments with many employees (and work closely with audit firms) whereas small businesses may have only one bookkeeper. Meanwhile, businesses run by one person have to handle accounting independently. Whether you are trying to manage your own finances or are interested in working in bookkeeping, learning the basics of accounting can help you.

Step

Part 1 of 4: Developing Accounting Skills

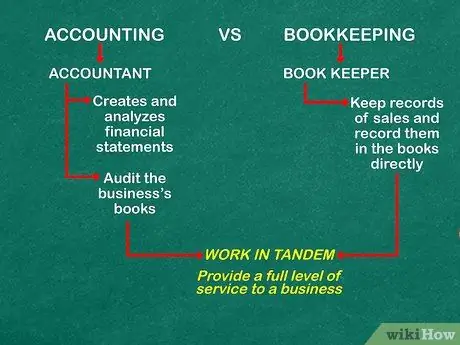

Step 1. Understand the difference between bookkeeping and accounting

The terms bookkeeping and accounting are often used interchangeably. However, the skills and responsibilities of the two are different. The bookkeeper generally records the details of the sale. Its main task is to ensure every rupiah earned and used by the listed company while the accountant is responsible for making and analyzing financial statements and auditing financial records to ensure the accuracy and accuracy of reporting.

- Bookkeepers and accountants often work together to provide a full service to the company.

- The difference between the two is marked by a professional degree, official certification, or professional organization.

Step 2. Get in the habit of creating worksheets in Excel

Microsoft Excel or other spreadsheet programs are very useful for accountants because they can help monitor numbers using graphs or perform calculations to create financial reports. If you only know the basics, you can always learn to work your way up to intermediate or expert in the creation of worksheets, charts, and graphs.

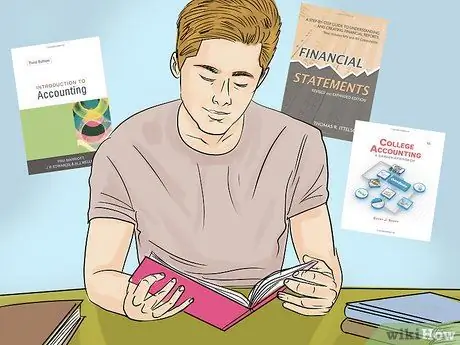

Step 3. Read the accounting book

Visit a local library to borrow an accounting book or purchase a book at the store of your choice. Look for books on the basics of accounting written by experienced people as they generally provide reliable information.

- “Introduction to Accounting” by Pru Marriott, JR Edwards, and Howard J Mellett is a commonly used book and is considered good for people who want to have a general knowledge of accounting as well as students who want to explore accounting.

- “College Accounting: A Career Approach” by Cathy J. Scott is a book often used in college for accounting and financial management classes. This book also offers a useful Quickbooks Accounting CD-ROM for novice accountants.

- “Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports” by Thomas R. Ittelson is a popular introductory book on financial statements that can be used for beginners interested in accounting.

Step 4. Take an accounting course

You can search for courses near you, or take a free online accounting course. Try the Coursera site or other educational platforms that offer free courses by top professionals in the accounting field.

Part 2 of 4: Practicing Accounting Fundamentals

Step 1. Understand the Dual Bookkeeping System

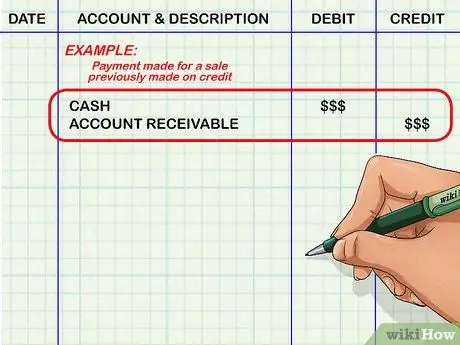

Accountants make two or more entries for each financial transaction. One transaction can be recorded as an increase in numbers in certain accounts and a decrease in numbers in other accounts. For example, a company accepts payment for goods sold on credit. This payment is recorded as an addition to the cash account and a reduction in the accounts receivable account (consumers payable to the company). The recorded additions and subtractions must be equal (to the amount of sales).

Step 2. Practice recording debits and credits

The Dual Bookkeeping System records transactions in the form of debits and credits. Both terms describe the addition or subtraction of certain accounts due to transactions. Using those terms is relatively easy if you keep two things in mind:

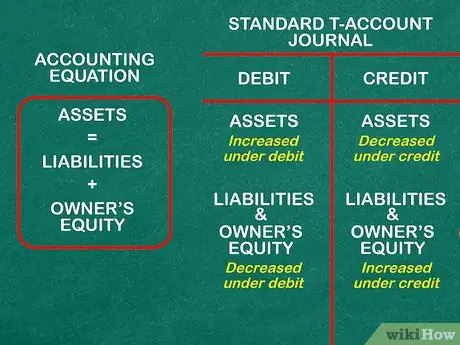

- Debit means record on the left side of the t-account (Estimated T-Account) and credit means you have to use the right side. T-account is a standard T-Account Estimation journal whose vertical sides are used to record transaction size.

- Assets=Debt+Equity. This is the accounting equation. Plant it in your head. This equation is a guide for determining the debit and credit positions of a transaction. For the “Assets” side, debit means addition and credit means subtraction. For the “Debt+Equity” side, debit means subtraction and credit means addition.

- Debiting an account that includes an asset (such as a cash account) means adding cash. However, debiting an account that includes debt (such as a current account payable) means a reduction in debt.

- Practice trying to enter various types of transactions into the Dual Bookkeeping System, such as issuing electricity bills or receiving payments from consumers.

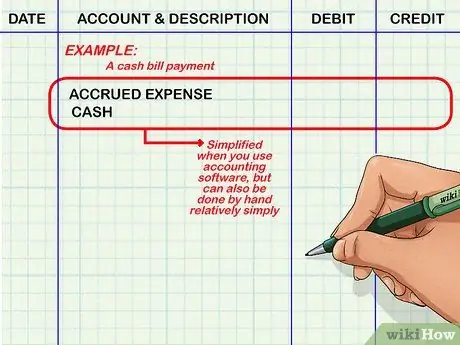

Step 3. Create and maintain a general journal

A general journal is a medium for recording transactions with a multiple bookkeeping system. Each transaction (debit and credit) is recorded using the relevant accounts in the general journal. So, for a bill payment transaction in cash, you need to make a credit entry in the cash account and a debit entry in the expense account. This process becomes simpler if you use an accounting program, but is still relatively easy to do manually.

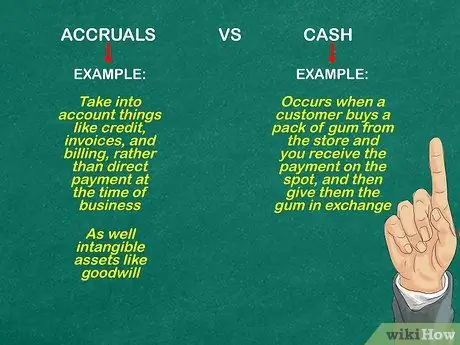

Step 4. Differentiate cash and accrual transactions

A cash transaction occurs when a customer buys candy in a store and you receive cash right away. Accrual transactions deal with things like credits, invoices, bills, not direct cash payments. Accrual transactions also record intangible assets such as goodwill.

Part 3 of 4: Studying Financial Statements

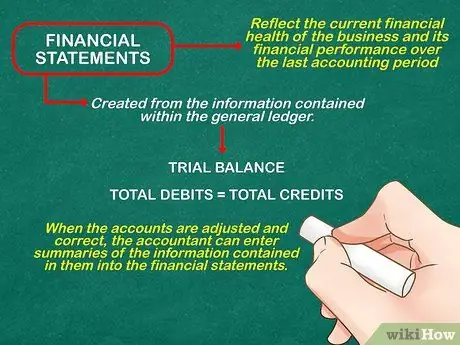

Step 1. Know how financial statements are prepared

The financial statements describe the company's current financial condition and financial performance during an accounting period. Financial statements are prepared based on the information contained in the general journal. At the end of the accounting period, each account is calculated to create a balance sheet. Total debits and credits must be balanced. If they are out of balance, the accountant should re-examine the balance for each account and make adjustments or corrections if necessary.

When all accounts are adjusted and appropriate, the accountant can enter the summary information into the financial statements

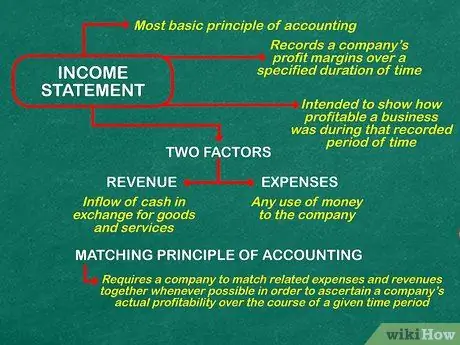

Step 2. Learn how to create an income statement

The income statement is a basic principle of accounting. This report records the company's profits over a period of time, ranging from one week to a year. The income statement is determined by two factors: the company's revenues and expenses.

- Revenue is the inflow of money from the sale of goods or services over a period of time-although it doesn't necessarily mean that cash is actually paid out over a certain period. Income can be in the form of cash or accrual transactions. If accruals are included in the income statement, it means that income in a certain week or month takes into account invoices and bills sent or received in that period even though cash has not been received. The income statement shows the level of profitability of the company, not how much money the company received in a certain period.

- Expenses are the use of money by the company for any purpose, such as the cost of shopping for materials or employee salaries. Like revenue, expenses are also reported when expenses are made, not when the company literally dispenses cash or pays.

- The matching principle in accounting requires companies to match related expenses and revenues together whenever possible to determine the company's actual level of profitability in a certain period. In a successful business, this process is just a picture of a cause-and-effect relationship. For example, an increase in sales will increase the company's revenue and business expenses, such as an increase in the need to purchase inventory for stores and sales commissions.

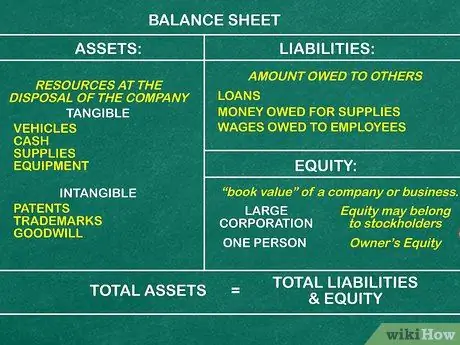

Step 3. Make a balance sheet

Unlike the income statement which describes the financial situation in a certain period, the balance sheet is a snapshot of the company's finances at a certain point. The balance sheet has three important components: assets, liabilities, capital (shareholders or owners of the company) at any given point in time. Think of the balance sheet as an equation that expresses the company's assets equal to debt plus equity. In other words, your property consists of what you borrowed and what is yours.

- Assets are company ownership. Think of assets as all of the company's resources, such as vehicles, cash, inventory, and equipment that the company owns at any one time. Assets can be tangible (plant, equipment) and intangible (patents, trademarks, goodwill).

- Accounts payable are all loans (or liabilities) a company owes at the time the balance sheet is written. Debt includes loans payable, money payable for inventory purchased on credit, and unpaid employee salaries.

- Capital is the difference between assets and debt. Capital is often equated with the “book value” of a company. If the company falls into the category of a large company, the capital may be owned by shareholders; if the business is only owned by one person, the capital written on the balance sheet is the capital owned by that one person.

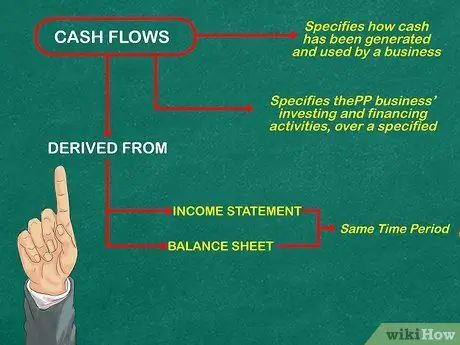

Step 4. Write a cash flow statement

In essence, this report describes how companies use and spend money including investing and financing activities over a certain period of time. This report is prepared using information from the balance sheet and income statement for the same time period.

Part 4 of 4: Learning Accounting Principles

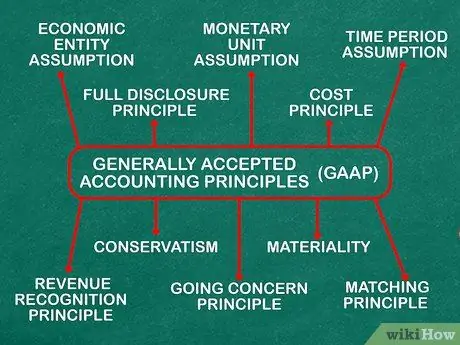

Step 1. Follow Generally Accepted Accounting Principles (GAAP)

In Indonesia, GAAP is called “Financial Accounting Standards” created by the Financial Accounting Standards Board. The principles and assumptions used to guide accounting practices to ensure the transparency and integrity of financial transactions are:

- The Economic Entity Principle requires an accountant who works for a sole proprietorship (a business owned by one person) to separate business transactions from the personal transactions of the owner of the company.

- The Monetary Unit Assumption is an agreement that recorded economic activity must be expressed in certain units of currency. Therefore, accounting only records activities that can be quantified into rupiah.

- The Time Period Assumption is an agreement that transaction reports must be based on a specific time period and that period must be recorded accurately. This period is generally short: at least one year although many companies use a one-week period. The report must specify when the reporting period begins and ends. It is not enough to include the date of report generation; an accountant must specify in the report whether the report represents a week, a month, a financial quarter, or a year.

- The Cost Principle or the Historical Cost Principle means that records are made based on the value of money when the transaction takes place without considering inflation.

- The Full Disclosure Principle requires accountants to provide all relevant financial information to interested parties, especially investors and creditors. Information should be presented in the body of the financial statements or in the notes at the end of the report.

- The Going Concern Principle or the Principle of Business Continuity assumes that the company will survive in the future. This principle requires accountants to provide all information about certain changes or failures that will occur in the future. If an accountant believes that a company is going bankrupt, he or she is obliged to provide that information to investors and other interested parties.

- The Matching Principle instructs accountants to match expenses with income in all financial statements.

- The Revenue Recognition Principle is a principle which states that revenue should be recorded when transactions are completed, not when money is actually paid.

- Materiality is a guide that gives accountants the freedom to professionally assess whether transactions with a certain amount of money are significant for inclusion in the report. This principle does not mean that accountants are allowed to provide inaccurate reports. The Materiality principle gives accountants the freedom, for example, to round the transaction value to the smallest rupiah in the financial statements.

- Conservatism or Conservatism is a principle that advises an accountant to report potential losses (in fact, this is an obligation), but the accountant is not allowed to report potential gains as actual gains. This is done to prevent investors from having an inaccurate picture of the company's financial situation.

Step 2. Follow national and/or international regulations and standards

Companies in the United States have regulations made by the Financial Accounting Standards Board while Indonesia has regulations made by the Financial Accounting Standards Board. These boards have rules and standards that aim to ensure interested parties have reliable and accurate information and accountants work ethically and honestly. The FASB framework concept can be found on the FASB website and the Financial Accounting Standards can be obtained on the Indonesian Institute of Accountants website.

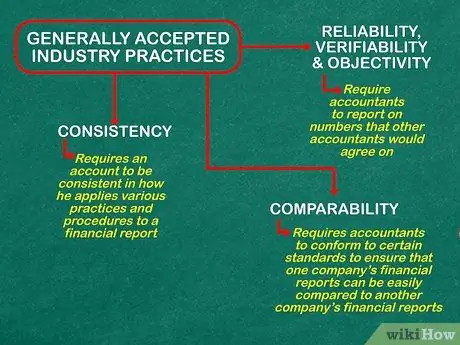

Step 3. Follow commonly followed practices in the industry

Below are the expectations that an accountant has of other accountants in shaping the general practice of accounting:

- The principles of Reliability, Verifiability, and Objectivity require an accountant to report figures that other accountants would likely agree on if they were exposed to the same information. This principle is implemented in order to maintain the dignity of the accounting profession and to ensure future transactions will be conducted fairly and honestly.

- The Consistency Principle requires accountants to carry out consistent practices and procedures in preparing financial statements. If a company changes its cash flow assumptions, the company's accountants have an obligation to report the change.

- The principle of comparability or comparability requires accountants to follow certain standards, such as GAAP or SAK, to ensure that the financial statements of one company can be compared with the financial statements of other companies.