- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Net income is usually the last number on the income statement, also known as the bottom line, which provides business owners with crucial information about how much money is left after expenses are paid. Therefore, net income is a measure of company profitability. Although very important, net income is quite easy to calculate using accounting procedures in the form of subtracting income with expenses.

Step

Method 1 of 2: Collecting and Compiling Information

Step 1. Prepare the company's income statement

In order to calculate net income correctly, you must fill out the income statement correctly as well. In fact, filling out an income statement while calculating net income is an easy way to structure your information. This can be done manually or by a data management program. See How to Write Financial Statements for more information (warning: English article).

The income statement covers a specific time period, for example January 1, 2015 to December 31, 2015. The period can be any time range, but is usually monthly, quarterly, or annually

Step 2. Gather the necessary information

To calculate net income, all the information needed to prepare an income statement is needed. This information includes all data related to the company's business revenues and expenses. Again, see How to Write Financial Statements for more information (warning: English article). The following sections will also discuss the required information in more detail

In general, financial statements list the company's sources of income (usually mostly through sales, but there is also interest income) and a list of expenses sorted by category, including cost of goods sold, operating expenses, administrative expenses, interest expenses (on debt)., and the tax burden

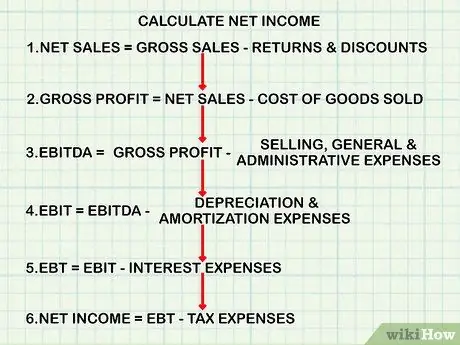

Step 3. Make sure you are using the correct formula

The calculation of net income follows a very specific formula. This formula parallels the company's income statement. However, if you are calculating net income without compiling a balance sheet, make sure you deduct expenses at the appropriate time in the calculation. The general structure of the calculation is as follows:

- Calculate the "net sales" (net sales) ie gross sales (gross sales) minus returns and discounts (returns and discounts).

- Subtract net sales from cost of goods sold to get gross profit.

- Subtract gross profit by selling, general, and administrative expenses to obtain Earnings before Interest, Taxes, Depreciation and Amortization (earnings before interest, taxes, depreciation, and amortization or EBITDA).

- Subtract EBITDA from depreciation and amortization to get earnings before interest and taxes (EBIT).

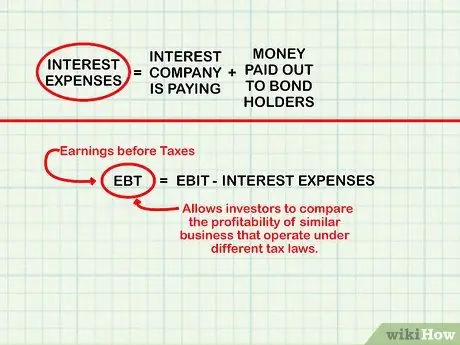

- Subtract EBIT from interest to get earnings before taxes (EBT).

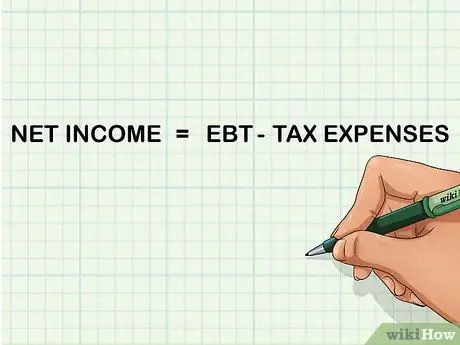

- Subtract EBT with tax expense (tax) to get net profit.

Step 4. Make sure you use a simple calculator

Depending on the size of your business, calculating net income can involve large numbers or complex calculations. To ensure the accuracy of calculations, use a calculator that is simple and easy to use.

Method 2 of 2: Calculating Net Profit

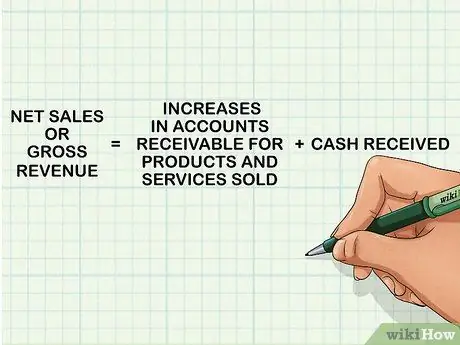

Step 1. Determine net sales

Net sales are derived from the accumulation of all cash received and plus receivables for products and services sold during the income statement period. This revenue is recorded when the product or service is provided to the customer, and not when cash is received. This is the first account in the income statement and net income calculation.

Note that some companies use the terms “revenue” and “sales” interchangeably, but other companies use “sales” only to identify the amount of product sold (except for revenue from other sources)

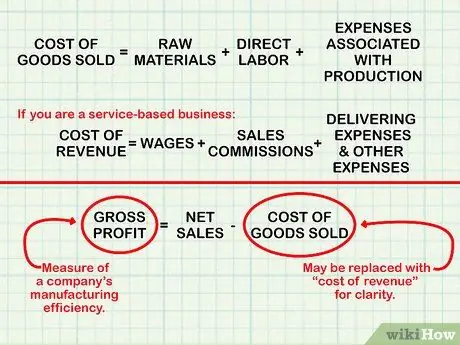

Step 2. Find the cost of goods sold figures

This account relates to production costs or purchases of goods sold by the company. Retail and manufacturing companies will have a large burden in this category. The total cost of goods sold is obtained from the cost of raw materials for production, direct labor costs, including salaries for employees who are not involved in administration or sales, and all expenses related to production, such as electricity.

- If you are a service company, “cost of goods sold” can be replaced with “cost of revenue” for clarity. This figure follows the same general concept, although it also includes expenses such as salaries, sales commissions, and expenses for rendering services (eg transportation or shipping expenses), and all other expenses incurred as a result of the sale of services.

- Once the total is obtained, subtract net sales from that number. The result is a gross profit and serves as a measure of the operating efficiency of a manufacturing company.

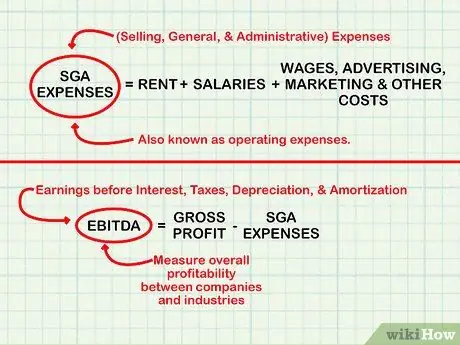

Step 3. Calculate SGA expenses (selling, general, and administrative) aka selling, general and administrative expenses

These expenses are in the form of expenses such as rent, salaries (including sales or administrative personnel), advertising, and marketing, as well as other expenses related to the company's primary operations. These expenses are also known as operating expenses.

Once the total is obtained, subtract the gross profit by this number to obtain the profit before interest, taxes, depreciation and amortization (EBITDA). EBITDA is used to measure overall profitability between firms and industries because it ignores the effects of financial and accounting decisions on earnings

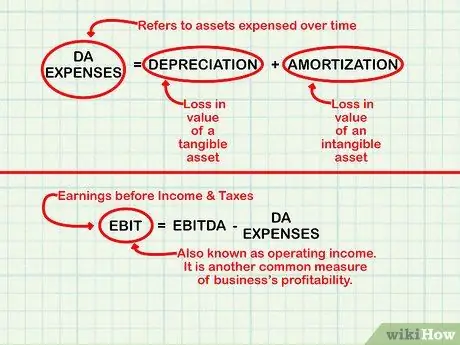

Step 4. Find depreciation and amortization expense

This figure generally reflects assets from the balance sheet that are expensed over time. Depreciation expense refers to the reduction in the value of tangible assets (eg machinery); amortization costs are dependent on deductions for an intangible asset (such as a patent). The accounting treatment recognizes them as expenses on the income statement over several years to spread the impact of an expensive investment, such as a new vehicle or factory, on the income statement.

- Depreciation and amortization expenses are complex accounting concepts. See How to Calculate Depreciation Expense on Fixed Assets and How to Calculate Asset Amortization for more information (warning: English article).

- Once you have the total depreciation and amortization expense, subtract EBITDA from that number to get EBIT, which is also an indicator of a company's profitability.

Step 5. Calculate interest expense

This expense relates to all interest the company pays (for example, on loans). Interest expense is also paid to bondholders. When calculating this figure, make sure you add up all interest income as well. Interest income can be in the form of money received from short-term investments, such as time deposits, savings and money market accounts.

Once the total is obtained, subtract (or add, if the amount of interest income is greater than interest expense) EBIT by that number to obtain profit before tax (EBT). EBT helps companies compare their profitability with similar businesses that are under the same tax laws

Step 6. Calculate the tax burden

Tax expense is the tax paid by the company during the income statement period. This fee varies depending on various factors, including the size of the business and the manner in which the tax return is filed. Keep in mind, the tax here does not include other taxes paid by the company such as property taxes. Property tax expense is included in the company's operating expenses.

Step 7. Subtract NRE from the tax burden to get a net profit

Thus, you get the company's profit figure after all the expenses