- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

You just won the lottery! All those unfortunate tickets and unfortunate numbers could eventually become a thing of the past. But what happens after you win the jackpot? Keep reading for information on how to claim your rewards and use this windfall wisely. (Notes: Lottery is not common in Indonesia, but if you are lucky, you can win lottery with very big cash prizes! There's nothing wrong with applying some of the tips given in this article.).

Step

Part 1 of 3: What to Do Right After You Win

Step 1. Try not to tout it

Don't tell anyone that you won the lottery until you actually get the money. No matter how much money you receive, your life will change drastically, and it will take time to digest this completely new situation. So take it easy, take a deep breath, and don't gloat. You should keep your privacy as long as possible.

Step 2. Read the instructions carefully

Do this before you claim your prize. Instructions are usually found on lottery tickets and ticket agency websites. You don't want your money to go missing just because of some stupid technical problem, do you?

- Sign on the back of the ticket unless there is a law against doing so or it will prevent you from forming a blind trust to receive the money on your behalf.

- Make several photocopies of the front and back of the ticket, and keep the original ticket in a safe at a reputable bank.

Step 3. Contact a lawyer immediately

You should consider your legal options about keeping it in a bank account and splitting up your winnings. Your attorney will provide information based on his expertise in this area and ensure you don't fall into legal traps.

Part 2 of 3: Understanding the Legal and Financial Implications

Step 1. Protect your privacy and identity

Most lottery winners are announced by the media, and you may get an interview request from your local news agency.

- You may protect your privacy in a way that you determine for yourself to receive your winnings. Or, you can use a legal entity to help disguise your identity.

- Think carefully about whether you really want media attention. It sounds great when you can be on the evening news and become an impromptu celebrity. However, being a celebrity also comes with some inconveniences. Your friend may start asking you for money. Your movements will be closely monitored. People will expect you to do certain things because now you are very rich. Engaging with media attention may not be the best move if you want to avoid this inconvenience.

Step 2. Consider forming a blind trust with your attorney

This will allow you to withdraw money while maintaining anonymity. You will provide a power of attorney and your attorney will help to resolve any issues you may have in the arrangement.

Step 3. Think about taxes

Two things are certain in life: death and taxes. Well, you probably don't have to worry about dying just yet, unless the shock of winning the lottery makes your heart beat a little erratically. But, yes, there will be taxes. You may have to pay double tax on your winnings the first time you receive the money, and if the money makes your tax rate higher, you will be required to pay taxes again at the end of the tax year.

- In the United States, all lottery winnings are considered taxable income, regardless of whether you receive it as a lump sum payment or payments in installments over several years.

- Storing lottery winnings in a trust has several tax advantages because it means avoiding a probate (a legal procedure for managing the property of a deceased person) from lottery money income after the lottery winner dies and minimizing taxes on the property.

- In short: trusts are not taxed too much, so consider setting up a trust!

Step 4. Form a partnership if tickets are purchased jointly

If you are buying tickets as part of a group, you may need to have some serious discussion and planning with your group.

Consider the situation if tickets are purchased jointly or by a group of individuals. Is there a verbal agreement to share the winnings? Is it enforceable under state law? Forming a partnership may be a better way to receive winnings on behalf of all partners than having a check passed to just one person

Step 5. Consider situations involving a partner or other person who is important to you

Lottery money can be considered a wedding fortune earned during a wedding, especially if the tickets were purchased with the wedding fund.

That means the money can be subject to a split between the two parties in the event of a divorce. Even if the parties are unmarried (or unable to marry, as in the case of same-sex couples in some states), there may be mutual rights to the winnings

Step 6. Consider making a donation to family and friends

Lottery winners can give their winnings as donations, up to an annual exclusion limit, without incurring prize tax liability. Making donations to charities also has favorable tax implications for lottery winners.

- Consider making a donation to a charity you have strong ties to, or an organization in need. Cancer research and children's charities are also popular choices.

- Ask the recipient of the donation to sign a confidentiality agreement. This will prevent them from disclosing your donation for at least five years.

Part 3 of 3: Creating Long-Term Benefits from Your Wins

Step 1. Contact a reputable accountant or financial advisor

You should do this before spending your money. They will help you weigh all the possible options and give you the best advice for managing your winnings.

- Your financial advisor will discuss a plan on how much money to spend and how much to save, whether it is better to invest your money and where to invest it, along with estimates such as when it is a good time for you to retire.

- Consider private banks and private bankers just for your lottery money and ask to deposit your investment results in a regular savings account, while moving the money to check if needed.

- Set up a trust in your personal bank for your children and grandchildren that will allow them to withdraw money from it.

Step 2. Set aside an initial amount that is not too big for you to spend having fun

Lottery winners who go bankrupt often squander money uncontrollably by buying several houses and cars in the early stages of getting their winnings. Save the rest of your winnings so you can live on the interest alone.

That may not be the most compelling advice, but it balances your short-term interests with long-term goals. No one ever regrets having money saved in the long run

Step 3. Consider accepting an annual payment rather than a lump sum payment

This will allow you to make potentially bad financial decisions for a year or two while you learn all about how to best manage your money.

Step 4. Consider not leaving your job

Now you are rich; but you will need something to keep you busy and prevent you from squandering your newly acquired wealth. Try to work part time or take a sabbatical.

- Now is the perfect time to explore the career you've always dreamed of. Whether it's a stock trader, parachutist, or high school teacher, get the job you really want now that you have the means.

- Consider going back to school. If you enjoy learning and enjoy the satisfaction that knowledge brings, consider enrolling in a class that interests you. You don't need to get into a famous university which is very expensive. A simple college is enough, as long as you give your brain a chance to work.

- Consider taking a finance course, this course can help you understand reports from your team of financial advisors.

- Don't forget to pay off your debts.

Step 5. Invest, invest, invest

You've heard the expression "You need money to make money." Well, that phrase doesn't apply to you anymore! You can make significant amount of money just by investing. It's not a fixed price, but it's a great way to make sure your money isn't just being squandered for nothing.

- Remember, if your investments don't generate a greater amount of money than inflation, that means in real terms your money's "purchasing power" is actually shrinking.

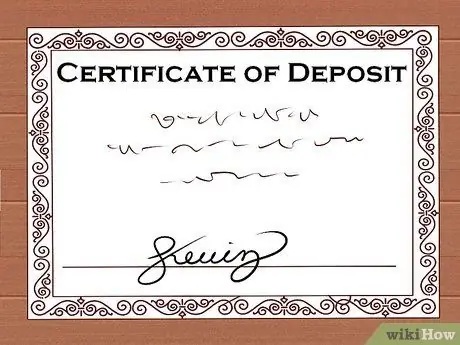

- Diversify your portfolio, but you should put limits on risky investments. Consider safer routes, such as retirement plans, time deposits, certificates or the money market. Ask your local credit union if they need volunteer board members. Learn about the ins and outs of finance.

- If you live in the US, keep in mind that the US government only guarantees each bank account up to $250,000, which means you shouldn't have more than $250,000 in each bank account if you want to be safe. Invest money you don't have in the bank in bonds or in the stock market. In Indonesia itself, the Deposit Insurance Corporation (LPS) provides guarantees for deposits of a maximum of 2 billion for customers at banks who are LPS participants.

Step 6. Buy everything using a rewards-based credit card and pay off the bill every month from your account

That way, you can get more rewards without trying too hard. But make sure you pay on time, so you can avoid the threat of interest owed to the bank.

Step 7. Stay humble

Maintain intimacy with your old friends. You have trusted them and know that they will support you for a long time. Try not to be flashy or attract unwanted attention.

Step 8. Shop smart

You may have enough money to buy an island and create a mini-nation, but you still have to run the mini-nation. Consider any additional costs you may have to incur before buying anything.

- Think carefully before buying a house. How much property tax do you have to pay? How many necessities are needed? How much money should you spend on its maintenance? Also consider that home values often fluctuate with the market.

- Think twice before you buy an expensive car. The car loses half its value once you take it home from the auto dealer. Expensive cars require expensive maintenance, and imported cars are heavily taxed by the government.

Step 9. Treat your family well

They have been with you long before you won the lottery. You may want to treat them something special, but you have no obligation to take care of their finances, if any. Remember that your family is with you to help.

Step 10. Purchase a Certificate of Deposit (CD) worth $250,000 each, federally insured, and collect the resulting funds

Buy the CD with the highest interest rate for the shortest possible time and sell or buy it back at the higher interest rate. The bank will help you do this. In Indonesia, mutual funds can be a promising investment option.

Tips

- Make a wish list that you can study later and then decide what you really need. Some things would be better left to be a dream than a very expensive reality!

- Don't waste your money on things you don't need except a small amount that you've already set aside for fun.

- Before you claim any winnings, write down or jot down everything you want to do or achieve, what you want to avoid in the future, and how you feel about current and future situations. That way, you can later look back and see how you felt and what you wanted to do when you didn't know what it was like to live as a billionaire. This may be what you need if your outlook on life ends up being distorted by money.

- Remember, when you are dealing with small banks, ask to meet with the bank's deputy director or top management. At larger national banks, go to Private Banking services or a similar division for customers with very large funds. They may have more options when it comes to banking, and have a better understanding of information disclosure and security procedures at banks.

- Don't spend your money right away. Set aside some money for yourself that you can spend each week and promise yourself that once it's gone it's gone!

- First use the money to pay off debt. Getting out of debt is important before you buy a lot of stuff.

- Always control yourself. Waste can make you lose yourself and your friends.

- If you don't change your normal shopping habits and put them into practice before that auspicious day, you'll always have plenty of cash for emergencies. Buy some expensive stuff you really want with that winning money, then move on with your life as you lived it before.

- Donate your old car to the Salvation Army or another charity.

- Don't brag about your victories, other people will be annoyed with you.

- Remember to be smart about the wealth you just got. Don't be impulsive or buy unnecessary things. Your extended family may expect you to hand out the money, but they are not automatically entitled to your money, nor are you obligated to give them a share of it.

Warning

- Don't let money become the main topic or issue between you and your friends, extended family, and boyfriend.

- Many lotteries require a public announcement to allow the organizers to publish their games, but you should be able to get legal help to prevent this for privacy reasons. If you can't, wear sunglasses as a last resort, change your dress style and use disguises in every published photo.

- Remember that money can't buy happiness. Some of the richest people in the world have the least happiness.