- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

"Sign here!" Checks are negotiable instruments. That is, a check is a form of a person's promise to pay a certain amount of money to another person. By signing a check made for you, you can deposit or cash a check to get the money on the check. Knowing how to properly sign checks and the different types of attestations you can use is an important part of managing your personal finances.

Step

Method 1 of 4: Signing Checks

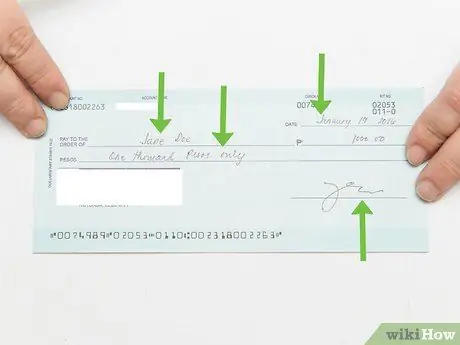

Step 1. Make sure that the information contained in the check is correct

The person giving you the check must write down your name, signature, date and amount of the check (both in writing and in numbers). Without all this information, your bank may not be able to process the check.

- If the check writer made a mistake, go to the person and ask for a new check. Some banks will accept initial-corrected checks, but this can also look suspicious. You won't have any problems at the bank by getting a new and correct check.

- If someone writes you a check with incorrect information, then the old check should be canceled. It's a good idea to tear up checks that you can't use.

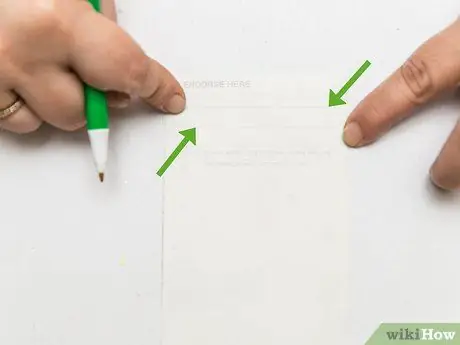

Step 2. Look for the gray line behind your check

Turn over the check you received and look for the gray line at the top of the check. Place your signature and name on one of these lines according to the name on the front of the check.

Many checks have "Do not write, stamp, or sign below this line" at the bottom of the signature box because banks need this space to document check disbursements

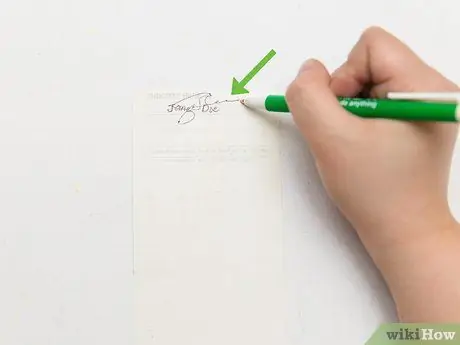

Step 3. Put your signature on one of the gray lines

To deposit or cash your check, you just need to sign one of the gray lines. Nothing else is required to certify a check.

- If there is more than one name on the check and the names use the word and, then all parties must sign the check to certify it. If the names use the word or, any recipient can sign the check.

- Make sure you sign in the attestation area to avoid confusion or mistakes at the bank.

- Make sure the signed name is the same as the name written on the check. For example, if the front of the check says "Bob Chandra", don't sign with the name "Robert Chandra". If there is a misspelling of your name on the check (for example it is written as Sara Haryanto, even though your real name is Sarah Haryanto), sign the check as it appears on the front of the check. Then, you can write down the correct spelling of your name underneath.

Step 4. Take your check to the bank to cash or deposit it

Ask the bank cashier to deposit a check into one of your accounts or replace it with cash. Keep in mind that a check that has no attestation restrictions (only a signature) means that whoever has the check physically can legally cash it. Therefore, you must protect signed checks to cash them. Consider waiting until you get to the bank where you will deposit your check before you sign it.

If you don't have a bank account, you can cash your check at the bank where you wrote the check. The name of the bank should be written on the front of the check. Note that the bank that cashed the check may or may not charge a fee to cash your check

Method 2 of 4: Signing Checks For Deposit Only

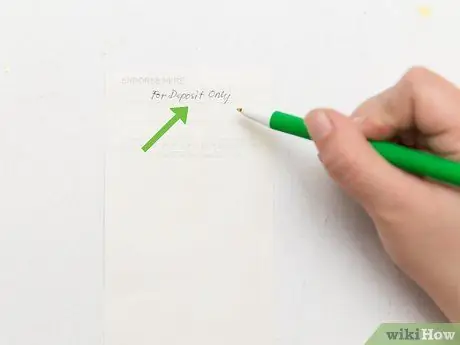

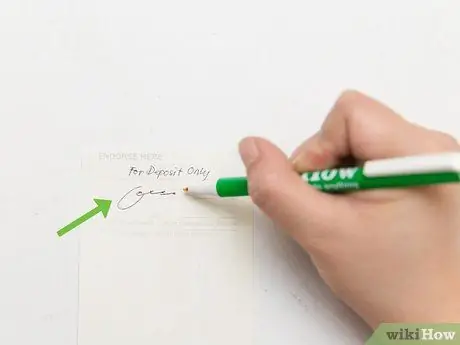

Step 1. Write For Deposit Only at the top attestation

This type of attestation limits the way checks are used, specifying that only the person whose name is on the front of the check can cash or deposit the check. By using this authorization limit, you ensure that no one else can use the check funds if you lose the check or have to ask someone else to deposit it.

This type of attestation is most effective if you mail your check for deposit or give it to someone else to deposit it on your behalf

Step 2. Sign the check on the next line

Make sure you leave enough space to write down the rest of the information you need. It states that you want to transfer rights to the check in order to fulfill the check writer's promise to pay. Your signature is always needed, no matter what type of authentication you use.

Note that if the signature is above the For Deposit Only, the check is technically an instrument instructing the bank to issue funds and can be changed by someone else

Step 3. Enter your bank name and account number

On the next line, you can write your bank name and account number. This will ensure that checks can only be deposited to the bank you wrote to and the account you have selected. Make sure you write down the account number where you want the deposit to be made.

- This is an endorsement limitation because it states the account where you want to deposit the check. This kind of attestation is useful when you are asking someone else to deposit your check, such as an employee. Anyone with access to your check can only deposit the check into your account.

- While it's good to protect your checks by writing down authorization limits in some cases, you should also protect your bank account information. Your bank account number is very important, and you should protect checks written with your account number with extreme care to avoid identity theft or fraud. Put the check in a sealed envelope and only allow trusted people to deposit the check.

Method 3 of 4: Signing Checks to Transfer to Someone Else

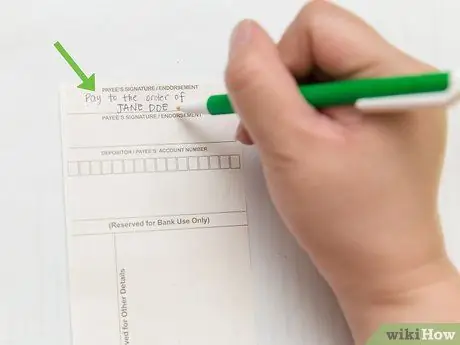

Step 1. Write Paid to on the top line

After this writing, write the name of the person who received the check transfer on the next line. This step transfers the rights to the check funds from you to the person you have chosen.

This step is like writing someone a brand new check, but that person has to sign the check as well

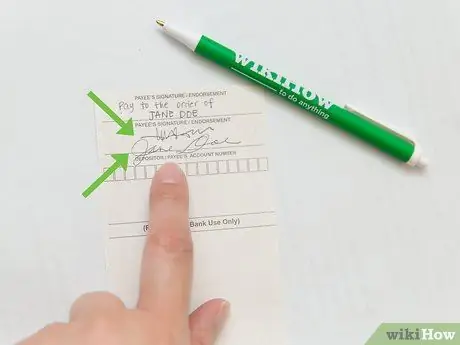

Step 2. Put your signature and name

You must sign under the name of the person receiving the transfer of the check that is printed on the check. The recipient must then also sign below your signature so try to leave space for the signature above the last line in gray.

Step 3. Ask the person to sign the check

After you sign the check, the person receiving the transfer of the check must also sign the check. The person must sign the check right under your signature.

After signing the check, the person receiving the check transfer can deposit or cash the check

Step 4. Go to the bank with the person receiving the check transfer, if needed

Authorities should be able to deposit checks, but some prudent banks may require you to be present. For example, for a check with a very large nominal or if the recipient of the check is from abroad.

You can first try letting the person deposit the check alone. If the person receiving the check transfer is unable to cash or deposit the check, you must go to the bank with them

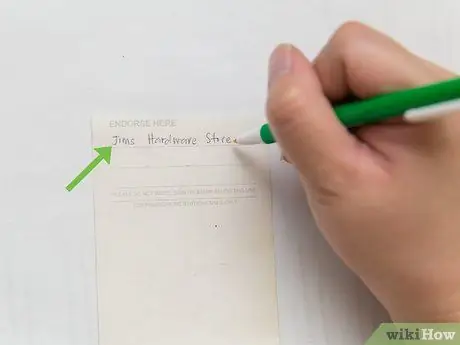

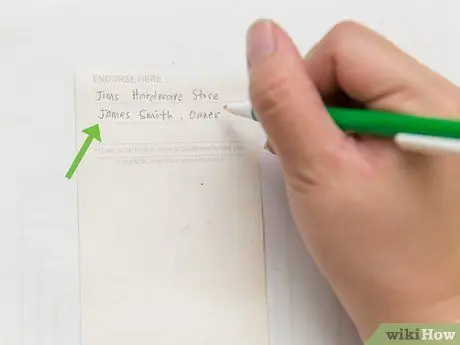

Method 4 of 4: Signing a Business Check

Step 1. Sign the check with your business information

Write on the lines in gray in the signature section on the back of the check. On the first line, write the name of your company or business.

- For example, write “ABC Electronics Store” on the first line of the check.

- Use this method if the check is addressed to your company and not just to you.

Step 2. Add any authorization restrictions

If you want to add any restrictions, you can do so before signing the check. As with personal checks, you can add validation restrictions to your business checks, indicating that you only want to deposit checks at the company's bank into certain accounts, or that you can transfer rights to the checks from the company to another individual or business.

- For example, writing For Deposits Only along with your bank and account number ensures that checks can only be deposited into your business account.

- If you want to transfer a check, you can write Paid to and the name of another person or company. After you have written an authorization for the transfer of a check, the person authorized to transfer the check must personally sign the check to be able to cash or deposit it.

Step 3. Write down your name and title

If you haven't added any restrictions, for example For Deposits Only, your business check doesn't have an authorization limit. This means that anyone with physical access to the check can cash or deposit the check.

- For example, you can write “Budi Susanto, Owner” under your company or business name.

- For your business check signature to be considered valid, you must be authorized by the company to do so. Your business account includes the names of authorized agents, who can make payments and deposit them for business purposes.

- Remember not to sign a check before you are ready to cash the check to protect your check from theft. Once you have signed a check with your title and business name, anyone with access to the check can cash it as a check holder.

Tips

- Some people will write the date on the front of the check after the date the check was written, which is usually called a “post dating” check. Banks do not legally require us to wait until the date stated on the check to cash it. However, you should be aware that if you receive a check back and cash it, the person writing the check could lose more money than the amount in their account.

- Many banks now have ATMs that allow you to deposit a check through an automated system or even allow you to deposit a check via a mobile app by taking a photo of the front and back of the check. Both methods require at least an endorsement in the form of a signature.