- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-06-01 06:05.

The balance sheet is an instantaneous view of business at any given date. Every business needs a balance sheet that is made on a regular schedule. While it may seem like a foreign language to someone unfamiliar with accounting, balance sheets are actually relatively easy to make. Use the following instructions to create a personal balance sheet for your household budget as well as a balance sheet for your business.

Step

Method 1 of 3: Personal Balance

Step 1. Organize your financial information

You will need both asset and debt records. Make sure that you have an up-to-date bank statement as well as a record of all outstanding debts.

Step 2. List all your assets

In the first column, list the assets and their values. This list includes both financial assets and tangible assets. The sum of these assets is your total assets. Ideally, you would want the asset to grow. Key assets include:

- Cash savings in the bank.

- Investments (stocks, building land, mutual funds).

- The resale price of your home.

- The resale price of your vehicle.

- The resale price of your personal possessions, such as jewelry and furniture.

Step 3. Record all your obligations

In the second column, list all your obligations and their values. This column contains all your debts. When you pay off debt, your liabilities will decrease. These obligations include:

- Education loan

- Vehicle loan

- Credit card debt

- Mortgage balance

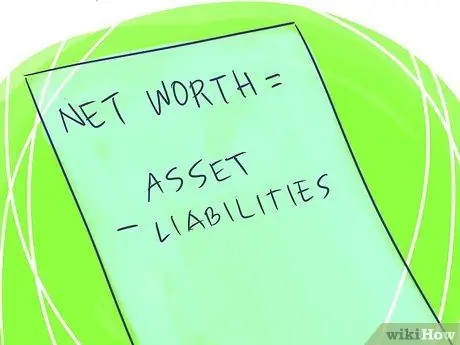

Step 4. Subtract your total liabilities from your total assets

The result is equity. Your equity will increase as your assets increase and your liabilities decrease. Use the balance sheet to budget finances and achieve higher equity.

Keep your balance sheet updated to track progress toward your financial goals. Try to recalculate at least twice a year

Method 2 of 3: Business Balance

Step 1. Understand the basis of the balance sheet

A balance sheet must always be in balance. The basic balance equation is Assets = Liabilities + Equity. In other words, Equity = Assets - Liabilities. Equity is a measure of the value of a company's net worth.

-

Asset is your company's resource. Assets include cash, accounts receivable, inventory, land, buildings, equipment, and more. The secret balance sheet breaks down assets into the following categories:

- Assets are not fixed. These assets consist of cash (money in a bank account), receivables (money borrowed from you), office supplies, and anything else that is expected to be received or used in a year.

- Fixed assets. Fixed assets are tangible goods owned by the business, which include land, buildings, machinery, furniture, and any object that is estimated to last more than a year.

-

Obligation are your company's debts. Liabilities include outstanding salaries, loan payments, and accounts payable. Liability is divided into two categories:

- Current debt. These obligations include anything that must be paid within the next year, such as accounts receivable, taxes, or payroll.

- Long-term obligation. These obligations include loans, mortgages, and leases.

- Equity is the amount invested by the owners or shareholders in the company. Equity also includes retained earnings or net profits held in the company.

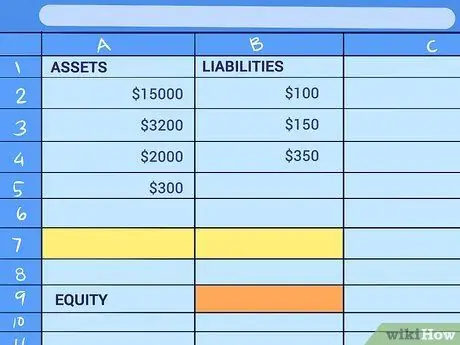

Step 2. Format your balance sheet

In the left column, you will list the assets. In the second column, you will list the liabilities and then write the equity under them.

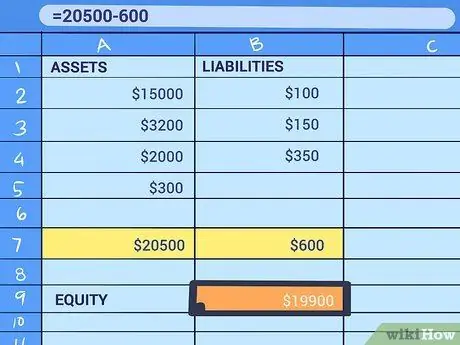

Step 3. Fill in your balance sheet

Fill in the fields with your assets, liabilities, and equity and their respective values. Remember that everything has to be in balance when you fill out the balance sheet. That is, assets must equal liabilities plus equity. If the balance sheet is out of balance, it is likely that some information has been entered or reported incorrectly.

Method 3 of 3: Balance Sheet Using Excel

Step 1. Download the template

There are different types of balance sheet templates available for Excel. Download the one that best suits your needs. Microsoft provides a number of templates for free. here.

Step 2. Open the template with Excel

The template file will open directly through the program. Click on the Office Button, then click Save As to make a copy of the template that you can start filling out. This will keep the template clean so you can create a new balance later.

Step 3. Fill in your balance sheet

Balance sheet templates are programmed to calculate your total assets, liabilities, and equity, and perform balance sheet calculations automatically.