- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

Writing checks correctly is very important in making and receiving payments. Even though checks are not widely used anymore due to the various digital ways to make payments, you must understand how to fill out a check in order to make a deposit slip at the bank or read payment documents by learning how to read a check below.

Step

Part 1 of 6: Knowing Who Makes the Payment

Step 1. Look at the top left corner of the check

In general, the name, address, and telephone number of the account holder who will make the payment are listed in the upper left corner of the check.

Step 2. Look for the check number in the top right corner

This check number is related to the account number mentioned above.

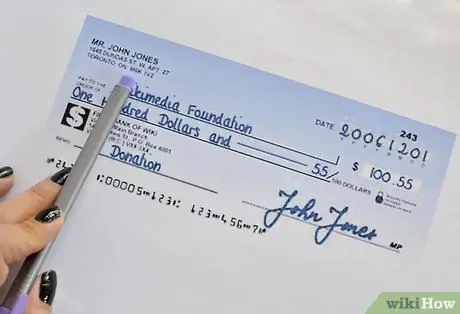

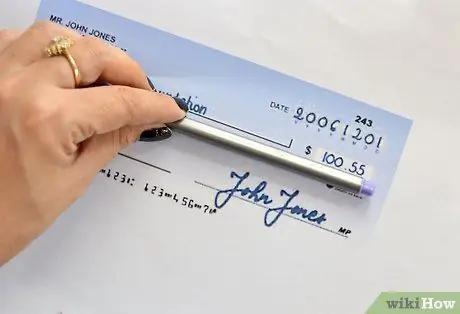

Step 3. Look for the payer's signature with the name and address listed in the top left corner of the check

This signature should be in the lower right corner of the check.

- If your check is issued by a company, it will be signed by an authorized company official such as a manager or staff of finance, bookkeepers or accountants. They must have the authority to issue checks on behalf of the company.

- A check is invalid if it is not signed, or it is signed but different from the specimen, or the signature is incomplete.

Part 2 of 6: Knowing the Check Issuing Bank

Step 1. Find the name of the bank that issued the check

The bank name is usually in the upper right corner or in the middle of the top check. You can see the bank name and address of the main branch office of the check issuing bank.

Bank names and addresses are not always included on checks. Some banks can identify their branch office and the account holder that issued the check by simply tracing the number at the bottom of the check

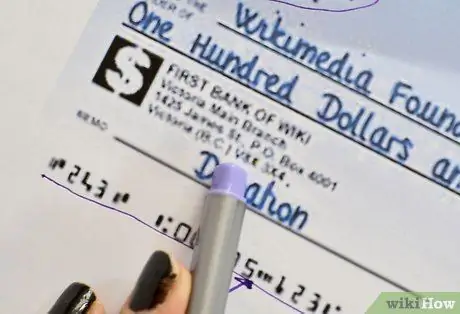

Step 2. Check the number at the bottom of the check

If you read from left to right, this number should consist of 3 groups of numbers.

This number will be a guide for the bank that issued the check to trace back this check from which branch office, find out the serial number of the check, and the account number of the check issuer

Part 3 of 6: Knowing the Check Date

Step 1. Look at the top right corner of the check, right next to or below the check number

Look for the date, month, and year the check was issued.

You must deposit the check within a few months of the issue date. Checks that are not cashed within 3 to 6 months will no longer be valid

Part 4 of 6: Knowing Who is Eligible to Receive Payments

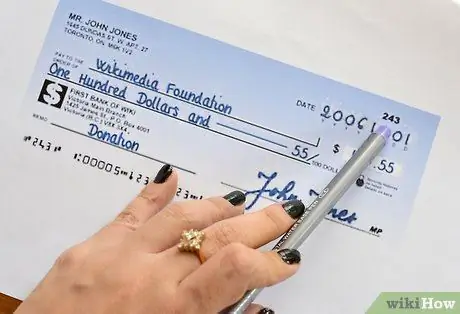

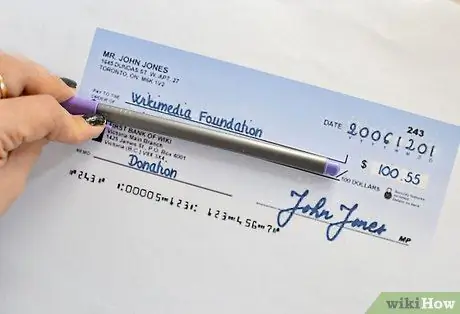

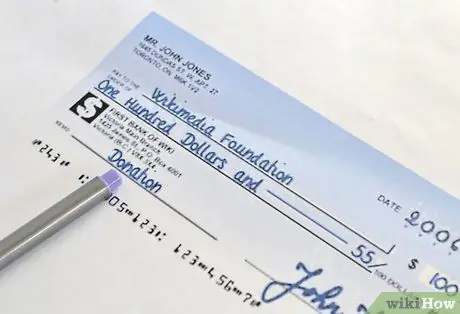

Step 1. Look for the words "Pay to

The payee's name must be written above the line from left to right across the top of the check.

- The payee's name on individual checks is usually written above the value of the check. On the same line as the recipient's name, the value of the check will be written in numbers.

- For typical corporate checks, the beneficiary's name is written elsewhere, usually under the number and number of the check value.

Part 5 of 6: Knowing the Value of a Check

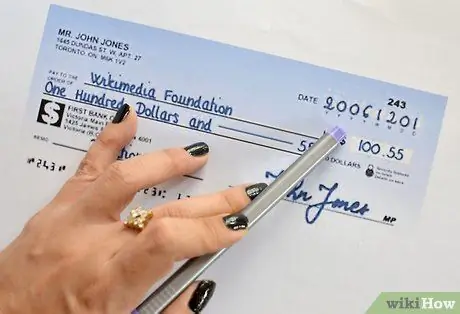

Step 1. Look for the value of the check in the small box to the right of the check

You will see a currency symbol followed by a number and 2 decimal places. The value of the checks written in this section is usually listed in numbers.

Step 2. Find the value of the check as a line of words followed by "Rupiah

This is calculated from the value of the check.

Writing the check value in 2 different places can ensure that the check value is correct

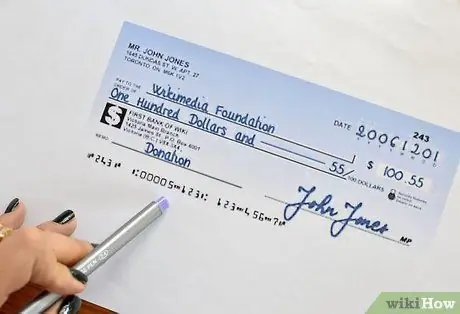

Section 6 of 6: Reading Check Issuance Statements

Step 1. Look for a line at the bottom left of the check

You'll see the word "Memo" followed by the reason for issuing the check.