- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Creating and sticking to a home shopping budget is a good habit, because with a budget, you can reduce expenses, save more, and avoid the trap of credit card bills. To make a home budget, you only need to record current income and expenses, and be disciplined to adjust expenses for a better financial condition.

Step

Method 1 of 3: Setting Up a Table or Cashbook

Step 1. Decide what form of budget you will create

You can create a budget with paper and pen, but a simple number crunching or accounting program will make it easier for you, if available.

- Find a sample budget sheet from Kiplinger at the following link.

- Budget calculations in simple accounting programs, such as Quicken, are generally automated, because accounting programs are designed for budgeting. Accounting programs also have extra features that will make it easier for you to plan your budget, such as a savings counter. However, accounting programs are usually not free, so in order to use them, you must purchase the program.

- Most number crunching programs provide built-in templates for creating a home budget. The template needs to be adapted to your needs, but creating a budget with a template is easier than creating one from scratch.

- You can also use an electronic budget app, such as Mint.com, which will help you keep track of your expenses.

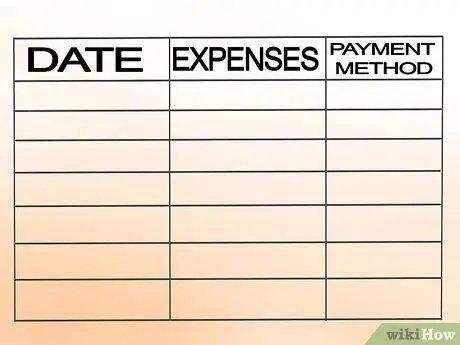

Step 2. Format the columns in the table from left to right

Write a heading in the column, such as "Date of Spending", "Amount of Spend", "Method of Payment", and "Fixed/Free".

- Record expenses and income with discipline every day or week. Many programs and apps provide a phone app that you can use to record expenses/income.

- The "Payment Method" column will help you find your payment records. For example, if you pay for electricity by credit card every month for points, write "Credit Card" in the "Payment Method" column in the "Electricity Bill" entry.

Step 3. Group your expenses

Each expense should be categorized to make it easier for you to calculate fixed monthly, annual, and free expenses. With grouping, it will be easier for you to enter expense calculations, and find specific expenses. Commonly used expense categories include:

- House rental/mortgage (including insurance);

- Electricity, Gas, and PDAM Bills;

- Household Operational Expenditures (such as salaries of domestic workers or gardeners);

- Transportation (cars, gasoline, city transportation, and travel insurance); and

- Food and Beverage (including expenses when eating out).

- Using an accounting program will make it easier for you to categorize expenses (as in the example above), and calculate expenses so that they are easier to understand. With an accounting program, you can find out what, where, when and how you spend money, as well as the payment method you use to pay certain bills. The accounting program also makes it easy for you to divide your expenses by time and priority.

- If you're using a paper ledger, you may want to use a different page for each category, depending on how much you spend per category each month. With the software, you will be able to add rows as needed.

Method 2 of 3: Recording Expenses

Step 1. Write down the biggest expenses on paper or programs, for example KPM/KPR payments, house rent, electricity/PDAM/internet bills, and dental/health insurance

Also write down the credit installments that you are doing. Before the bill arrives, write down the approximate figure.

- Some types of bills, such as house rent or mortgages, have a fixed amount each month. However, other bills, such as electricity bills, fluctuate. To fix this, write down the estimated amount billed (such as last year's bill amount), then replace it with the actual bill amount after the bill arrives.

- Try rounding expenses up or down (in increments of $100) to estimate the bill.

- Some companies allow you to pay a fixed average bill, instead of changing the amount billed each month. If financial balance is very important to you, consider the option of paying the average bill.

Step 2. Calculate your required expenses

Remember what things you have to buy/pay for, and the price. How much money do you spend on gas every week? What is your budget for weekly/monthly shopping? Think about the things you should, not want to buy/pay for. After you have set up the rows for those expenses, write down the estimated expenses. After you've made your mandatory spending, replace the estimated figure with the bill you paid.

- Spend money as usual, but keep every receipt, or record every expense. At the end of the day, keep track of your expenses, either on paper, on your phone, or on a computer. Make sure you record the exact amount of your expenses, and don't use too general information, such as "food" or "transport."

- Software like mint.com can help you with the categories it provides. Mint provides various categories, such as Groceries, Utilities, and Miscellaneous Shopping, which can make it easier for you to see how much you spend for each category.

Step 3. Also take note of free expenses that can generally be reduced, such as lunch at an expensive cafe, a trip with friends, or coffee from a cafe

Write each expense on a separate line. Your list of expenses may look terrible at the end of the month, but if you break it down by expense type, it will be easier to read

Step 4. Enter the savings row

While not everyone can save regularly, aim to save until you can, and save if possible.

- Aim to save at least 10 percent of your salary. By saving 10 percent of your salary, your savings will quickly grow without drastically affecting your quality of life. It hurts, doesn't it, holding back hunger at the end of the month? Therefore, save just in case, do not wait for the remaining money at the end of the month.

- Adjust the amount of savings if needed, or adjust spending to reach the savings target. The money you save can be invested, or used for other purposes, such as continuing your studies or taking a vacation.

- Some banks in the US provide free savings programs that you can join, such as Keep the Change from Bank of America. The program rounds up your debit card transactions and transfers the difference to a savings account, also paying a percentage of the savings. This program can be a good way to save a little bit each month.

Step 5. Add up all expenses each month

Calculate each category, then add up the results to find out the percentage of spending in each category.

Step 6. Record all your income, whether it's tips, extra work, money you find on the road, salary, or wages, then add them up

- Write down the salary amount, not the total income, for this income period.

- Record all income as if you were recording expenses. Total weekly or monthly income if needed.

Step 7. Compare the total income and expenses

If your expenses are more than your income, consider reducing your expenses, or find ways to reduce your mandatory expenses.

- Detailed information about expenses and their priorities will help you figure out what expense items you can brake or reduce.

- If your income is greater than your expenses, you should be able to save the rest of your income. This savings can be used for anything, such as a second mortgage, tuition fees, or other major expenses. You can also set aside some money for small expenses, such as traveling.

Method 3 of 3: Creating a New Budget

Step 1. Select the expense items you want to reduce, especially free expenses

Set aside some money for free expenses, and don't go over that amount.

- Setting aside money for free expenses is fine, really. Frugality doesn't mean neglecting fun. However, with a budget, you can still save money while still having fun. For example, if you often go to the cinema, set aside Rp. 200,000 to watch a movie. After the film's funds run out, don't spend any more money to watch it.

- Also pay attention to mandatory expenses. Mandatory expenses should ideally only take up a certain percentage of income. For example, food expenditure should only amount to 5-15 percent of income. If a mandatory expenditure item consumes more income than it should, try to put the brakes on the expenditure.

- Your spending percentage will vary, depending on the circumstances. For example, spending on food is affected by food prices, family size, and special needs. In essence, avoid unnecessary expenses. For example, if you spend a lot of money on fast food, why not cook at home?

Step 2. Set aside funds for unexpected expenses

By setting aside an emergency fund, unexpected expenses will not destroy the budget that you have set, so your finances will be healthier.

- Estimate the amount of your emergency fund you need to spend over a year, then divide by 12 to determine the monthly emergency fund amount.

- This emergency fund can be used in case of unexpected expenses. Instead of using a credit card, you should use an emergency fund.

- If at the end of the year you still have an emergency fund left, great! The funds that have been set aside can be saved or invested.

Step 3. Calculate the funds needed to achieve the short, medium and long term targets

Instead of being free, these expenses are planned expenses. Do you need to change your furniture, buy new clothes, or fix your car this year? Plan those big expenses so they don't burden long-term savings.

- Remember, buy things after saving. Ask yourself, do you need the item you are going to buy right now?

- After you use the planned money, write down the actual amount of spending, then delete the estimated funds that you made earlier to avoid duplicate data.

Step 4. Create a new budget, combining savings, income and expenses

Making a shopping budget not only helps you save and save so that your life is calmer, but it can also be an incentive to save money, so that your long-term goals are achieved without going into debt.