- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

In times of crisis, sometimes saving for an emergency can be difficult. Many of us live on a salary, and have difficulty making ends meet. Since emergency situations, such as job loss or health problems, can happen to anyone, it is recommended that you have savings that can cover 3-6 months of living expenses. However, based on a 2014 survey, 52 percent of households in Indonesia have no savings at all. Right now, you may be having a hard time saving money, but fortunately, there are simple steps you can take to live frugally.

Step

Method 1 of 4: Setting and Sticking to a Budget

Step 1. Record your expenses

Keep proof of every purchase you make in a month, and collect all monthly accounts. Divide expenses into two types, namely fixed and flexible, then break it back into "wants" and "needs".

- Expenditures remain approximately the same every month. Fixed expenses that include needs such as house rent, electricity and telephone payments, car installments, loans, insurance, and health costs. Fixed expenses that include wants generally come from subscriptions, such as cable TV fees, premium telephone service, and high-speed internet (unless required for business/work).

- Flexible expenses the amount changes every month. While there is a minimum amount that needs to be spent on these items, most people spend more than the minimum amount. Flexible expenses that include necessities including food and clothing. Meanwhile, flexible expenses that include wants are generally in the form of entertainment expenses, such as alcohol, hobbies, electronics, and other luxury items.

- Some banks and credit card issuers provide automated software to track expenses. The software can split expenses by post for you.

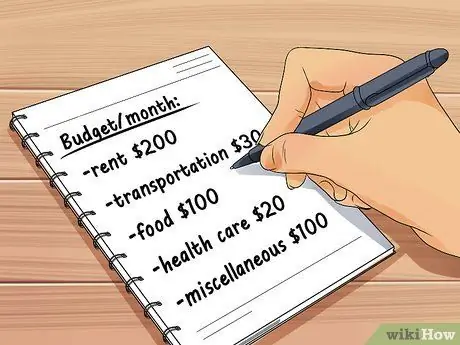

Step 2. Create a budget

Start by writing down your net income after taxes. Then, subtract the fixed expenses. Then, find out what 10 percent of your net income is. Try to save 10 percent of your net income each month. After that, subtract the income back by 10 percent that you will save. Use the remaining money to make a budget estimate.

- After paying your bills and saving, do you have enough money to cover your spending habits? If not, it's time to downsize. Start deducting expenses from flexible wants posts, then fixed wants posts, then flexible needs posts.

- If your income is not fixed, for example, if you work for a retail company and don't have a fixed work schedule, start making a budget by taking into account your average income for the last 6-12 months.

Step 3. Avoid impulse buying, and put off big purchases that don't have to be made right away

If you don't pay attention to your expenses, your budget will break in just a few clicks or a single visit to the store.

Purchases that are considered "big" will of course depend on your income. For many people, the two purchases that are considered "big" are a house and a car. Both purchases must be considered carefully before being implemented. However, while furniture, electronics, and home furnishings are considered "big" purchases for the average worker, they are considered "normal" for those who earn more. The same goes for various other purchases, such as books or shoes

Method 2 of 4: Reducing Monthly Expenses

Step 1. Reduce electricity usage

Oftentimes, the electricity bill is a fairly large expense item. Therefore, reduce the use of electricity in your home. By reducing your use of electricity, you are also helping the environment.

- Seal cracks in your home to improve insulation and reduce the need for heating and air conditioning. Raise the temperature of the thermostat in the summer, and lower the temperature in the winter.

- Unplug electronic devices that you are not using, and don't forget to turn off the lights. Set your computer to enter power-saving hibernate mode when you're not using it.

- Choose an electronic device that has a power saver feature.

Step 2. Consider lowering the service level

Find a different insurance, telephone, and internet service provider from the service you are currently using. You may find a new offering that is better than the current service. Consider whether the level of service you are getting is still what you need. Also, try negotiating the service price with the current service provider to get a lower rate. If you mention your intention to switch providers, they will probably make a better offer.

Step 3. Buy a car that is "durable" and saves gas

If you are going to buy a new car, make sure you buy a car with features that fit within your budget. Buy a car that is known to be durable and requires low maintenance costs. You will save money if you buy a gas-efficient car, especially if you use the car to go to work.

Step 4. Reset your mortgage

If your credit score improves after buying a home, you may want to reset your mortgage. Because many homeowners' credit scores improve over time, they may be able to get lower mortgage rates. Rearrangement of credit may reduce interest or monthly installments. Contact your bank to discuss resetting the mortgage.

Method 3 of 4: Reducing Expenditures

Step 1. Buy food smartly

Even though food is a necessity, spending on food can be bloated. Cheap food is generally considered unhealthy, but there are many ways to save on food expenses without sacrificing nutrition.

- Many people spend their money eating out, especially lunch at work. If you are determined to eat at home, you can save quite a bit of money each month.

- Shop at a discount, instead of making a traditional shopping list or being "loyal" to a particular brand. While discounts on wholesale purchases are sometimes attractive, buy groceries in moderation.

- Choose the groceries with the lowest price per unit. Although many people assume that the largest pack will result in a lower price per unit, that assumption turns out to be wrong. If you are lazy to count, many supermarkets display the price per unit next to the original price of the item.

Step 2. Cut down on entertainment spending

Many people spend a large part of their salary on entertainment. Fortunately, entertainment spending can be controlled, and most easily reduced.

You may be easily tempted to follow friends who spend time at bars or other expensive places. Instead of cutting off contact with the friend, try suggesting or planning a low-cost entertainment event, such as a movie or a meal at home, instead of a movie or restaurant. To exercise, head to the nearest park, instead of spending money on a gym subscription

Step 3. Pay attention to the services you subscribe to, and unsubscribe for the services you don't use very often

With high-speed internet, most people can easily unsubscribe from cable TV. Subscriptions to games, beauty services, and magazines may also seem small, but the numbers can grow if you collect them.

If you use certain services on a regular basis, you may still be able to lower the service level. For example, if you subscribe to a movie streaming service that lets you borrow DVDs, but you've never borrowed DVDs from that service, you might be able to subscribe to a special streaming plan

Method 4 of 4: Earn More

Step 1. Clean up your warehouse, and consider selling items you no longer want or need

Instead of throwing away items like furniture, sell them when you replace them.

- Sell small, easy-to-ship items via auction sites or online shopping, and try selling large or inexpensive items online. Remember that your time is valuable, and you probably don't want to spend time selling cheap stuff online.

- If possible, pretend that the additional income is not there, instead of taking it into account in the monthly budget. Save all the additional income you can.

Step 2. Use the free time you have to open a side business, such as babysitting or caring for dogs

- If you like making salable items, such as clothes, dolls, beauty products, and jewelry, try selling your work on craft sites.

- Avoid businesses that require large capital until you have enough savings. Start a business that can be done with readily available materials, or can be purchased cheaply.

- With effort, your expenses will be reduced. If your Sunday nights are spent babysitting, you'll save money by not going to the movies or bars.

Step 3. Rent free space in your home

In areas with a high cost of living, it is common practice to rent out an empty room in an apartment or house. By renting out free space, you can earn extra income that you can save.

- Before starting to rent out vacant space, pay attention to the applicable regulations. If you lease back a house you rented, the landlord must know about the lease, or you could be arrested.

- Be careful when choosing a tenant, especially if you have to live under the same roof. If you're not careful, your security, property, and credit score could be jeopardized. Instead, find tenants through friends and coworkers. Do a background check on potential tenants first. These checks are not expensive.

- If you will be leaving your home for a long period of time, consider renting the house out to short-term tenants. Or, if in your area there are frequent events attended by many people, you can stay at a friend's house during the event, and rent out the house to visitors.

Tips

- The adage "little by little over time becomes a hill" seems to apply when you save the loose change at home. Try saving that money as part of an emergency savings account. When your piggy bank is full, take it to a bank that provides a free coin sorting service, and deposit the proceeds into your savings account.

- As you become more able to save, or as your income increases, try increasing the percentage of income you save.

- If the company you work for offers a retirement savings plan, save as much as possible. Don't waste this opportunity.

- Don't lose your budget for entertainment and hobbies completely. Happiness increases productivity, which in turn increases the amount of money you will earn.

- Disconnect landlines to save money, but before doing so, make sure the quality of your home cell phone calls is on par with landlines.

- Don't try to save money by ignoring home insurance. Home insurance premiums are generally not very expensive, and will help you avoid bigger costs later.

- Once you have short-term savings, work on paying off certain debts. If you have high interest debt (up to a dozen or tens of percent), pay off the debt as soon as possible. The debt pays off quickly, thus hampering potential future income. After the high-interest debt is paid off, try paying off the interest-bearing debt of up to 9 percent. Debt with interest below 1% can be deferred until you have savings equivalent to 6-12 months of spending.