- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

Calculating daily interest is useful when determining the amount of interest earned or paid. This calculation is applied when calculating interest payable due to late payments to creditors, customers or suppliers. In personal finance, calculating interest is used to estimate the cost of closing a mortgage or evaluating savings and investment account options. The following are some ways to accurately calculate daily interest.

Step

Method 1 of 3: Computer Calculations

Step 1. Gather the information needed to calculate interest

This information includes the amount of funds to be invested or saved, the investment/saving period, and the interest rate provided. You will need multiple sets of variables if you want to compare alternatives.

You will need some calculations on each alternative to complete the comparison

Step 2. Open the spreadsheet program on the computer to calculate the daily interest

You will enter the data from step 1 into special cells on the worksheet, and then enter the appropriate formula. Once the formula has finished calculating all the variables, you can easily evaluate several alternatives.

- Commonly used paperwork programs include Microsoft Excel and iWork Numbers.

- You can also search for online spreadsheet programs such as Google Docs or Zoho Sheet.

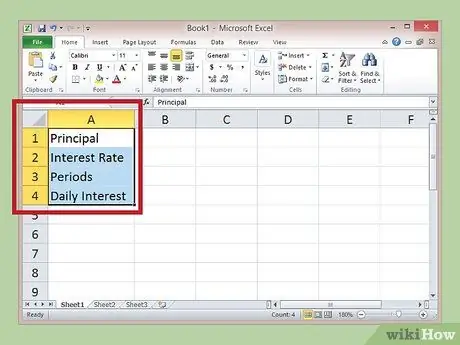

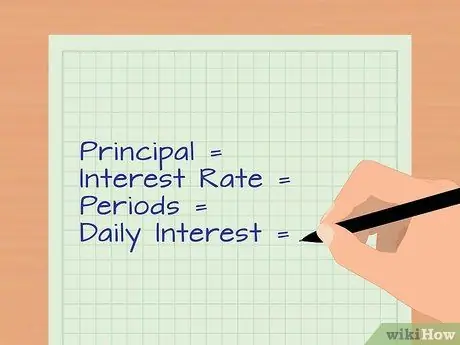

Step 3. Fill in the labels in column A, rows 1-4, with Principal, Interest Rate, Period, and Daily Interest

You can expand cells by right-clicking on the column number, A, B, or C, etc. (A customizable arrow will appear). These labels are for your reference only.

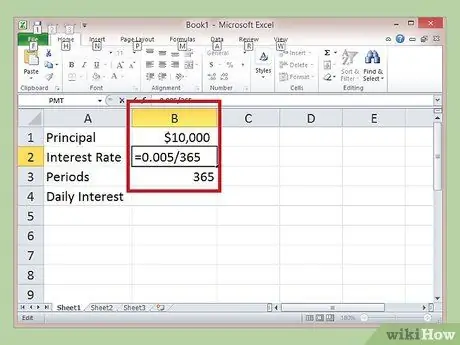

Step 4. Enter the details for the specific transaction in column B, rows 1-3 according to the label

Divide the interest rate percentage by 100 to convert it to a decimal number. Leave cell B4 (Daily Interest) blank for now.

- The interest rates presented are usually annual. Therefore, divide by 365 days to convert it to daily interest rate.

- For example, if your principal investment is IDR 10,000, and your savings account offers an interest rate of 0.5%, enter the numbers “10000000” in cell B1 and “=0.005/365” in cell B2.

- The number of investment/saving periods determines how long the investment stays in the account, unless compound interest is added. You can use the example period of one year, to enter in cell B3 as “365”.

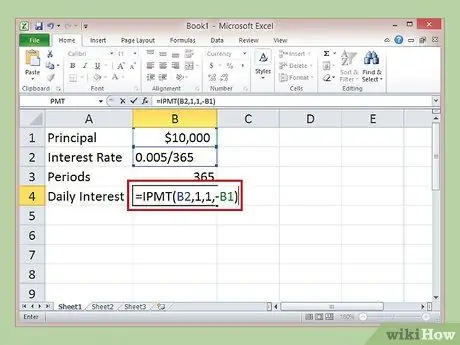

Step 5. Create a function in cell B4 to calculate the annual interest as a daily amount

Functions are special formulas created by programmers to simplify calculations. To do this, click on the first cell in B4. Once the cell is selected, click inside the formula bar (formula bar).

- Type "=IPMT(B2, 1, 1, -B1)" into the formula bar. Press enter.

- The daily interest received by this account in the first month is IDR 137 per day.

Method 2 of 3: Manually Calculation of Daily Interest

Step 1. Gather the necessary information

Some of the information needed is the amount of investment or savings funds, the period of investment or savings, and the interest rate given. You may have several interest rates you want to compare.

Step 2. Convert the interest rate percentage to a decimal number

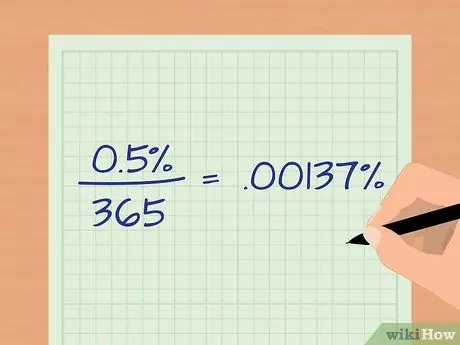

Divide the interest rate by 100 and then divide by 365 to get the daily rate.

The annual interest rate percentage of 0.5% or 0.005 divided by 365 is 0.00137%, aka 0.000137

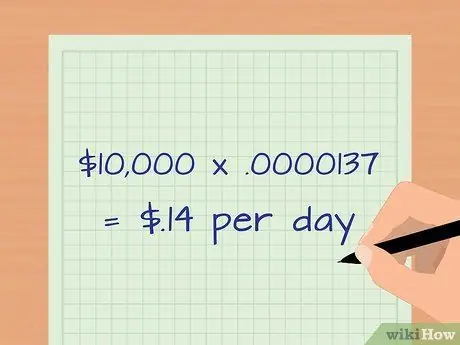

Step 3. Multiply the principal investment/savings by the daily interest rate

If the principal investment/savings is Rp. 10,000,000, multiply by 0, 0000137 and get the result of Rp. 137.

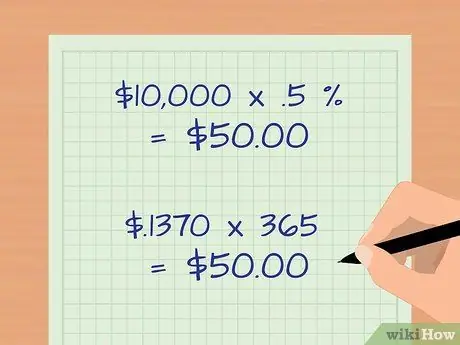

Step 4. Check your calculations

Multiply the $10,000,000 principal by the annual interest rate (0.5%) to calculate the interest manually. The answer is IDR 50,000. multiply the daily interest amount of IDR 137 by 365 days and the answer is very close to IDR 50,000.

Method 3 of 3: Calculation of Daily Compound Interest

Step 1. Gather the required information

The interest earned that remains on the savings or investment will be accumulated (added to the principal amount of the original savings or investment). To calculate it you need the principal amount, the annual interest rate and the number of compounding periods per year (365 days) and the length of time the money will be held in the account (in years).

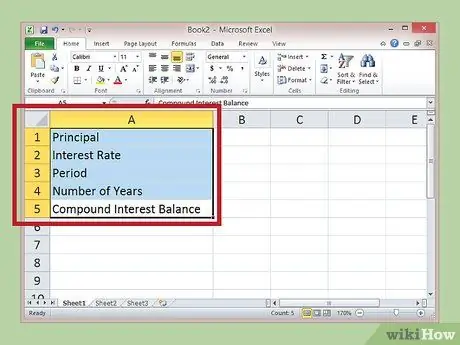

Step 2. Open your spreadsheet program

Fill in column A, rows 1-5 with the following labels: Principal, Interest Rate, Period, Number of Years, and Compound Interest Balance. You can enlarge the cell by clicking on the line to the right of the column number (A, B, C, etc.). An arrow will appear as a sign that the cell can be changed. These labels are for reference only.

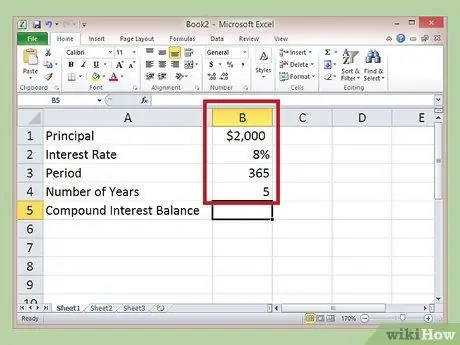

Step 3. Enter the details for your calculation in column B, rows 1-4, according to the label

Enter 365 for the Period and Number of Years is the number of years you want to calculate. Leave cell B5 (Compound Interest Balance) blank for now.

For example, Principal = $2,000,000, Interest rate = 8% or 0.08, Compound period = 365, and Number of Years is 5

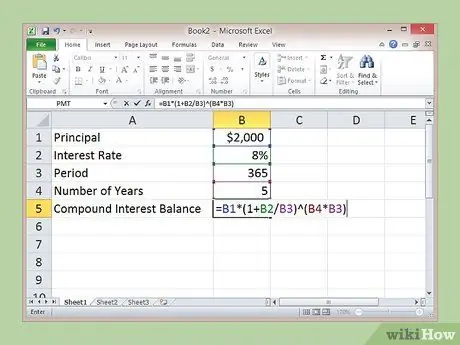

Step 4. Click cell B5 to select a cell and click inside the formula bar then type:

=B1*(1+B2/B3)^(B4*B3) and click enter. The result of the Daily Compound Interest Balance after 5 years is IDR 2,983,520. You can see, reinvesting the interest earned is quite a profitable way.

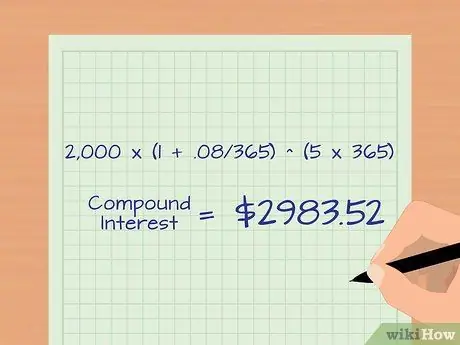

Step 5. Calculate compound interest manually

The formula is Initial Investment *(1 + Annual Interest Rate / Period per year) ^ (Number of Years * Period per year). The symbol ^ denotes the exponent (power).

For example, use the information in Step 3: Principal = $2,000,000, Interest Rate = 8%, Period = 365, and Number of Years = 5. Compound Interest Balance = = 2,000,000 * (1 + 0.08/365) ^ (5 * 365) = IDR 2,983,520

Tips

- You can use the IPTM function to determine the daily interest on the mortgage. If you sell your house in the middle of the month, the final payment balance will change daily. The daily interest amount will show the exact payment amount.

- You can also use the IPMT function to determine the daily interest on late payments.