- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

If you're one of those people who live on a paycheck from one month to the next, managing personal finances may seem difficult. The first step for you to be able to meet your daily needs is to create and stick to a budget. Furthermore, you can set strategies to increase your income and reduce your expenses.

Step

Part 1 of 3: Making a Budget

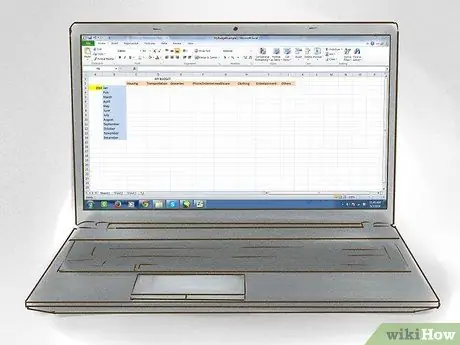

Step 1. Create your budget

Use a table on your computer and list your types of expenses in the first column. Write each month's name sequentially on each line.

- Add a title line at the very top.

- Your expenses should be divided by categories, such as housing, transportation, routine shopping, telephone/internet, health care, interest payments, eating out, clothing and entertainment.

- Plan your budget for at least the next 12 months.

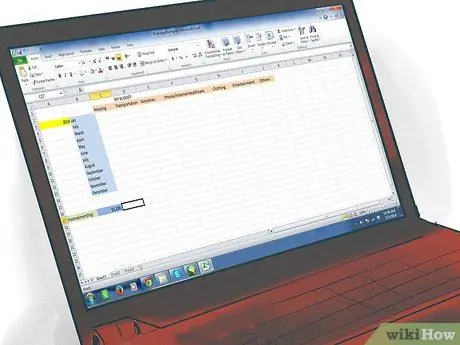

Step 2. Add a separate line for income and enter your income after deducting taxes

If you are married, enter the income and expenses of the whole family. You need to know the complete economic condition of the family when you shop for the needs of so many people.

Step 3. Don't spend any money without recording it in your budget

First of all, collect your proof of payment documents, credit card bills and checking accounts. Then, record last month's expenses.

- Whenever you find proof of payment that doesn't match any of the expense categories, add a new category. You need to create an accurate picture of your spending patterns.

- Download the Mint app on your smartphone, or use it on your computer, if you use these devices regularly. The app has a budgeting feature, which records your expenses and adds them up each month, so you can see if you're still within your budget or not.

Step 4. Subtract income by expenses

If the result is minus, this means that you are in debt and need to develop a strategy to meet daily needs.

Step 5. Observe all your expenses carefully

Pay attention to expenses that you can eliminate each month, for example, eating out, traveling or shopping for clothes, so that your daily needs are met.

Part 2 of 3: Minimizing Expenditures

Step 1. Pay attention to your transportation costs

Hit this number by taking a car with several others commuting or taking the bus to commute to work. Replace gas and repair costs with monthly bus tickets if this reduces your total expenses in this category.

Step 2. Shop wholesale

If your regular shopping numbers are high, make sure that you don't shop at small stores near your home again. Collect discount coupons and stock up on food in the fridge, because eating at home is more economical than eating out.

Step 3. Rearrange your home financing or move to a smaller rental residence if your home costs are too high

Experts recommend that the cost of the house does not exceed 30% of your income. If you are below the poverty line in your country, try applying for subsidized housing specifically for those on low incomes.

Visit https://familiesusa.org/product/federal-poverty-guidelines to find out the poverty line figures in various countries

Step 4. Register to become a member of a health care financing program (eg in Indonesia, BPJS)

Some locations have programs that allow you to register, in order to demonstrate your inability to pay health care costs with proof of tax payment. If you don't have insurance, apply for health insurance before March 31 of the current year to get a tax deduction that can be used to reduce health care costs as well.

Step 5. Ask your boss if you can work from home some days of the week

This can save your gas and transportation costs.

Step 6. Buy clothes at a thrift store

You can find high-quality clothes that look brand new, if you're willing to look carefully at your local second-hand clothing store. Also resell your unused clothes to stores that accept them.

Step 7. Rent movies, music and books at the local library

Most libraries have very comprehensive media programs that you can take advantage of in exchange for Netflix or cable TV programming, to increase your income. Rent an exercise guide DVD and terminate your membership program at the gym.

Step 8. Contact your creditors and ask them to work with you

Agree on a new payment schedule without having to wait for interest bills to continue to increase. Medical institutions, utility companies (electricity, water, etc.), and other organizations may be willing to stop raising your interest if you pay a fixed (albeit small) amount each month.

Living in debt will make it impossible for you to recover financially, so don't delay asking for help if your interest payments or bank fees eat up too large a part of your income

Step 9. Sign up for free meal programs

This is a program that has been proven to save a significant amount of money on routine shopping expenses.

Part 3 of 3: Increasing Income

Step 1. Sign up for special benefits or insurance claims for the unemployed, if you have recently lost your job

If you can't do this, sign up for free training programs at your nearest community service office.

Step 2. Apply for overtime

Your company may need people who can work late into the night and on weekends. Be the person they need it.

Step 3. Turn your skills into money

Advertise yourself on a website like Craigslist or Fiver.com and promote your expertise in computer repair, moving, catering, painting, cleaning a lawn or garden from dry leaves, taking the dog for a walk, or anything else. You will be surprised at how many people need these services.

Step 4. Join a community or organization for dog care, baby/kids, or house keepers

Organizations of this kind usually screen their potential members strictly, however, if you manage to become a member, you will earn a regular income every weekend.

Step 5. Sell your belongings on websites like Craigslist or eBay

Thoroughly comb the entire contents of your house. Sell anything you don't really need to cover your expenses.

Step 6. Ask your friends for help

Don't ask them to give you money, unless it's absolutely essential. However, they may need help with something or find out what part-time jobs are available.

Step 7. Look for jobs online

Transcription, marketing, survey taking, website editing and other jobs are available online at low operating costs. Check that the work is genuine and not a scam, before providing your financial information.