- Author Jason Gerald gerald@how-what-advice.com.

- Public 2023-12-16 10:50.

- Last modified 2025-01-23 12:04.

Payment gateways ("payment gateways") allow your online store to accept credit card payments from customers. The service is a paid service, and the fee is calculated per transaction. Due to the many payment line providers available, choose the right service so you can save money and run your business smoothly. Once you choose a payment line service, you can easily apply the service to your online store.

Step

Method 1 of 2: Choosing a Payment Line Service

Step 1. Understand how the service works

The payment line service processes the customer's credit card information by sending the data to the service server, then making the sale and sending the confirmation back to your site. You can apply a payment path to your online store software.

Step 2. Check the services of your "hosting"

Your "hosting" service provider or store software provider may provide payment line services that you can implement on your site. Check your website's control panel or your online store's administration page for payment line options.

Step 3. Choose a payment line

Many payment line services are available, and choosing one can be confusing. Before you start looking for a service, check which payment line services your online store software supports. Your store's software user support site generally has a payment line service compatibility list. Some of the widely supported payment line services include:

- PayPal

- Payza

- Perfect Money

- egopay

- SecurePay

- Authorize.net

- Verify

- Braintree

- SecurePay

Step 4. Pay attention to the rates and terms of use

Generally, payment line services will charge a registration fee, monthly fee, and a small fee per transaction. Compare service fees to find the service that best fits your needs.

Step 5. Choose between direct or external payment channels

An external payment line (or redirect) will direct the customer to another site to complete the payment, while the direct/transparent payment line processes the payment in-store, so the customer is not redirected to another site. If possible, opt for a direct checkout line to make your store look more professional.

Step 6. Create an account for the store

You will need to create a store account which will then be linked to the checkout line service. This account allows you to receive payments from consumers. These accounts will also generally charge a fee per transaction.

Step 7. Create an account at your preferred payment line service

After registering, you will receive important information to install in your online store.

The information can be a name and password, or an ID and authorization file

Method 2 of 2: Implementing a Payment Line to an Online Store

Step 1. Set up your online store

Most online sellers use third-party software to create stores for customers. The software handles the order page and the code that redirects the payment information to the checkout line. Creating code from scratch is the most difficult part of web development, so it's best done by an expert.

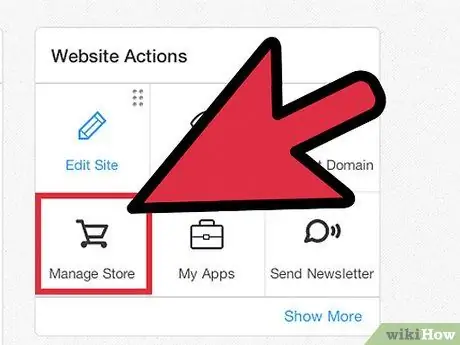

Step 2. Add a payment method

The process for adding this method will vary depending on the service you're using, but generally you'll need to enter payment line service information for each method you wish to accept (e.g. Visa, MasterCard, etc.). Your payment line service determines the types of cards you can accept.

You can add a payment method from your store's administration page. Find the "Payments" page or something similar

Step 3. Test the payment path

Generally, you can use a test account or " sandbox " in your payment line service. This account allows you to make fake transactions to ensure that the payment process runs smoothly. Make sure you test the checkout line before opening a shop.