- Author Jason Gerald gerald@how-what-advice.com.

- Public 2024-01-19 22:11.

- Last modified 2025-01-23 12:04.

For people who make payment transactions using checks or demand deposits, one of the skills that need to be mastered is calculating the balance of funds in a checking or savings account. That way, you know the amount of funds in the bank and what the funds are used for. In addition to preventing payments with blank checks, you can apply a consistent budget, avoid fines, and detect errors in recording transactions or charging fees by the bank.

Step

Part 1 of 3: Recording Receiving and Disbursement Transactions

Step 1. Use the cash book

Do you know the function of the booklet provided by the bank when you receive the checkbook? This booklet is useful for recording all receipts, expenses, and other transactions through a checking account, such as deposits, ATM cash withdrawals, debit card payments, bank fees, and debiting of funds for checks that you issue.

If you don't have a cash book from the bank, buy one at a bookstore or make your own using a notebook, HVS paper, or lined folio paper

Step 2. Find out the current balance of funds in the bank

You can find out your current account balance by accessing online checking accounts, making transactions at ATMs, and calling or meeting customer service staff at the bank.

- Write the balance on the top line of the box to the right of the first page of the cash book or the first line of folio paper with the caption "Initial Balance".

- It is possible that the current balance has not been deducted by checks issued but not debited and transactions with debit cards that have not been processed. To get an accurate balance, check the checking account again a few days later.

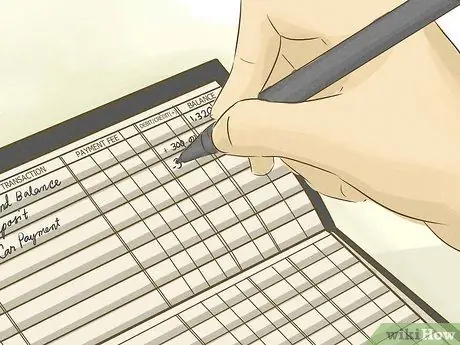

Step 3. Record all bank transactions

Do bookkeeping every time you make debit (money out) and credit (money in) transactions through the bank. There are 2 columns on the right side of the cash book, one for debit transactions and another for credit transactions. Include the amount of funds issued in the debit column and the amount of funds received in the credit column.

- Record all checks that you issue. Make sure you always record the check number, the date of issue of the check, the name of the payee (if you are issuing the check on behalf of), and the amount of the check.

- Keep a record of all withdrawals or payments made through the bank. Whenever you take cash through a teller or ATM and shop using an ATM card or debit card at a supermarket or online store, write down the amount immediately. If you are charged an ATM fee, write down the number as well.

- Record all online payment transactions. If you receive a confirmation code from the website or app after you make an online payment, write it in the cash book to the right of the beneficiary's name.

- Record the deposit of funds to the checking account. Make sure you record all transactions that change your checking account balance!

Step 4. Include a description each time you record a transaction

This step helps you remember what the funds were used for when checking your account balance.

For example, include descriptions: vegetables, gasoline, car payments, restaurants, and so on

Step 5. Take the time to do a match if your account is also used by someone else

You need to communicate regularly with him about transactions made through a joint account so that both of you can record detailed mutations and balances in each other's cash books.

If you have multiple accounts, make a separate cash book for each account to make checking easier

Part 2 of 3: Calculating Current Account Balance

Step 1. Calculate your checking account balance regularly

You may calculate the balance every time you make a transaction or periodically, for example when you book a monthly bill payment.

- If you've ever made a payment with a blank check or overdraft, you'll need to calculate the balance each time you make a payment or issue a check.

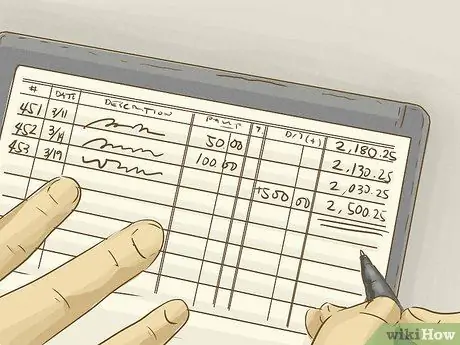

- Reduce the balance with all payments made through checking accounts, such as buying groceries with a debit card, cash withdrawals via ATM, and issuing checks. In addition, the checking account balance must be deducted if you make a payment via wire transfer.

- If there is a cash deposit, bank credit, or incoming transfer, add the number to the checking account balance.

- Subtract debit transactions from credit transactions plus the opening balance. The result must be a positive number. Write the ending balance in the far right column.

Step 2. Match transactions made through checking accounts

At the beginning of each month, download a checking account to compare the cash book to the checking account and find out which checks have been debited.

- Add the balance with the interest income paid by the bank.

- Subtract the balance with the fees charged by the bank.

- Make a match between recording transactions in the cash book and checking accounts. Make sure the ending cash book balance matches the balance stated by the bank in the checking account. Make sure the ending cash book balance does not take into account payments that have not been debited and transactions that are not listed in the checking account.

Step 3. Correct any errors in the cash book

If the ending balance of the cash book and checking account is different, find out the cause, then fix it.

- Recalculate addition and subtraction. Make sure you include the correct numbers and calculate correctly since calculating the starting balance.

- Look for transactions that have not been recorded. Did you forget to record your payment after shopping at the supermarket? Are there any checks that haven't been debited yet? Do you record transactions that occur after the checking account date?

- Subtract the ending balance of the checking account from the ending balance of the cash book. Is the difference equal to one of those transactions? If it's the same, maybe you haven't recorded it correctly.

- If the difference is an even number, divide the number by 2. Is the result of this division the same as one of the transactions in the cash book? If they are the same, you may be doing addition instead of subtraction or vice versa.

Step 4. Find out whether there are checks that have not been debited

Funds issued using checks and other payments are not necessarily debited directly. If you suspect that a check or payment has not been debited, subtract the amount from the checking account balance and compare it to the cash book balance.

One effective way to do reconciliation is to check transactions regularly and check each check that has been debited

Step 5. Contact your bank if you suspect an error has been charged to your checking account

Immediately call or meet customer service at the bank to ask for clarification about the wrong debit or not your obligation and discuss refund options.

Make sure you report dubious bank transactions even if it turns out that you yourself forgot to record after shopping or already threw away the payment receipt

Step 6. Complete the reconciliation

If you have the correct ending balance, draw a double line under the ending cash book balance. That way, you immediately know the ending balance of the cash book after reconciliation if you want to calculate the balance of the checking account or make another reconciliation.

This step also serves as a reminder if there has been an error in the recording in the cash book when you want to calculate the balance of the checking account

Part 3 of 3: Understanding the Importance of Reconciling

Step 1. Know that banks can and sometimes make mistakes in recording transactions.

Checking checking account balances manually seems old-fashioned in this modern era. However, many financially savvy people keep checking their checking account balances regularly. So if the bank makes a mistake, you know right away and can ask for a fix.

Warning: if you only rely on checking accounts or credit card transaction reports to verify whether the current account mutation is correct or not, you will not know if the bank made a mistake in recording transactions so that you were harmed

Step 2. Manage spending money to save money

After reconciling the checking account and cash book, you can confirm the amount of funds in the checking account. This way, you can create a budget to prevent unnecessary expenses.

Create a realistic budget to prevent wastage or deficits so you can save

Step 3. Avoid issuing blank checks and fines

When writing a check, you may not know the balance in your checking account because you haven't had time to look at the checking account. Therefore, you need a cash book to determine whether or not there are enough funds in your checking account to issue checks and ensure checks are not rejected.

- Usually, the bank imposes a fine if the customer issues a blank check. Some banks do not charge a penalty if a customer places a deposit to guarantee the issuance of a check. Ask the bank if you don't know the provisions on fines for issuing blank checks.

- Keep in mind that once you deposit the check, the funds don't go straight to your account because the bookkeeping takes time. Some banks provide credit provisions for these funds and block the excess for several business days. The amount of the credit provision and the period of blocking of funds are determined by the bank concerned.